Self Employment Printable Small Business Tax Deductions Worksheet

Self Employment Printable Small Business Tax Deductions Worksheet - Page last reviewed or updated: Social security and medicare taxes and income tax withholding: For a full list, go to the publication 535 for 2022 pdf. Web department of the treasury internal revenue service. Turbotax can help make the job easier. _______________________________ paid employees or other individuals i want to deduct a home office. Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig. 15th day of 4th, 6th, and 9th months of tax year, and 15th day of 1st month after the end of tax year. It has been designed to help collect and organize the information that we will need to prepare the business portion of your income tax returns in the most efficient and timely manner possible. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. Easily calculate your tax rate to make smart financial decisions. Page last reviewed or updated: Request a filing extension if needed. 15th day of 4th, 6th, and 9th months of tax year, and 15th day of 1st month after the end of tax year. Go to www.irs.gov/schedulese for instructions and the latest information. Create a tax filing calendar. Businesses can apply for an ein in several ways including online at irs.gov. Request a filing extension if needed. Go to www.irs.gov/schedulese for instructions and the latest information. It has been designed to help collect and organize the information that we will need to prepare the business portion of your income tax returns in the. Best online tax filing services compared. Guide to business expense resources. Make note of common tax deductions and credits. Gather the needed business tax return documents. The irs does not allow a deduction for undocumented mileage. Generally, expenses such as haircuts, manicures, pedicures, etc. Know what tax forms you need to file. Month/day/year vehicle was placed in service for business use: Make note of common tax deductions and credits. Page last reviewed or updated: For a full list, go to the publication 535 for 2022 pdf. Month/day/year vehicle was placed in service for business use: Download your 2022 small business tax deductions worksheet [pdf] Easily calculate your tax rate to make smart financial decisions. You had church employee income of $108.28 or more. The self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Guide to business expense resources. Web with an easy web search, you can easily get a substantial selection of free, printable worksheets for a range of subjects and also grade levels such as printable. Web this spreadsheet helps you track everything you buy for. See the filledin por tions of both schedule se (form 1040), selfemployment income, and form 1040, later. Turbotax can help make the job easier. Request a filing extension if needed. If there are multiple vehicles, please attach a separate statement with a breakdown per vehicle. Download your 2022 small business tax deductions worksheet [pdf] The self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Know the types of small business taxes. Web department of the treasury internal revenue service. You figure your selfemployed rate and max imum deduction for employer contributions you made for yourself as follows. The irs does not allow a deduction for undocumented mileage. Consider income, expenses and vehicle information. If there are multiple vehicles, please attach a separate statement with a breakdown per vehicle. Guide to business expense resources. For a full list, go to the publication 535 for 2022 pdf. Keep a written mileage log showing the date, miles, and business purpose for each trip. Turbotax can help make the job easier. It has been designed to help collect and organize the information that we will need to prepare the business portion of your income tax returns in the most efficient and timely manner possible. Keep a written mileage log showing the date, miles, and business purpose for each trip. You can reduce your business. Month/day/year vehicle was placed in service for business use: The self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Web when we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the tax deductions available to your small business. Best online tax filing services compared. Web with an easy web search, you can easily get a substantial selection of free, printable worksheets for a range of subjects and also grade levels such as printable. In summary, we need these sources of information: Generally, expenses such as haircuts, manicures, pedicures, etc. Businesses can apply for an ein in several ways including online at irs.gov. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. For a full list, go to the publication 535 for 2022 pdf. The irs does not allow a deduction for undocumented mileage. Social security and medicare taxes and income tax withholding: Schedules c, e and f. Make note of common tax deductions and credits. Page last reviewed or updated: If there are multiple vehicles, please attach a separate statement with a breakdown per vehicle.

Business Tax Deductions Cheat Sheet Excel in PINK Tax Etsy

Tax Deductions Sheet. Business Tax Deductions. Personal Tax Deductions

The Epic Cheat Sheet to Deductions for SelfEmployed Rockstars

Tax Write Offs Your Guide To All Itemized Deductions Business tax

Printable Small Business Tax Deductions Worksheet

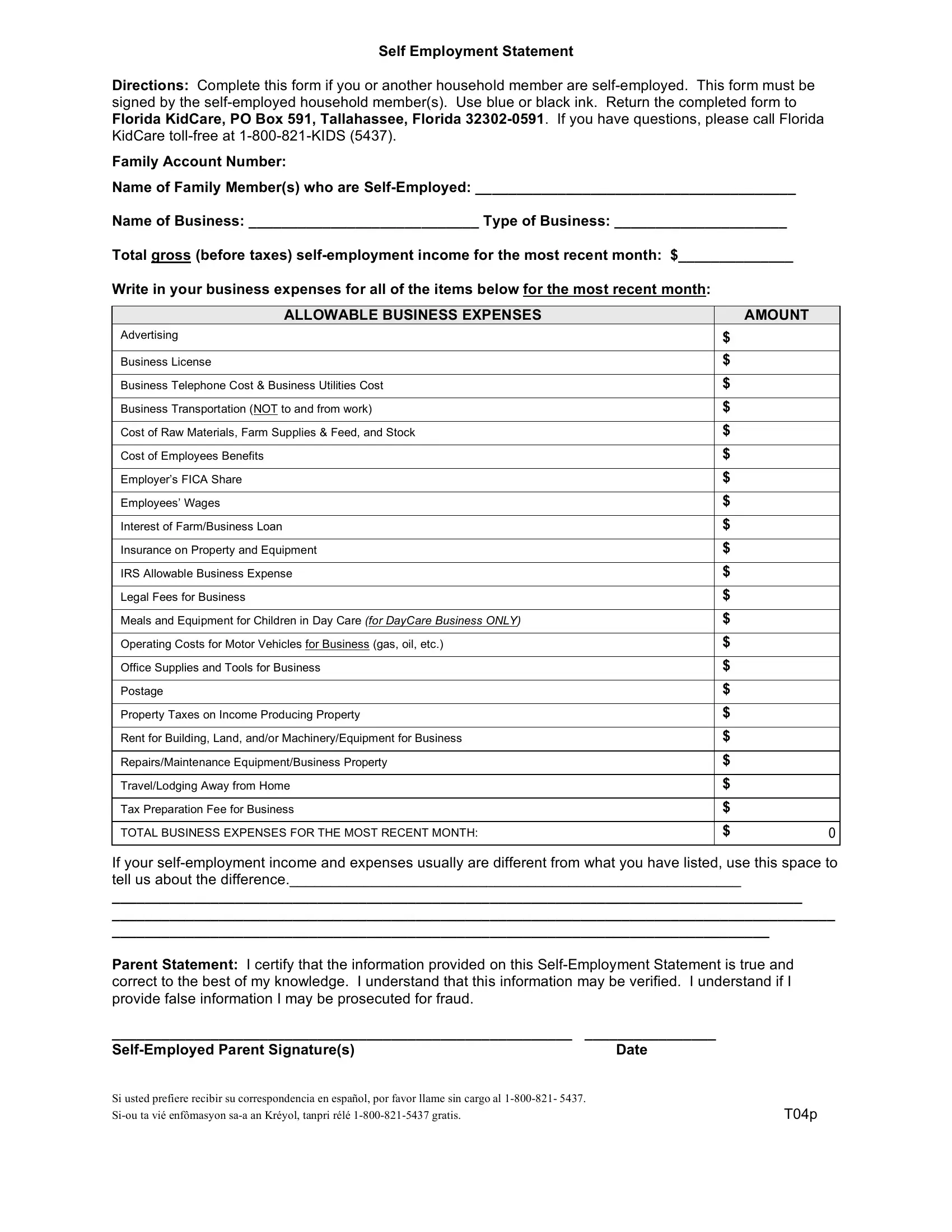

Self Employment Form ≡ Fill Out Printable PDF Forms Online

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

20++ List Of Itemized Deductions Worksheet Worksheets Decoomo

Owner Operator Trucker Tax Deduction Worksheet

Printable Small Business Tax Deductions Worksheet Check Out This

Web Below Is A Mapping To The Major Resources For Each Topic.

_______________________________ Paid Employees Or Other Individuals I Want To Deduct A Home Office.

Gather The Needed Business Tax Return Documents.

Go To Www.irs.gov/Schedulese For Instructions And The Latest Information.

Related Post: