Refund Status Calendar

Refund Status Calendar - The irs says they issue 90% of refunds in that time frame. The irs updates the app overnight, so if you don't see. Several elements can affect the timing of your tax. Be sure to use the same information used on your return: Web you can use the tool to check the status of your return: If you choose to have your refund. Web to check your refund status, you need the amount of the new york state refund you requested. Web most taxpayers receive their refunds within 21 days of filing. The irs will accept and process returns through april 15, 2024. All fields marked with an. Web as a result of all of this, the deadline for filing federal income tax returns (generally form 1040), will be tuesday, april 18, 2023, and most states usually follow the same calendar. Find out why your refund may be. If you choose to have your refund. The irs says they issue 90% of refunds in that time frame. Web. Web when you click “submit,” you’ll get the latest status on your refund. Be sure to use the same information used on your return: System [+] when can i expect my refund? Web see your personalized refund date as soon as the irs processes your tax return and approves your refund. Social security number, tax year, and refund amount. Web the irs generally issues refunds within 21 days of when you electronically filed your tax return, and longer for paper returns. Be sure to use the same information used on your return: Web expect the irs to acknowledge your return within 24 to 48 hours. Web you can start checking on the status of your refund within 24 hours. The irs says they issue 90% of refunds in that time frame. The irs does not release a calendar, but continues to issue guidance that most filers should receive their refund within 21 days. Web expect the irs to acknowledge your return within 24 to 48 hours. The irs updates the app overnight, so if you don't see. Web most. Web individuals waiting for refunds can check their status by visiting where’s my refund on aztaxes.gov. Web the irs generally issues refunds within 21 days of when you electronically filed your tax return, and longer for paper returns. Tips for using the where's my refund? Web you can start checking on the status of your refund within 24 hours after. Several elements can affect the timing of your tax. If you choose to have your refund. Web you can start checking on the status of your refund within 24 hours after the irs has received your electronically filed return, or 4 weeks after you mailed a paper. Web to log in, you'll need your social security number, filing status and. Web as a result of all of this, the deadline for filing federal income tax returns (generally form 1040), will be tuesday, april 18, 2023, and most states usually follow the same calendar. Be sure to use the same information used on your return: System [+] when can i expect my refund? The irs says they issue 90% of refunds. Web the irs generally issues refunds within 21 days of when you electronically filed your tax return, and longer for paper returns. Southwest airlines’ 2022 service meltdown alone, which impacted 17,000 flights, resulted in more. Several elements can affect the timing of your tax. Web individuals waiting for refunds can check their status by visiting where’s my refund on aztaxes.gov.. Web individuals waiting for refunds can check their status by visiting where’s my refund on aztaxes.gov. Web see your personalized refund date as soon as the irs processes your tax return and approves your refund. Be sure to use the same information used on your return: Southwest airlines’ 2022 service meltdown alone, which impacted 17,000 flights, resulted in more. Washington. Web you can start checking on the status of your refund within 24 hours after the irs has received your electronically filed return, or 4 weeks after you mailed a paper. Find out why your refund may be. You get personalized refund information based on the processing of your tax return. Web individuals waiting for refunds can check their status. System [+] when can i expect my refund? Find out why your refund may be. Check the status of your california state refund. Southwest airlines’ 2022 service meltdown alone, which impacted 17,000 flights, resulted in more. You get personalized refund information based on the processing of your tax return. Several elements can affect the timing of your tax. Washington — with millions of tax refunds going out each week, the internal revenue service reminded taxpayers today that recent improvements. Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. The irs does not release a calendar, but continues to issue guidance that most filers should receive their refund within 21 days. Web to check your refund status, you need the amount of the new york state refund you requested. If you choose to have your refund. Be sure to use the same information used on your return: The irs says they issue 90% of refunds in that time frame. Use where's my refund to check the status of individual income tax returns and amended individual income tax returns you've filed within the last year. Web most taxpayers receive their refunds within 21 days of filing. You can get your refund information for the current.

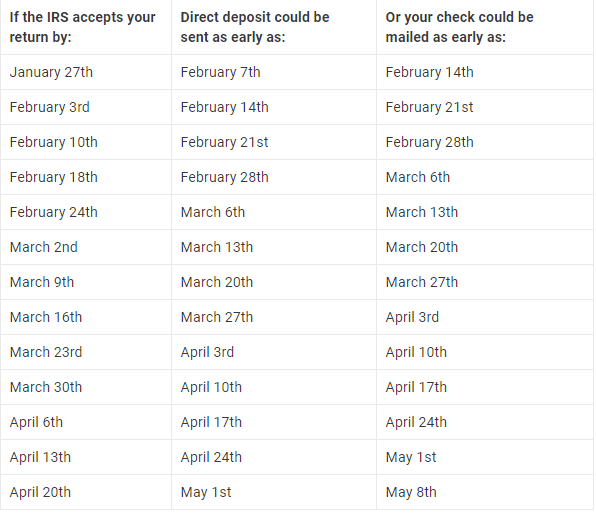

The IRS Tax Refund Schedule 2023 Where's My Refund?

Refund Schedule 2022 IRS Refund Cycle Chart

Tax Refund Chart to Help You Guess When You’ll Receive Your Money In

IRS Refund Status IRS Processing Dates Chart Online Refund Status

How to Check Your Tax Refund Status Shared Economy Tax

The IRS Tax Refund Schedule 2023 Where's My Refund?

Refund Cycle Chart Online Refund Status

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule

Irs Updates On Refunds 2023 Calendar 2023 Get Calender 2023 Update

IRS Refund Schedule 2024 When To Expect Your Tax Refund

Web The Irs Generally Issues Refunds Within 21 Days Of When You Electronically Filed Your Tax Return, And Longer For Paper Returns.

Web You Can Use The Tool To Check The Status Of Your Return:

The Irs Will Accept And Process Returns Through April 15, 2024.

Web To Log In, You'll Need Your Social Security Number, Filing Status And The Expected Amount Of Your Refund.

Related Post: