Tax Exempt Letter Template

Tax Exempt Letter Template - Section 122 of the federal credit union act (12 u.s.c. Web as a special service to government entities, irs will issue a “governmental information letter” free of charge. Review the criteria for tax exempt status. Tax exemption letter request form template; Web updated april 24, 2024. Workers compensation exemption letter template; Each engagement requires careful consideration to address its particular. Exemption request cover letter template; Web a vaccine exemption letter is a document used by an individual requesting to be exempted from a vaccination mandate. Web tax exempt letter template. Review the criteria for tax exempt status. Web page last reviewed or updated: Section 122 of the federal credit union act (12 u.s.c. What must a request for a group exemption contain? Web as a special service to government entities, irs will issue a “governmental information letter” free of charge. Review the criteria for tax exempt status. The name of the donor and the full, legal name of your organization. Letter requesting tax exemption certificate. Form 990, return of organization exempt from income tax. Web an exemption letter is an official document that allows an exemption requestee not to do an activity or pay some financial responsibilities. The donor will use this letter as proof of his or her donation to claim a tax deduction. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: An engagement letter is a contract that establishes the services a practitioner will provide to his or her clients. Workers compensation exemption letter. Web page last reviewed or updated: Exemption request cover letter template; Each engagement requires careful consideration to address its particular. To, fere youth organization street no 2997 delhi. Web these templates serve as a formal means of presenting requests for tax exemption, substantiating eligibility, and providing the necessary documentation to support the claim.to utilize these templates, you can simply insert. The links below lead to two printable versions of the letter. Each engagement requires careful consideration to address its particular. Web these templates serve as a formal means of presenting requests for tax exemption, substantiating eligibility, and providing the necessary documentation to support the claim.to utilize these templates, you can simply insert your specific details, such as names, addresses, and. If so, an organization may generally contact customer account services by phone, letter, or fax to request an affirmation letter. Dear sir/madam, fere youth organization is a charity organization working for special education in. Web these templates serve as a formal means of presenting requests for tax exemption, substantiating eligibility, and providing the necessary documentation to support the claim.to utilize. Letter requesting tax exemption certificate. Web an exemption letter is an official document that allows an exemption requestee not to do an activity or pay some financial responsibilities. Web read more here. The donor will use this letter as proof of his or her donation to claim a tax deduction. The acknowledgment to the donor should include the following: The name of the donor and the full, legal name of your organization. Web sample letter for income tax exemption. If you need one of these letters for you or someone else, jotform sign has you covered. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or. Identify the entity requesting tax exempt status. § 1768) states in relevant part: We’ve included the following 2 samples to give you an idea of how you can personalize and include the required tax information. Letter requesting tax exemption certificate. The central organization submits a letter to the irs on behalf of itself and its subordinates. Dear sir/madam, fere youth organization is a charity organization working for special education in. We’ve included the following 2 samples to give you an idea of how you can personalize and include the required tax information. It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. Statement that no goods or services were provided. Web exempt organizations forms & instructions. Outline the reasons why you need the exemption, contact information, and doctor’s notes if applicable. Workers compensation exemption letter template; Instructions for form 990 pdf. Letter requesting tax exemption certificate. Section 122 of the federal credit union act (12 u.s.c. Web updated april 24, 2024. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: If so, an organization may generally contact customer account services by phone, letter, or fax to request an affirmation letter. Exemption request cover letter template; An engagement letter is a contract that establishes the services a practitioner will provide to his or her clients. Web an exemption letter is an official document that allows an exemption requestee not to do an activity or pay some financial responsibilities. The donor will use this letter as proof of his or her donation to claim a tax deduction. The links below lead to two printable versions of the letter. Each engagement requires careful consideration to address its particular. Identify the entity requesting tax exempt status.

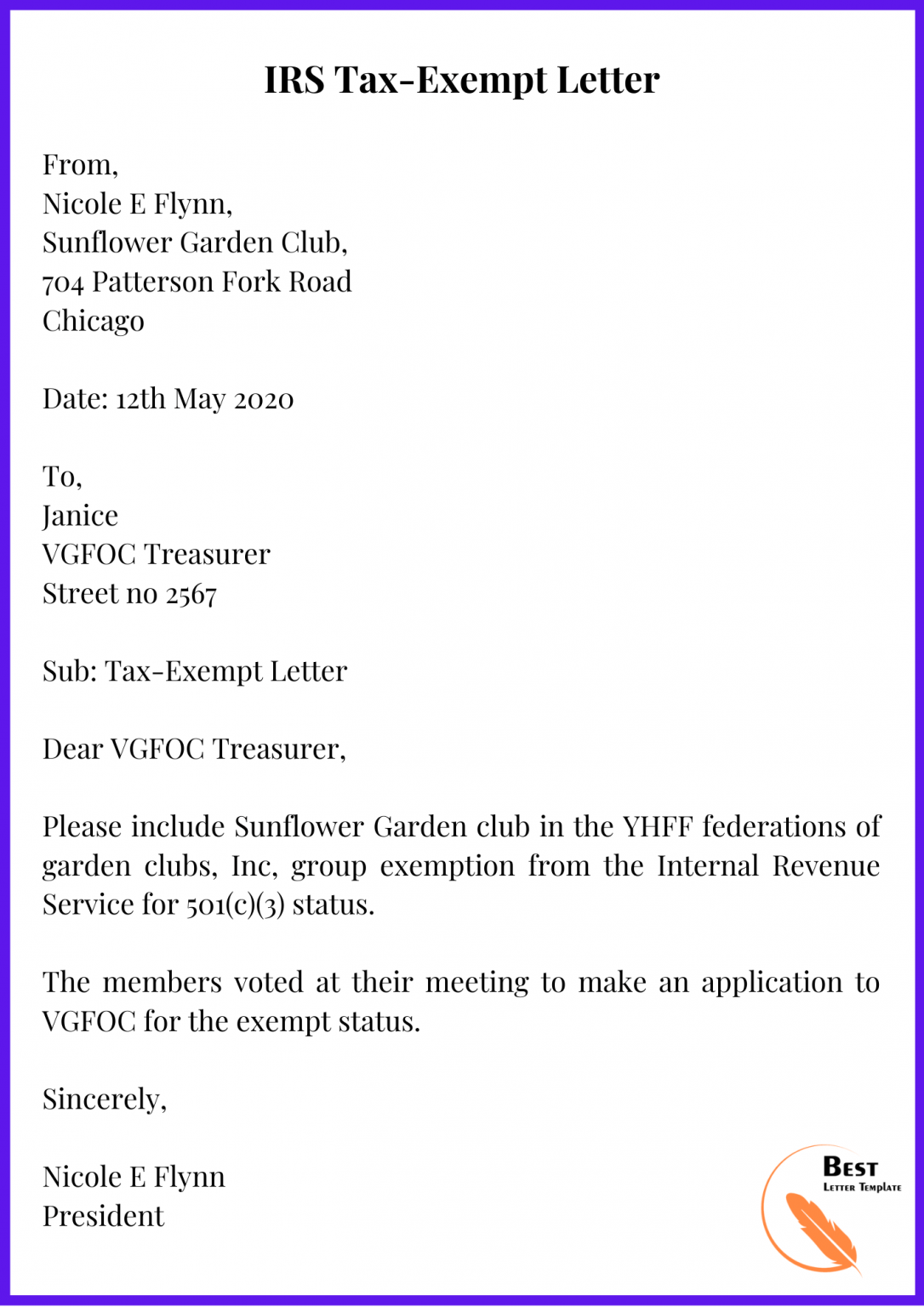

Tax Exempt Letter

Tax Exempt Donation Letter Sample Form Fill Out and Sign Printable

Free Sample Letter For Tax Exempt Donation

Tax Letter Template Format, Sample, and Example in PDF & Word

Tax Exempt Form Request Letter Awesome 25 Inspirational with Resale

Tax exempt status letter of affirmation by josh.kufera Issuu

Tax Exempt Status Documentation Charles Town Presbyterian Church

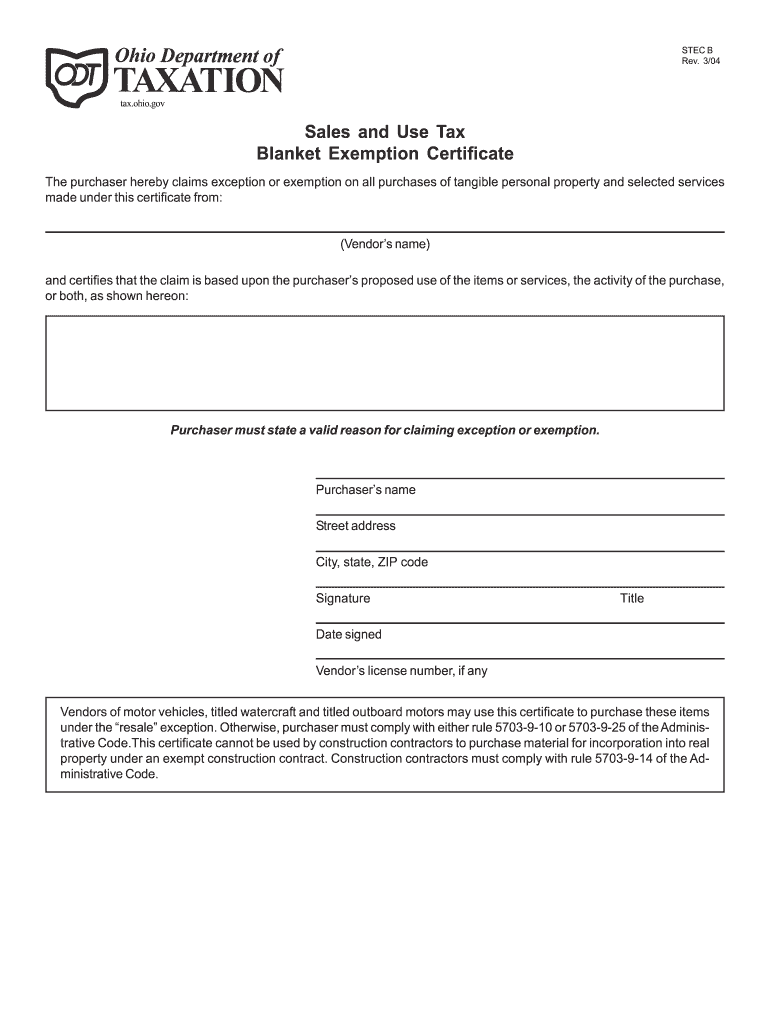

Ohio Tax Exempt Form Fill Out and Sign Printable PDF Template

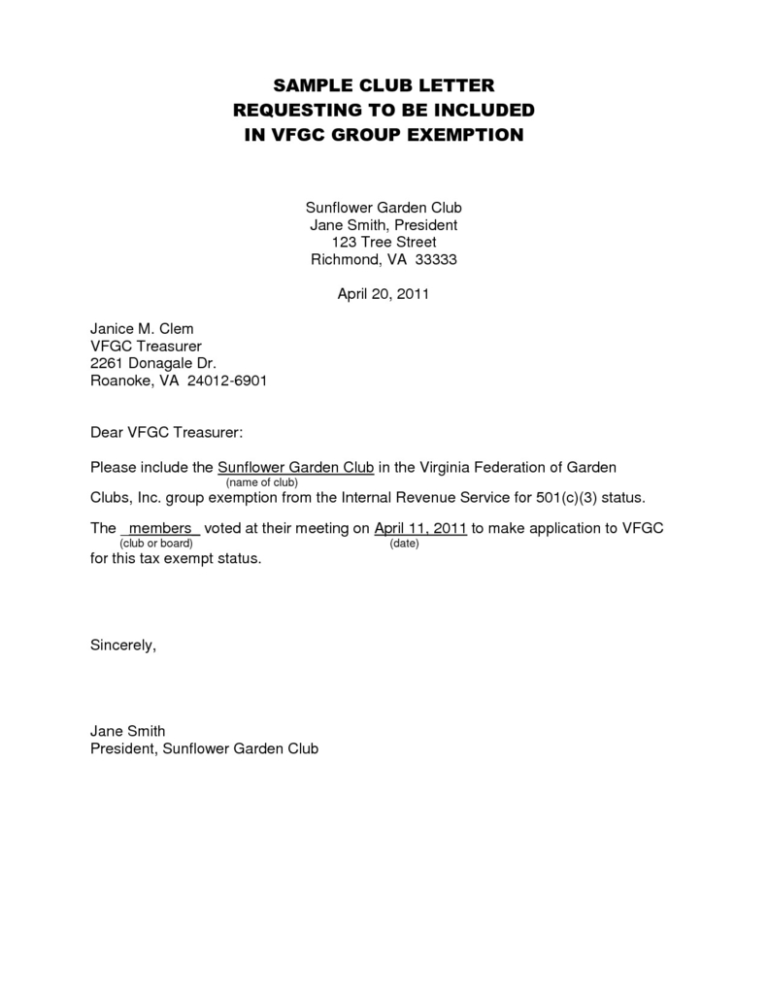

Sample Letter Tax Exemption Form Fill Out and Sign Printable PDF

Best Templates Tax Exempt Letter Sample

From, William S Zamora 3750 Reynolds Alley San Francisco.

This Letter Is To Be Submitted To Institutions And Agencies And Is Subject To Approval Or Denial.

The Date That The Gift Was Received By Your Nonprofit.

The Central Organization Submits A Letter To The Irs On Behalf Of Itself And Its Subordinates.

Related Post: