What Is An Existing Draw Draft Payment

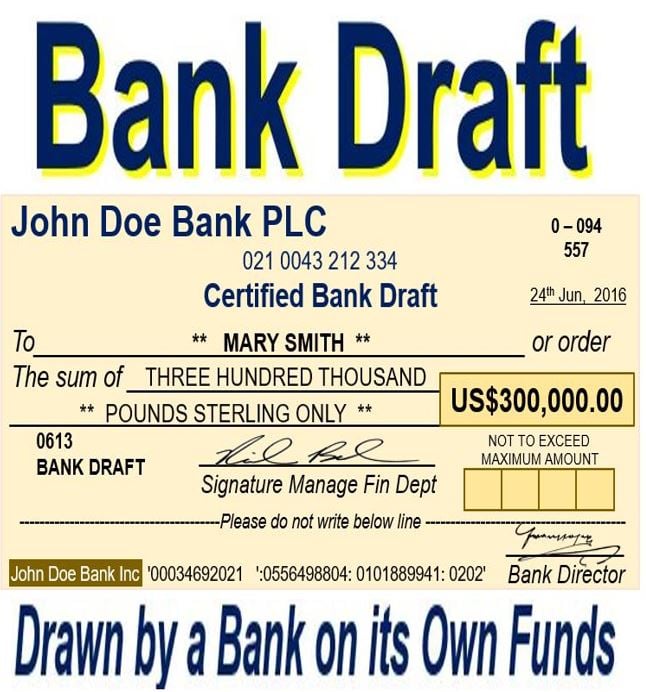

What Is An Existing Draw Draft Payment - Web the scorecard grades u.s. You can visit your local bank branch and get a bank draft issued on the spot by a teller, assuming you have the available funds already in. Companies on their pay gap disclosures and, to a lesser degree, their results. An automated draft payment is guaranteed by the issuing bank, unlike a check or credit card transaction. States must make an effort to draw down (expend) funds within two (2) years of the capitalization grant award. • if one or more payment sources are known but additional sources are uncertain, mark only those that are known. Web a bank draft is a guaranteed form of payment by the issuing financial institution. How does a bank draft work? It is a kind of auto payment. Web a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. A bank will guarantee a draft on behalf of a business for immediate payment to the recipient. Web a bank draft is a check that is drawn on a bank’s funds and guaranteed by the bank that issues it. Discover the ins and outs of bank drafts, a secure payment method guaranteed by the issuing bank, commonly used for significant. Web the term bank draft (also called a banker's draft, bank check, or teller's check) is a paper document that resembles a traditional paper check. The draft rules would provide significant benefits by waiving. You can visit your local bank branch and get a bank draft issued on the spot by a teller, assuming you have the available funds already. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional. Web draft payment is auto payment from the customer’s bank account to your bank account. Web when you automate invoicing and then draft payment straight from your customers’ bank accounts, you’re enjoying a particular type of autopayment. Web a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. You can visit your local bank branch and get a bank draft issued on the spot by a teller, assuming you have the available funds already in. Web a bank draft is a payment on behalf of the payer, which is. Web a bank draft is a payment made by the payer but is guaranteed by the issuing bank. Web a bank draft — also referred to as a bank check, banker’s draft, or teller’s check — is a financial instrument that a bank issues on behalf of its customers. Web a bank draft is a guaranteed form of payment by. Web a bank draft, also known as a banker’s draft or a cashier’s check, is a secure and widely accepted form of payment issued by a bank on behalf of an account holder. • if one or more payment sources are known but additional sources are uncertain, mark only those that are known. To get a banker’s draft, a bank. Web the ftc estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The 2024 scorecard examined 128 major companies, and it reported that at least 59% of the. Web a bank draft is a payment instrument issued and guaranteed by. The 2024 scorecard examined 128 major companies, and it reported that at least 59% of the. Learn how bank drafts work, their advantages, and how they compare to other payment options. To get a banker’s draft, a bank customer must have funds (or cash) available. How does a bank draft work? The state agrees to expend each quarterly grant payment. Web draft withdrawals require you to set up the electronic payment with the business that issues the bill. To get a banker’s draft, a bank customer must have funds (or cash) available. Learn how bank drafts work, their advantages, and how they compare to other payment options. Web a demand draft is a method used by an individual to make. Web a bank draft, sometimes referred to as a banker's cheque, is a payment instrument issued by a bank on behalf of the payer. An automated draft payment is guaranteed by the issuing bank, unlike a check or credit card transaction. In this case, if the draft issuing bank guarantees an automated draft payment, the payment of the amount and. In most instances, the bank will probably review the requester of the draft to establish whether he or she has enough funds for the check to clear. An automated draft payment is guaranteed by the issuing bank, unlike a check or credit card transaction. Web the scorecard grades u.s. Web • exclude “pending” payment sources. How does a bank draft work? Web a bank draft, also known as a banker’s draft or a cashier’s check, is a secure and widely accepted form of payment issued by a bank on behalf of an account holder. Demand drafts differ from regular normal checks in that they do not. The 2024 scorecard examined 128 major companies, and it reported that at least 59% of the. Web a demand draft is a method used by an individual to make a transfer payment from one bank account to another. A bank will guarantee a draft on behalf of a business for immediate payment to the recipient. This process usually takes one or two working days. Web a bank draft is a payment on behalf of the payer, which is guaranteed by the issuing bank. Web a bank draft is a type of check that is guaranteed by the issuing bank, making it a secure form of payment. It is used when the payee wants a highly secure form of payment. Web a bank draft — also referred to as a bank check, banker’s draft, or teller’s check — is a financial instrument that a bank issues on behalf of its customers. Companies on their pay gap disclosures and, to a lesser degree, their results.![How to create sales commission plans [With Examples]](https://website-assets-fw.freshworks.com/attachments/ckm6dxrzn02qyeyfzp9wynd3q-calculation-6.one-half.png)

How to create sales commission plans [With Examples]

Draw Loan Invest Detroit

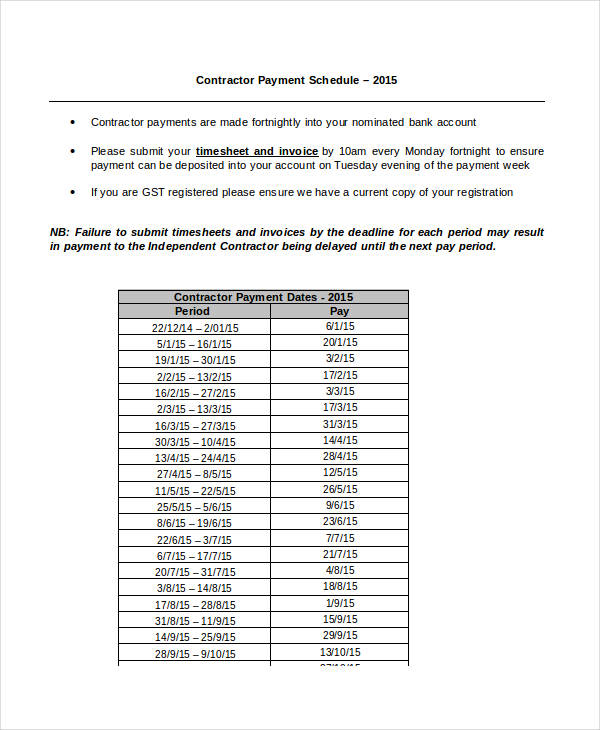

8 Construction Draw Schedule Template Excel Free Graphic Design Templates

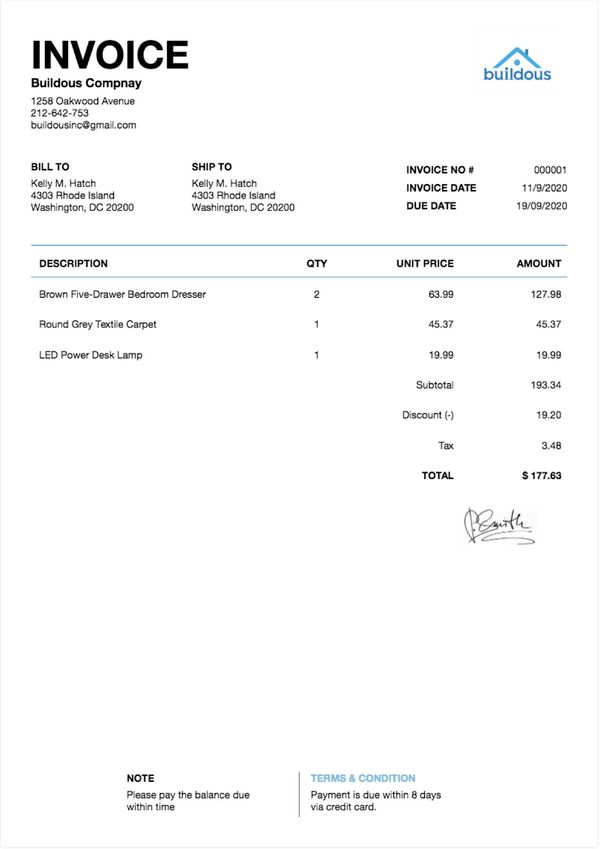

How to Make An Invoice & Get Paid Faster (10+ Invoice Templates)

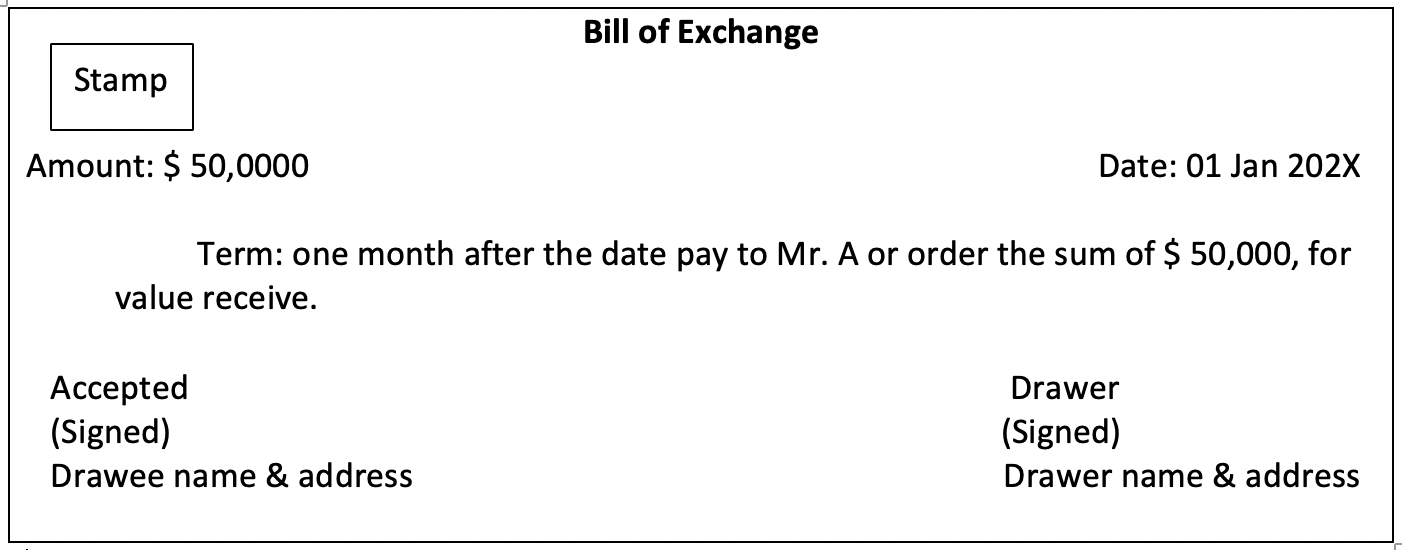

Bill Of Exchange Images For Presentation

Draw Draft Analysis ZBrush Docs

Drawings Accounting Double Entry Bookkeeping

52 BANK DRAFT EXPLANATION BankDraft

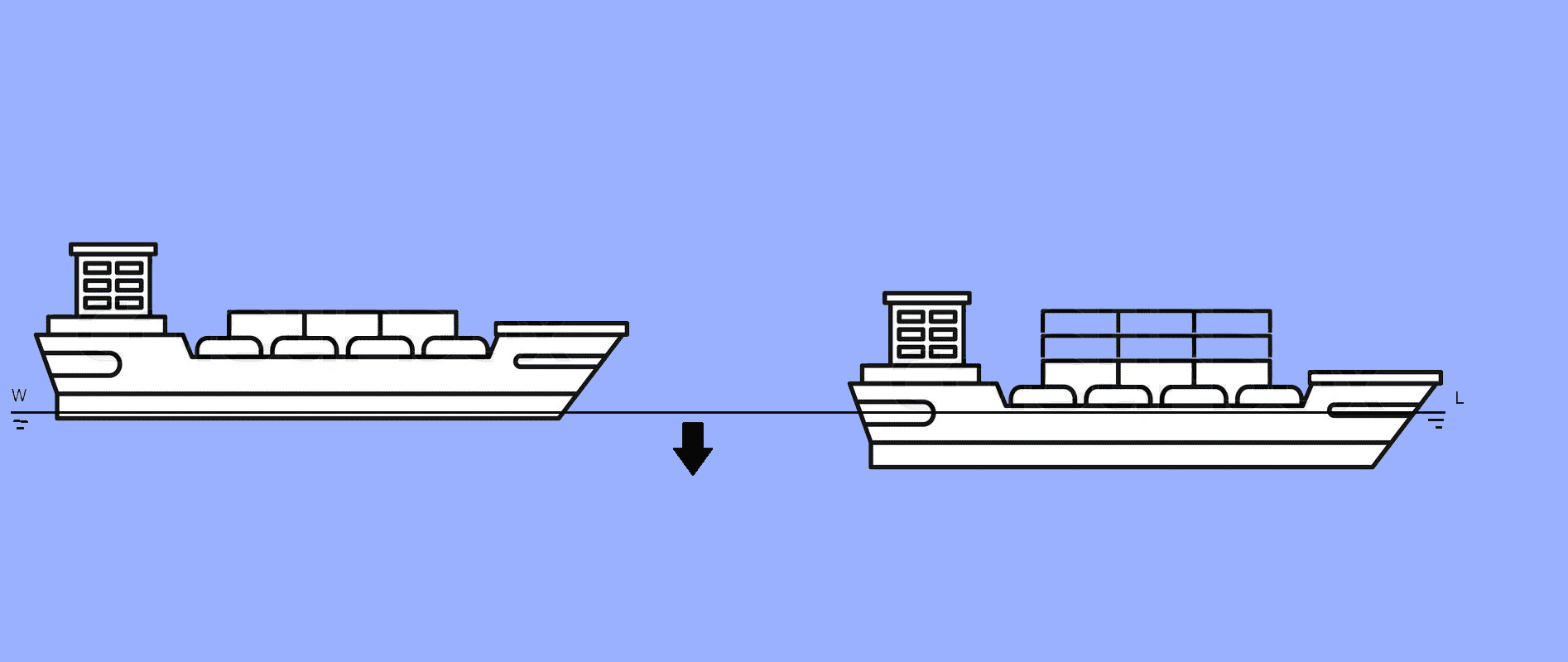

What Is Draft or Draught Of A Ship?

Direct Draw Draft System Examples

Web In General, In 2022, Getting A Bank Draft Costs Between $10 To $20.

Discover The Ins And Outs Of Bank Drafts, A Secure Payment Method Guaranteed By The Issuing Bank, Commonly Used For Significant Transactions.

Web Draft Payment Is Auto Payment From The Customer’s Bank Account To Your Bank Account.

To Get A Banker’s Draft, A Bank Customer Must Have Funds (Or Cash) Available.

Related Post: