Tax Form 8332 Printable

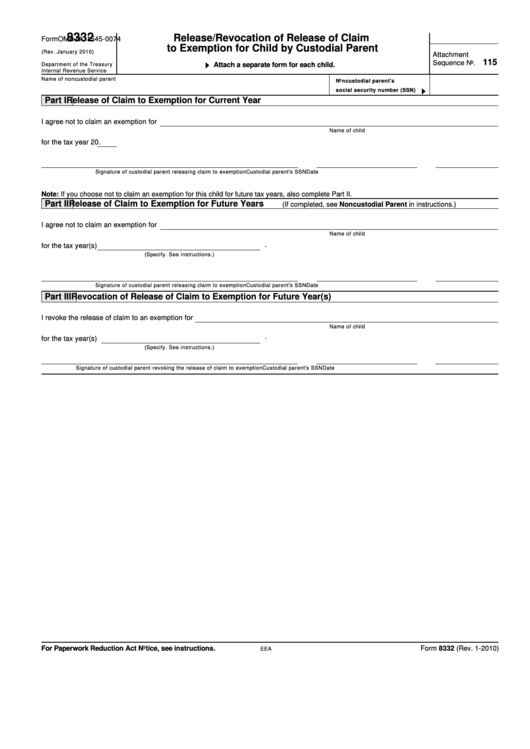

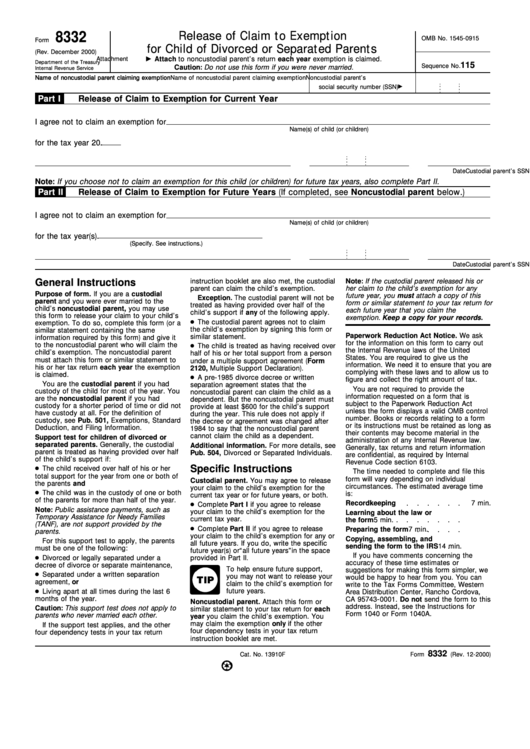

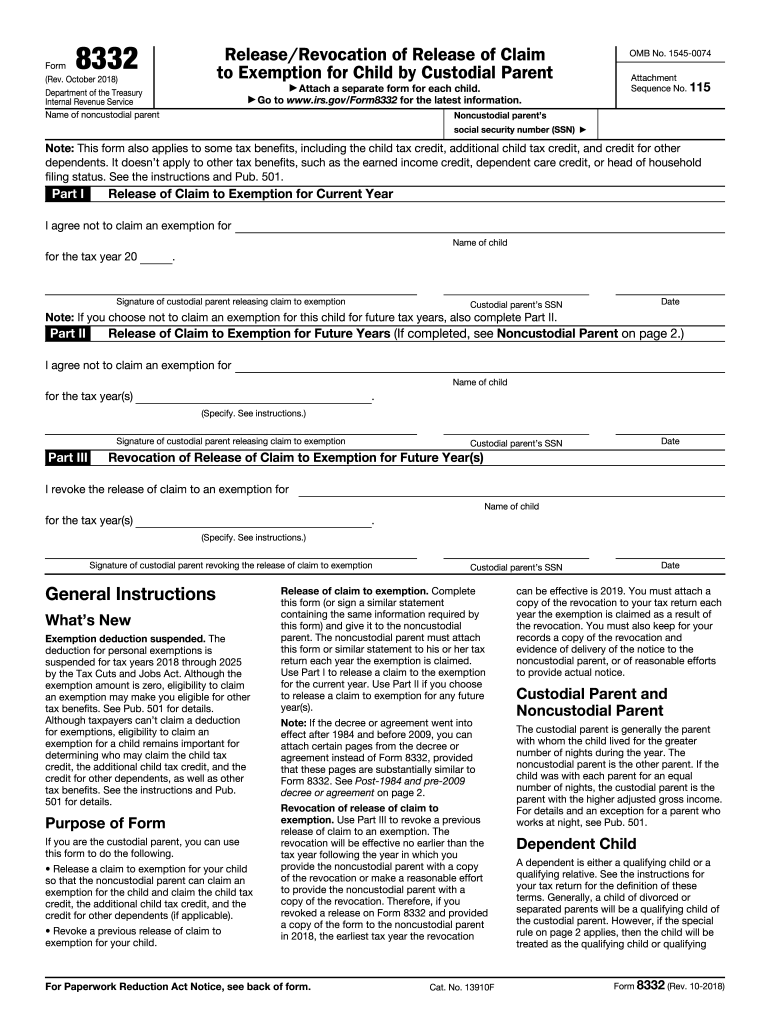

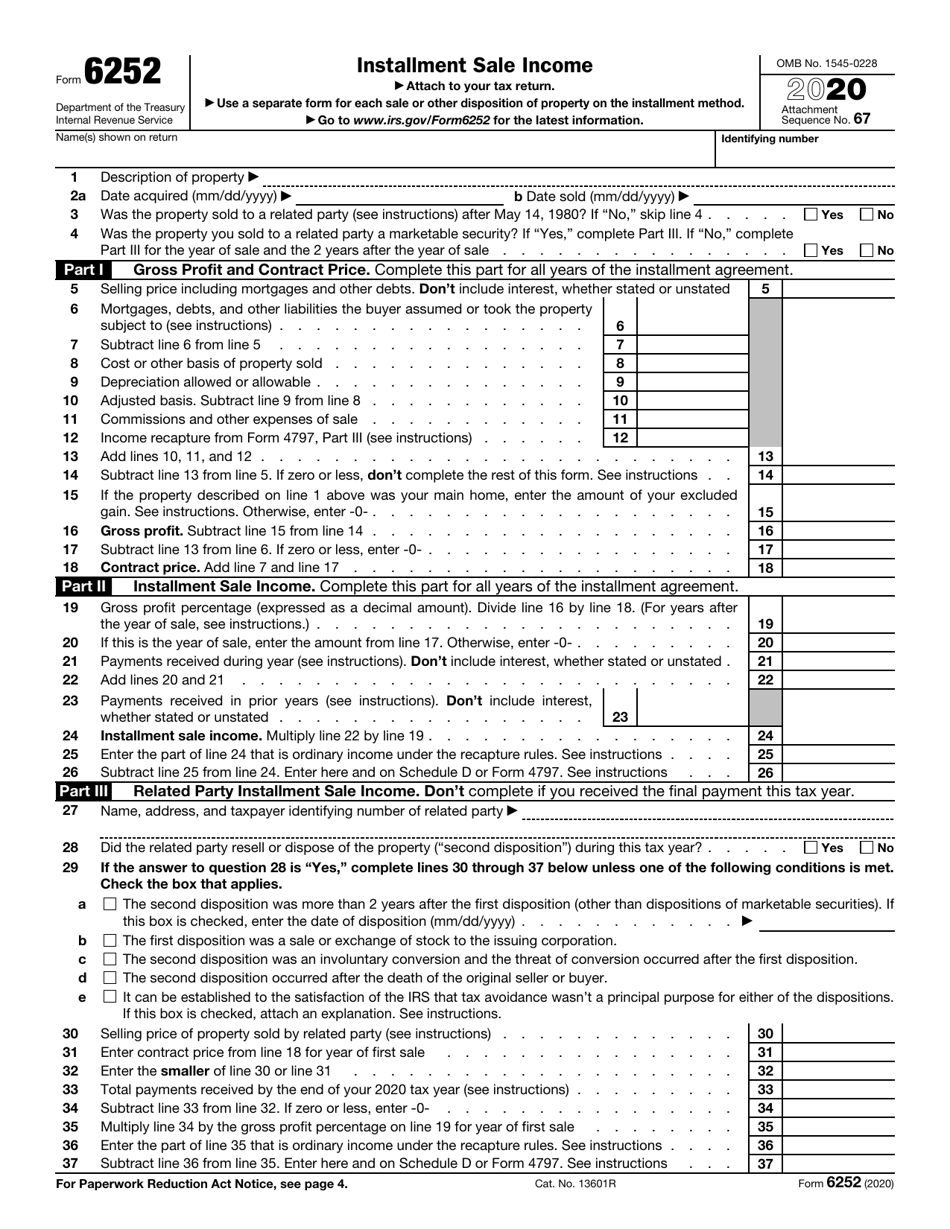

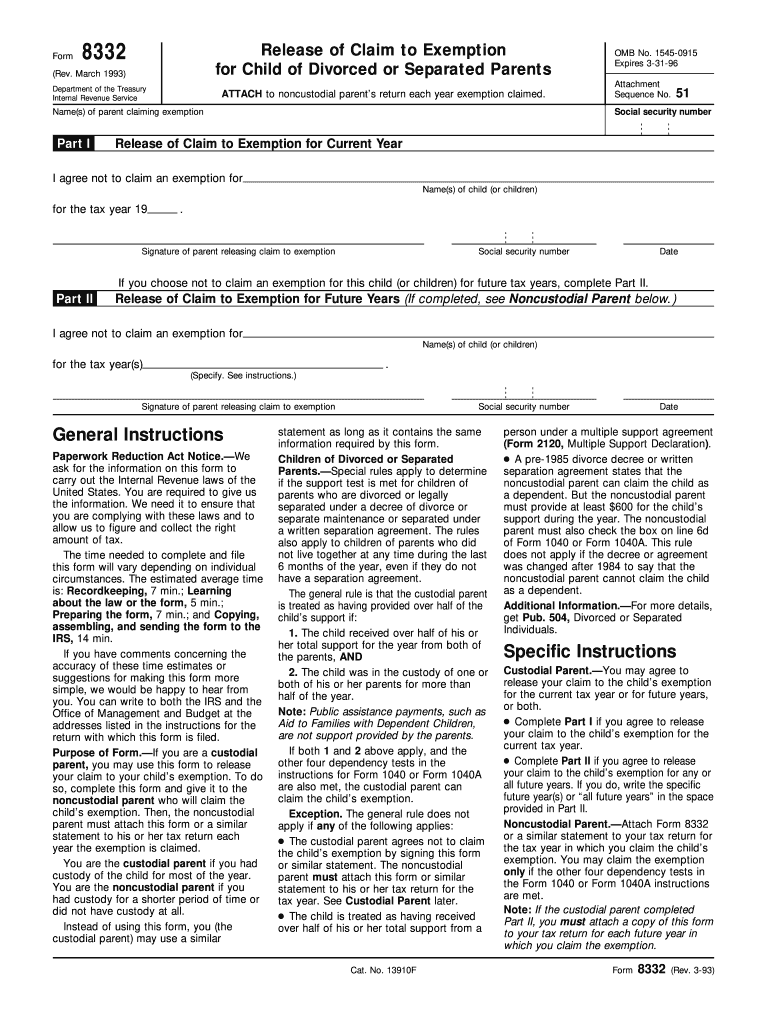

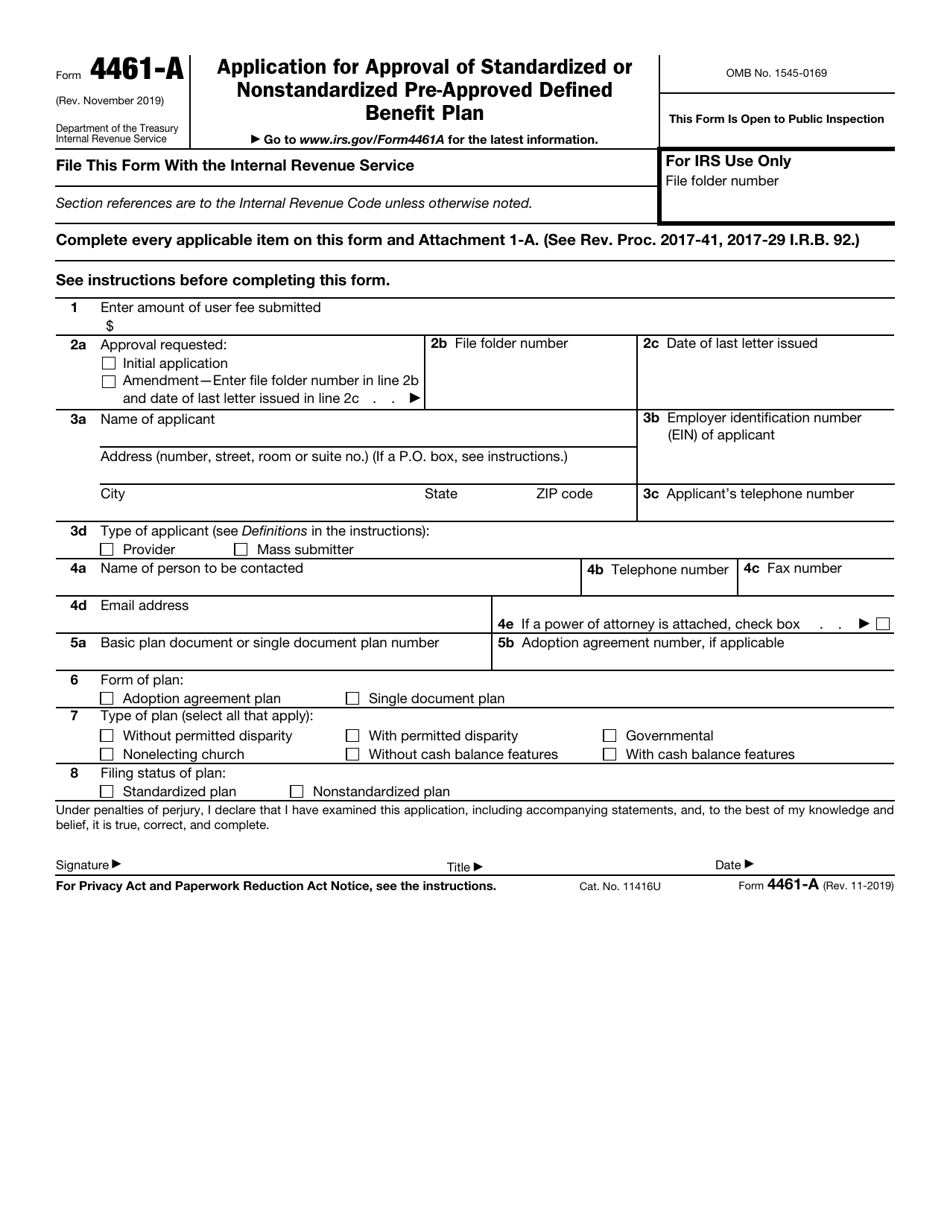

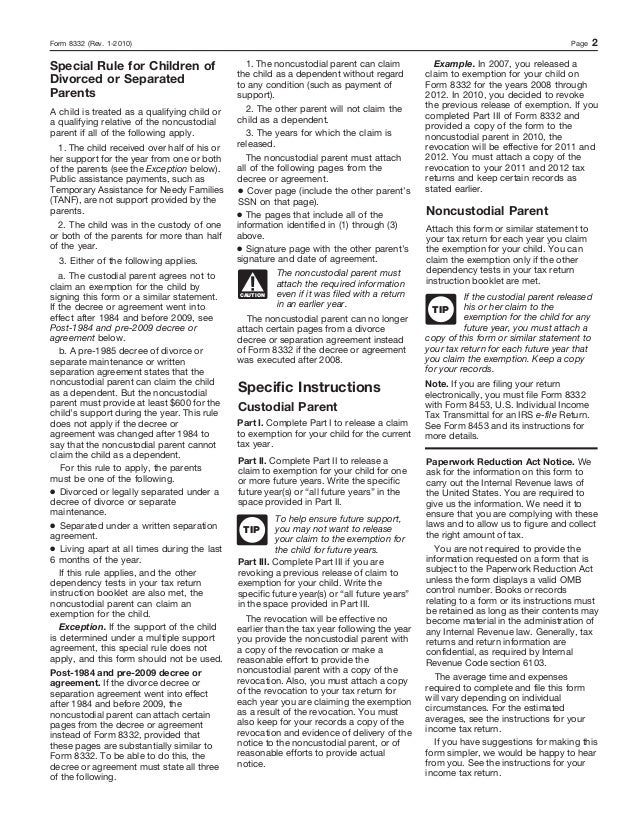

Tax Form 8332 Printable - The release of the dependency exemption will also release to the noncustodial parent the child tax credit and the additional child tax credit (if either applies). Child and dependent care tax credit phaseout. This article dives deep into form 8332, a crucial document for custodial and noncustodial. When would a custodial parent give up their exemption? Prepare the form 8332 on the noncustodial parent's return. Open form follow the instructions. Filing tax forms and exemptions can be challenging, especially for parents after a divorce or separation. Head of household filing status. Child and dependent care credit. Web when to use form 8332. October 2018) department of the treasury internal revenue service. A custodial parent can also use the form to transfer child dependency rights to the noncustodial parent permanently or reclaim their right to claim a child as a dependent. Web irs form 8332: Who is responsible for filing form 8332? If you are a custodial parent and you were ever married. Head of household filing status. The form can be used for current or future tax years. Easily sign the form with your finger. If you are the custodial parent, you can use this form to do the following. This article dives deep into form 8332, a crucial document for custodial and noncustodial. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. This article dives deep into form 8332, a crucial document for custodial and noncustodial. Solved•by intuit•updated july 17, 2023. Print, sign, and distribute to noncustodial parent. Revocation of release of claim. Web form 8332 is generally attached to the claimant's tax return. Prepare the form 8332 on the custodial parent's return. Web form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial. Form 8332 is used by custodial parents to release their claim to their child's exemption. This website is not affiliated with irs. Most federal forms are available but might not be available immediately. The transmittal form can be found here: October 2018) department of the treasury internal revenue service. Easily sign the form with your finger. Follow the onscreen instructions to complete the return. Release a claim to exemption for your. The form can be used for current or future tax years. Release of claim to exemption for child by custodial parents. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. Solved•by intuit•updated july 17, 2023. Make entries in these fields: If you have custody of your child, but want to release the right to claim your child as a dependent to the. Prepare the form 8332 on the custodial parent's return. Child and dependent care credit. Follow the onscreen instructions to complete the return. The form can be used for current or future tax years. The release of the dependency exemption will also release to the noncustodial parent the child tax credit. Web form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Solved•by intuit•updated july 17, 2023. Filing tax forms and exemptions can be challenging, especially for parents after a divorce or separation. All noncustodial parents must attach form 8332 or a similar statement to their return. The transmittal form can be found here: Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Delete the data entered. Attach a separate form for each child. Release a claim to exemption for your. The transmittal form can be found here: Release of claim to exemption for child by custodial parents. Make entries in these fields: Prepare the form 8332 on the custodial parent's return. What tax benefits cannot be transferred? The transmittal form can be found here: Solved•by intuit•updated july 17, 2023. Form 8332 is used by custodial parents to release their claim to their child's exemption. Follow the onscreen instructions to complete the return. Revocation of release of claim to exemption on this page. The release of the dependency exemption will also release to the noncustodial parent the child tax credit. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of divorced or separated parents in the search box and choose jump to. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child.

Form 8332 Printable Printable Templates

Form 8332 Release/Revocation of Release of Claim to Exemption for

Irs Form 8332 Printable

IRS Form 8332 A Guide for Custodial Parents

Tax Form 8332 Printable

8332 PDF 20182024 Form Fill Out and Sign Printable PDF Template

Tax Form 8332 Printable

Form 8332 Fill Out and Sign Printable PDF Template airSlate SignNow

Tax Form 8332 Printable

IRS Form 8332

If You Have Custody Of Your Child, But Want To Release The Right To Claim Your Child As A Dependent To The Noncustodial Parent You’ll Need To Fill Out Form 8332.

When Would A Custodial Parent Give Up Their Exemption?

Who Is Responsible For Filing Form 8332?

Web Find Out Which Forms Are Supported By H&R Block’s Online Tax Preparation Program.

Related Post: