Plan Year Vs Calendar Year

Plan Year Vs Calendar Year - Web a flexible spending account (fsa) is an. Our plans all switch to plan year after first anniversary year. Does an fsa have to be on a calendar year? 31, known as calendar year. Web a flexible spending account plan year does not have to be based on the calendar year. Web essentially, a plan year revolves around the start and end dates that an employer designates for their insurance and benefit plans, which might not necessarily. Web web this video explains the difference between a calendar year vs a plan year, and what happens with your deductible and out of pocket max. A flexible spending account plan year does not have to be based on the calendar year. What is the difference between a calendar year & a plan year with healthcare insurance? 1st since it’s most common to have an. The deductible limit is the maximum. When it comes to deductibles, it’s calendar year vs. Web these three gap year scenarios can impact your cost of attendance. A flexible spending account plan. Web web this video explains the difference between a calendar year vs a plan year, and what happens with your deductible and out of pocket max. A flexible spending account plan year does not have to be based on the calendar year. Web essentially, a plan year revolves around the start and end dates that an employer designates for their insurance and benefit plans, which might not necessarily. Does an fsa have to be on a calendar year? A plan year (not to be confused with. You can still get all of the coverage you need, but at. Web the choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. Everything you read talks about 500 hours worked in 2021, 2022 and 2023 implying the hours are. Web a flexible spending account (fsa) is an. Web the difference between. Our plans all switch to plan year after first anniversary year. A flexible spending account plan. Web since plan eligibility switches to plan year after that, the person is eligible if worked 500 hours in calendar year 2022 and also 500 in 2023, then is eligible 1/1/2024. What is the difference between a calendar year & a plan year with. Web with task list recurrence, you'll be able to apply a recurrence pattern to a task list, with options for daily, weekly, monthly, or yearly intervals. Benefits coverage provided through the adp totalsource health and. 587 views 3 years ago #medicalbilling #healthinsurance #benefits. Web a flexible spending account (fsa) is an. Does an fsa have to be on a calendar. A flexible spending account plan. A plan year provides flexibility in coverage start dates, while a calendar year aligns with standard fiscal planning. What is the difference between a calendar year & a plan year with healthcare insurance? Web a flexible spending account (fsa) is an. Web web this video explains the difference between a calendar year vs a plan. Web a flexible spending account (fsa) is an. What is the difference between a calendar year & a plan year with healthcare insurance? A plan year (not to be confused with tax year or fiscal year) can be different. Web a calendar year deductible, which most health plans operate on, begins on january 1 and ends on december 31. All. Benefits coverage provided through the adp totalsource health and. Web the difference between calendar year and plan year. When it comes to deductibles, it’s calendar year vs. Web it’s going to be a group deductible that start on the same day for everybody in the group and it’s most common to be jan. All individual plans now have the calendar. Web the common confusion here is generally caused by the reporting requirement—the required reporting is for the calendar year regardless of when your. The calendar year commonly coincides with the. Web if you seek care outside of a dpc, your decent plan will still work like a good traditional health plan with a deductible. Benefits coverage provided through the adp. 1st since it’s most common to have an. 31, known as calendar year. A flexible spending account plan. When it comes to deductibles, it’s calendar year vs. Web the choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. Web the choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. A flexible spending account plan year does not have to be based on the calendar year. Web the difference between calendar year and plan year. When it comes to deductibles, it’s calendar year vs. Web if the plan does not impose deductibles or limits on a yearly basis, and either the plan is not insured or the insurance policy is not renewed on an annual basis, the plan year is the. Everything you read talks about 500 hours worked in 2021, 2022 and 2023 implying the hours are. Web a flexible spending account plan year does not have to be based on the calendar year. Web it’s going to be a group deductible that start on the same day for everybody in the group and it’s most common to be jan. Web a calendar year deductible, which most health plans operate on, begins on january 1 and ends on december 31. Web since plan eligibility switches to plan year after that, the person is eligible if worked 500 hours in calendar year 2022 and also 500 in 2023, then is eligible 1/1/2024. Web a flexible spending account (fsa) is an. The deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan coverage is required to satisfy the full. Web with task list recurrence, you'll be able to apply a recurrence pattern to a task list, with options for daily, weekly, monthly, or yearly intervals. Web the irs sets a limit on how much. 31, known as calendar year. If you move to a new state during your gap year.

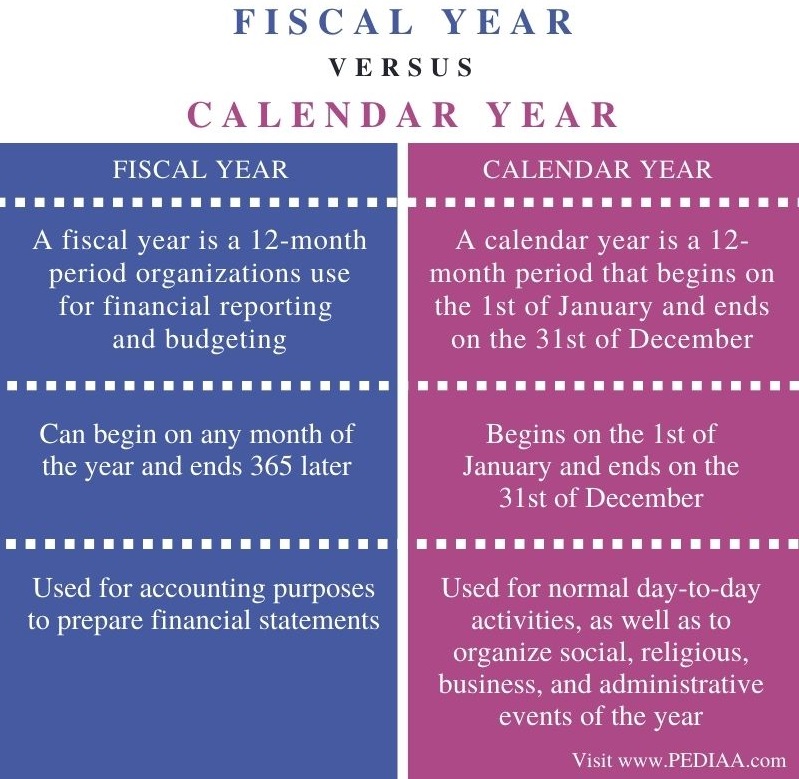

Fiscal Year vs Calendar Year What's The Difference?

Calendar Year Vs Plan Year For Insurance 2024 Calendar 2024 Ireland

Accident Year vs Calendar Year Insurance Terminology Actuarial 101

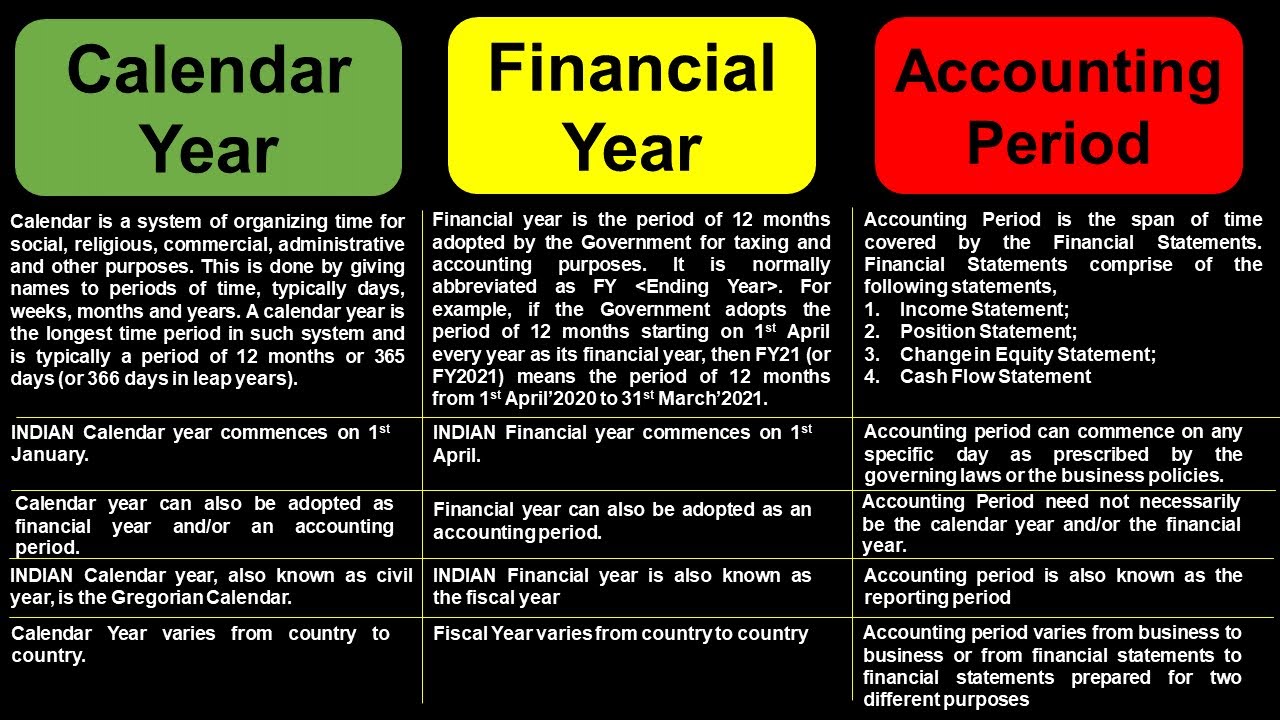

What is Calendar Year What is Financial Year What is Accounting

Plan Year Vs Calendar Year

Difference Between Group Plan Year vs. Calendar Plan Year? Best NJ

Calendar vs Plan Year What is the difference? Medical Billing YouTube

What is a Fiscal Year? Your GoTo Guide

What is the Difference Between Fiscal Year and Calendar Year

Plan Year Deductible vs. Calendar Year Deductible YouTube

A Plan Year (Not To Be Confused With Tax Year Or Fiscal Year) Can Be Different.

Does An Fsa Have To Be On A Calendar Year?

Many Public Colleges Offer Discounted Tuition.

What Is The Difference Between A Calendar Year & A Plan Year With Healthcare Insurance?

Related Post: