Tax Deductible Donation Letter Template

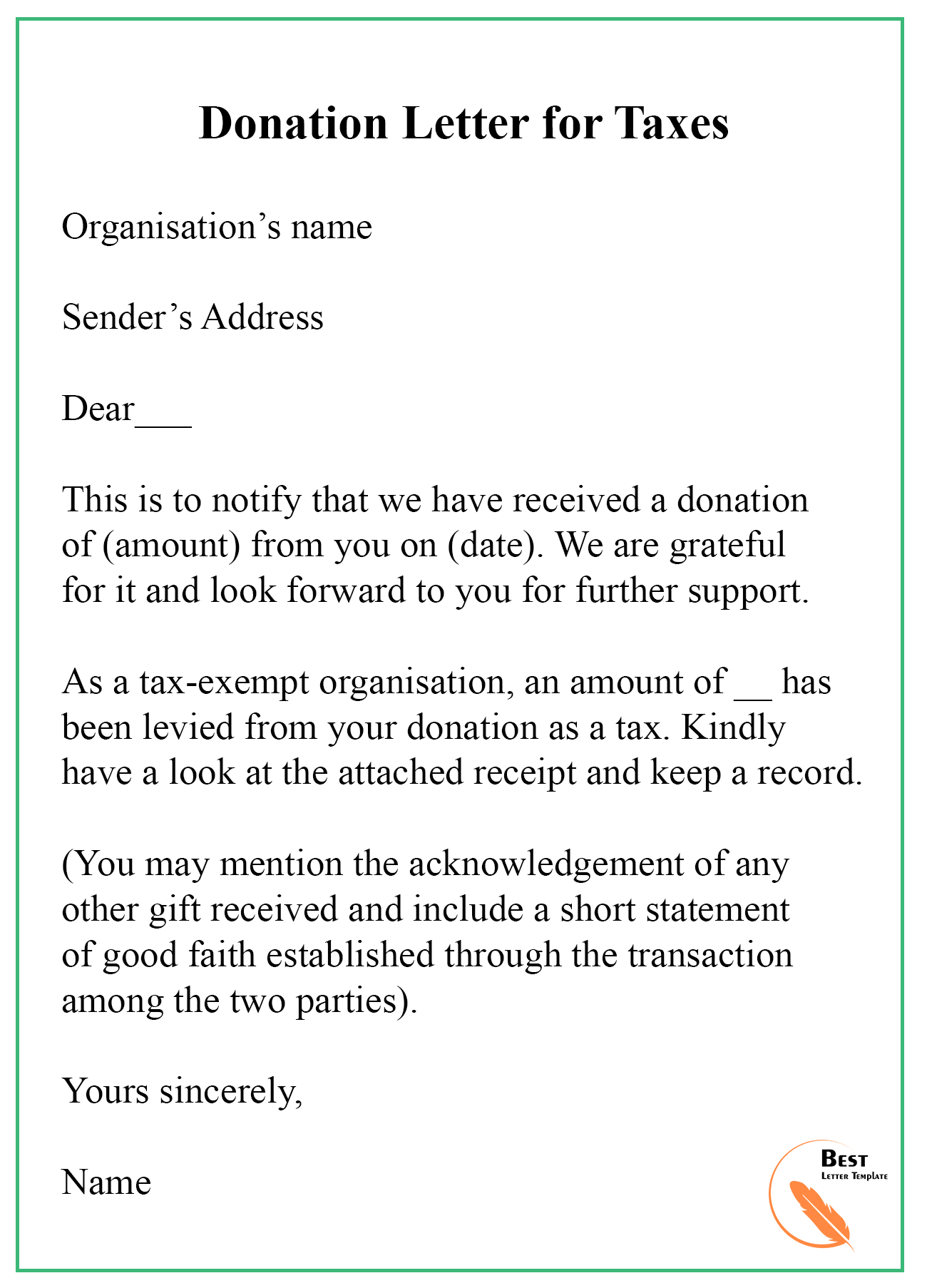

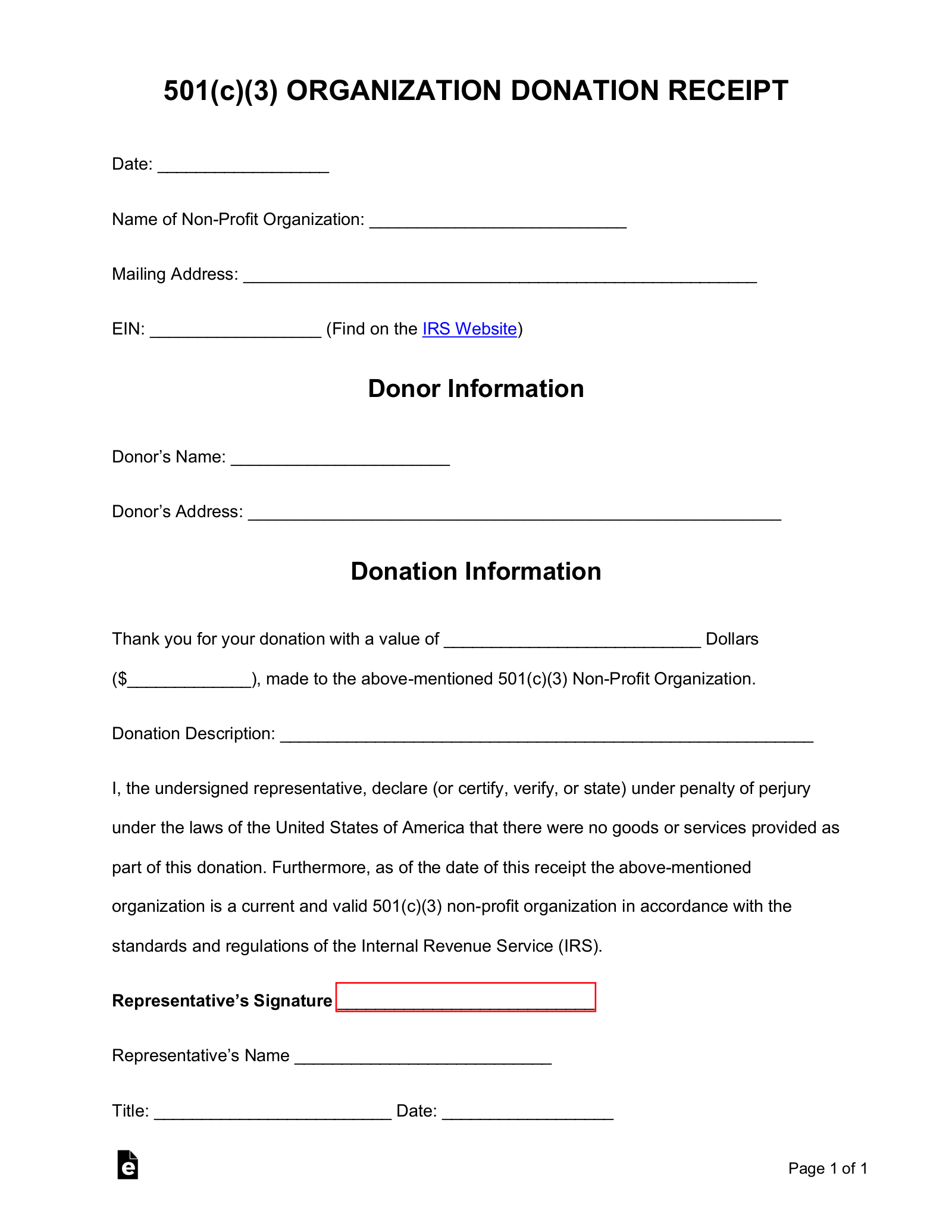

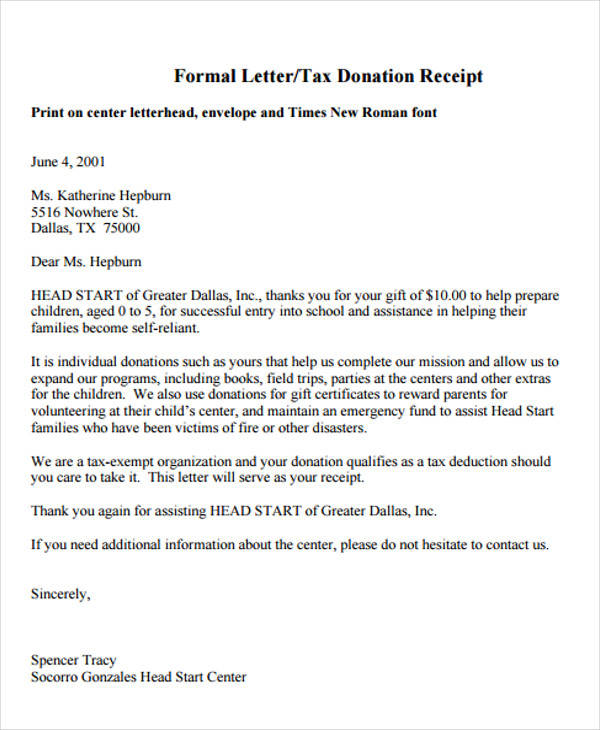

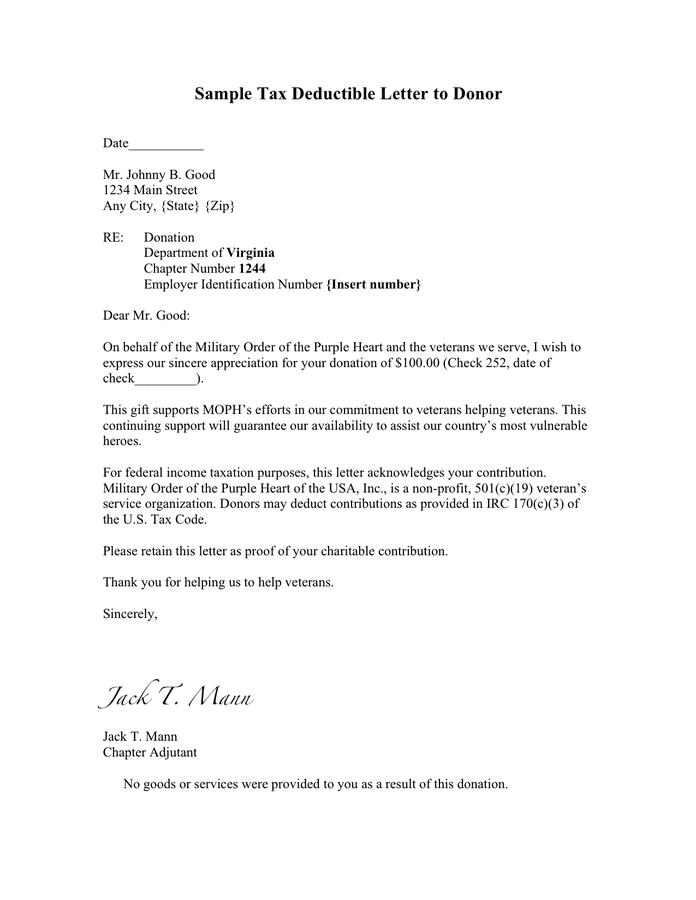

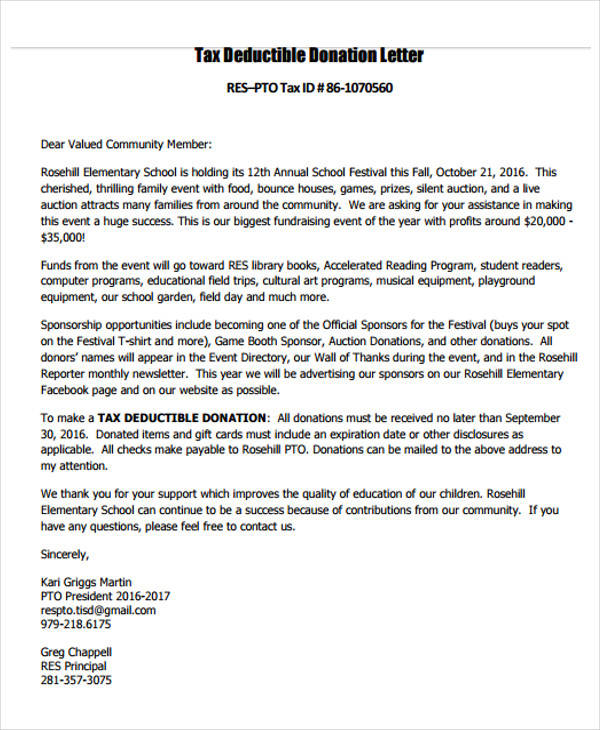

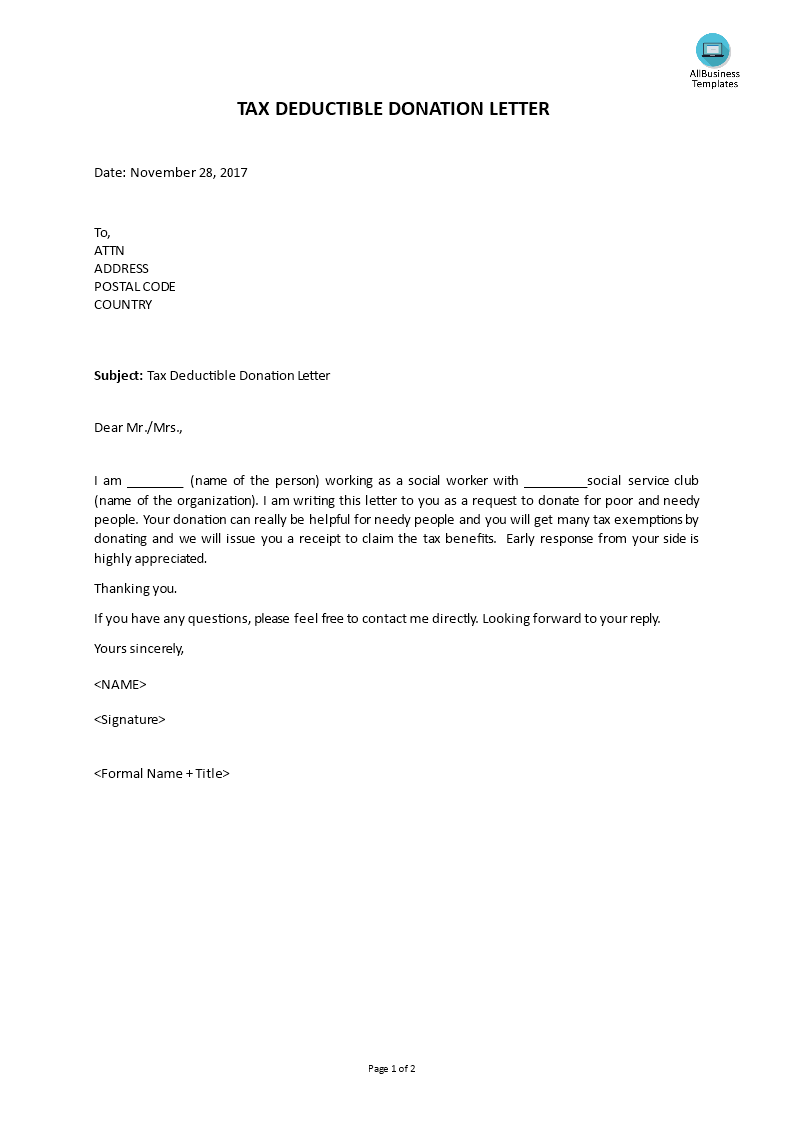

Tax Deductible Donation Letter Template - A tax deduction letter is used by charities and foundations to acknowledge donations, thank donors, and give each donor the information required to use the donation as a tax deduction. These are examples of tax donation receipts that a 501c3 organization should provide to its donors. As we’ll discuss below, it’s also an opportunity for you to provide the official documentation required by the irs to donors who have given a. What they will need from you, the nonprofit they donated to, is a written document (an email or letter) that includes the three following elements: Web a donor or donation acknowledgment letter is a letter nonprofits send to thank their donors for their gifts. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Web your amazing donation of $250 has a tax deductible amount of $200. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it. If your charity or nonprofit needs a more efficient way to write tax deduction letters, do it with this automated tax deduction letter from jotform sign. Web a 501 (c) (3) donation receipt is required to be completed by charitable. Web updated december 18, 2023. If your charity or nonprofit needs a more efficient way to write tax deduction letters, do it with this automated tax deduction letter from jotform sign. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Does it. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. As we’ll discuss below, it’s also an opportunity. A tax deduction letter is used by charities and foundations to acknowledge donations, thank donors, and give each donor the information required to use the donation as a tax deduction. Donation receipts are important for a few reasons. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web your amazing donation. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Web here is the template that guides you in drafting a pleasant and professional tax deductible donation letter. Web sample 501(c)(3) donation receipt (free template) all of these rules and regulations can be confusing. Web. Content marketing manager, neon one. As we’ll discuss below, it’s also an opportunity for you to provide the official documentation required by the irs to donors who have given a. The receipt shows that a charitable contribution was made to your organization by the individual or business. Web many of your donors are eligible to deduct donations from their taxes.. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Tax deductible donation for orphanage. Web here is the template that guides you in drafting a pleasant and professional tax deductible donation letter. Web your amazing donation of $250 has a tax deductible amount of $200. Dear sir /madam, i, ________ (name of. Does it have to be in a certain format? Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. If your charity or nonprofit needs a more efficient way to write tax deduction letters, do it with this automated tax deduction letter from jotform sign.. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it. Can i create a donation receipt template for my emails and letters? Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Tax deductible donation for orphanage. Web updated december 18, 2023. Content marketing manager, neon one. Can i create a donation receipt template for my emails and letters? Below, you will find a receipt for your records. Does it have to be in a certain format? Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity. These are examples of tax donation receipts that a 501c3 organization should provide to its donors. Web church donation receipt letter for tax purposes is often used in church fundraising letter template, church letter template, donation receipt, tax purposes, charitable contributions, nonprofit organizations, letters, tax exempt form and tax deductions. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it. Use our free tax deductible donation letter to help you get started. If your charity or nonprofit needs a more efficient way to write tax deduction letters, do it with this automated tax deduction letter from jotform sign. Tax deductible donation letter sample. Web here is the template that guides you in drafting a pleasant and professional tax deductible donation letter. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Tax deductible donation for orphanage. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web updated december 18, 2023. Donation receipts are important for a few reasons. Web tax deductible donation letter template. Dear sir /madam, i, ________ (name of the person) am working as a social worker with _________social service club (name of the. What they will need from you, the nonprofit they donated to, is a written document (an email or letter) that includes the three following elements: We’ve included the following 2 samples to give you an idea of how you can personalize and include the required tax information.

Free Donation Receipt Template Awesome 003 Template Ideas Tax

13+ Free Donation Letter Template Format, Sample & Example

Sample 501c3 Donation Receipt Letter Master of Documents

29 Images of Goodwill Donation Letter Template

a donation form for the local high school parent club, with an orange

FREE 40+ Donation Letter Templates in PDF MS Word Pages Google

Sample tax deductible letter to donor in Word and Pdf formats

FREE 40+ Donation Letter Templates in PDF MS Word Pages Google

Tax Deductible Donation Thank You Letter Template Examples Letter

Tax Deductible Donation Letter Templates at

Web A Donor Or Donation Acknowledgment Letter Is A Letter Nonprofits Send To Thank Their Donors For Their Gifts.

Below, You Will Find A Receipt For Your Records.

Web Your Amazing Donation Of $250 Has A Tax Deductible Amount Of $200.

The Receipt Shows That A Charitable Contribution Was Made To Your Organization By The Individual Or Business.

Related Post: