State Of Iowa Payroll Calendar 2024

State Of Iowa Payroll Calendar 2024 - Web the iowa withholding tables are an alternative to the withholding formula to determine how much to withhold from your employees’ paychecks for wages paid beginning january 1,. Web working day payroll calendar, 2024. Web payroll finalized in workday. Web payroll finalized pay date dec 16 ‐ dec 31 01/03/2024 01/05/2024 01/05/2024 01/08/2024 01/10/2024 jan 1 ‐ jan 15 01/18/2024 01/19/2024 01/22/2024 01/23/2024. Review our common questions if you need additional help. Web use the following links to access printable monthly calendars: Off cycle payroll request form. Web all boise state human resource services only human resource services. Web pay period & insurance deduction schedule ***preliminary fy 2024***. Senior payroll manager teri kruse reminds employees. Web payroll finalized in workday. Web march s m t w t f s 25 26 27 28 29 / 1 2 3 4 5 6 7 8 98 10 1114 12 13 14 / 15 16 17 18 19 20 21 22 23 24 252 26 27 28 / 29 30 Review our common questions if you need additional. Web use the following links to access printable monthly calendars: The measure would lower iowa’s individual income tax to a 3.8% flat rate beginning in 2025, a cut. January ‐ june 2024 payroll dates semi‐monthly monthly january april january april. Form used to request a payroll advance for an. The biweekly payroll calendar provides pay period dates, time record due. To compute partial academic year or semester amounts,. Web the iowa department of education gets more power over the aeas with oversight functions and funding shifting to the state. 25 payroll, their second of 2024. Web the fourth quarter 2023 quarterly census of employment and wages (qcew) data has been released. Web march s m t w t f s. Senior payroll manager teri kruse reminds employees. Form used to request a payroll advance for an. To be used with fiscal year appointments only. Web the iowa withholding tables are an alternative to the withholding formula to determine how much to withhold from your employees’ paychecks for wages paid beginning january 1,. To compute partial academic year or semester amounts,. Salary book data is presented in original form as received from the department of administrative services without additional verification or editing. The biweekly payroll calendar provides pay period dates, time record due. 22 is the deadline for the jan. Human resource services payroll team and hr processing team payroll and. Web the fourth quarter 2023 quarterly census of employment and. Salary book data is presented in original form as received from the department of administrative services without additional verification or editing. Web payroll finalized in workday. Web pay period & insurance deduction schedule ***preliminary fy 2024***. To be used with fiscal year appointments only. State of iowa holiday calendar. Web use the following links to access printable monthly calendars: 22 is the deadline for the jan. There are a total of 262 working days in the 2024 calendar year. Web payroll finalized pay date dec 16 ‐ dec 31 01/03/2024 01/05/2024 01/05/2024 01/08/2024 01/10/2024 jan 1 ‐ jan 15 01/18/2024 01/19/2024 01/22/2024 01/23/2024. Web the iowa withholding tables are. Web the iowa withholding tables are an alternative to the withholding formula to determine how much to withhold from your employees’ paychecks for wages paid beginning january 1,. Off cycle payroll request form. 22 is the deadline for the jan. State of iowa holiday calendar. This data is a census of jobs covered by unemployment. Form used to request a payroll advance for an. Web use the following links to access printable monthly calendars: Web march s m t w t f s 25 26 27 28 29 / 1 2 3 4 5 6 7 8 98 10 1114 12 13 14 / 15 16 17 18 19 20 21 22 23 24 252. Off cycle payroll request form. The measure would lower iowa’s individual income tax to a 3.8% flat rate beginning in 2025, a cut. Web the iowa withholding tables are an alternative to the withholding formula to determine how much to withhold from your employees’ paychecks for wages paid beginning january 1,. Web in iowa, employers are obligated to compensate workers. Form used to request a payroll advance for an. 22 is the deadline for the jan. Review our common questions if you need additional help. Web payroll finalized pay date dec 16 ‐ dec 31 01/03/2024 01/05/2024 01/05/2024 01/08/2024 01/10/2024 jan 1 ‐ jan 15 01/18/2024 01/19/2024 01/22/2024 01/23/2024. This data is a census of jobs covered by unemployment. Web pay period & insurance deduction schedule ***preliminary fy 2024***. Web march s m t w t f s 25 26 27 28 29 / 1 2 3 4 5 6 7 8 98 10 1114 12 13 14 / 15 16 17 18 19 20 21 22 23 24 252 26 27 28 / 29 30 Web the fourth quarter 2023 quarterly census of employment and wages (qcew) data has been released. Web the iowa department of education gets more power over the aeas with oversight functions and funding shifting to the state. Human resource services payroll team and hr processing team payroll and. Off cycle payroll request form. 25 payroll, their second of 2024. Web payroll finalized in workday. State of iowa holiday calendar. Web in iowa, employers are obligated to compensate workers at a rate of 1.5 times their regular hourly wage for any hours worked beyond 40 in a week. To be used with fiscal year appointments only.

Cummins Payroll Calendar 2024 2024 Payroll Calendar

2024 Printable Payroll Calendar 2024 CALENDAR PRINTABLE

2024 Federal Payroll And Holiday Calendar 2021 Broward Schools

2024 Biweekly Payroll Calendar 2024 Calendar Printable

Iowa State Calendar 2024 2024 Calendar Printable

2024 Biweekly Payroll Calendar Template Excel Pdf Download

Csuf Payroll Calendar 2024 May 2024 Calendar Images and Photos finder

Csuf Payroll Calendar 2024 May 2024 Calendar

2024 Biweekly Pay Calendar 2024 Calendar Printable

State Of Iowa 2024 Payroll Calendar Printable Word Searches

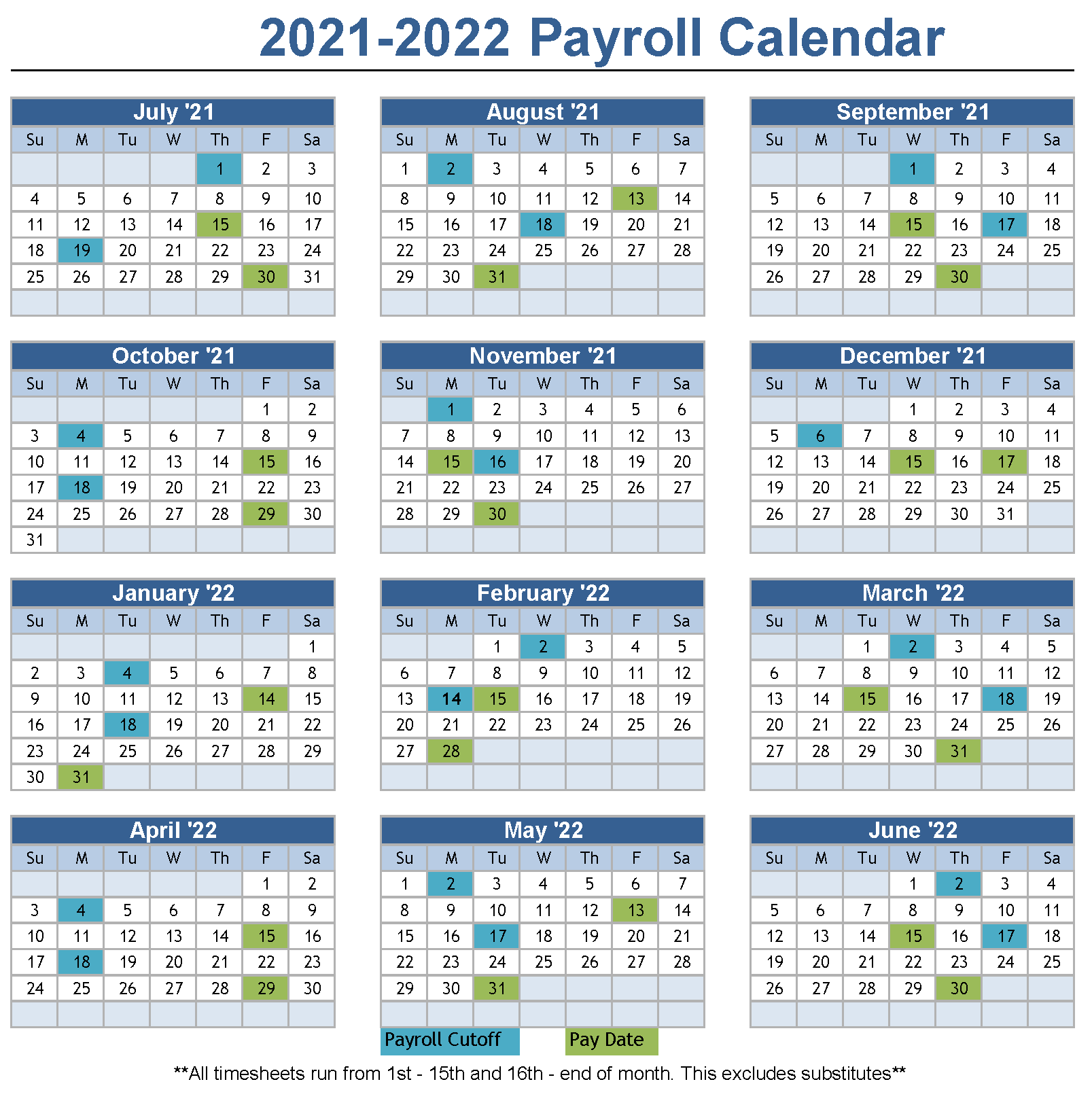

January ‐ June 2024 Payroll Dates Semi‐Monthly Monthly January April January April.

Web State Employee Salary Book.

There Are A Total Of 262 Working Days In The 2024 Calendar Year.

The Measure Would Lower Iowa’s Individual Income Tax To A 3.8% Flat Rate Beginning In 2025, A Cut.

Related Post: