Owners Draw

Owners Draw - Web an owner's draw is when a business owner takes funds out of their business for personal use. Web owner’s draws are withdrawals of a sole proprietorship’s cash or other assets made by the owner for the owner’s personal use. Learn how owner's draw works for sole proprietors,. As a business owner, at least a part of your business bank account belongs to you. West paces racing, danny gargan, gmp stables, first derby for each. Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. Sierra leone drew the no. Business owners may use an. Salary is a regular, fixed payment like an employee would receive. As an owner of a limited. Web learn what an owner's draw is, how it affects your business finances, and how to choose between draw and salary methods. Web learn the pros and cons of the draw method and the salary method for small business owners. In a corporation, owners can receive compensation by a salary or. Is an owner’s draw considered income? Web what is. Web owner's draw is a distribution from the owner's equity account, which represents the owner's investment in the business. Web the post position draw for both the derby and the kentucky oaks was held on saturday evening and we’ve got a full breakdown below. Web owner draws are only available to owners of sole proprietorships and partnerships. Compare the tax. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. How are corporate llcs taxed? Web learn what an owner's draw is, how it affects your business finances, and how to choose between draw and salary methods. Post positions for the 2024 kentucky oaks are set;. Solved • by quickbooks • 877 • updated 1 year ago. West paces racing, danny gargan, gmp stables, first derby for each. Set up and pay an owner's draw. Web learn what an owner's draw is, how it affects your business finances, and how to choose between draw and salary methods. How much should i pay myself as a business. Post positions for the 2024 kentucky oaks are set; What is an owner's draw? Web learn what owner's draw is, how to record it in a sole proprietorship or partnership, and how it affects the balance sheet. Salary is a regular, fixed payment like an employee would receive. How are owner’s draws taxed? Web what is an owner’s draw? Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. Web louisville courier journal. The account in which the draws are recorded is a. 2 post, with catching freedom at. West paces racing, danny gargan, gmp stables, first derby for each. Web what is an owner’s draw? Compare the tax implications, flexibility, and benefits of each method. Web learn the pros and cons of the draw method and the salary method for small business owners. More like this small business. Web what is an owner’s draw? Web owner draws are only available to owners of sole proprietorships and partnerships. How to pay yourself as a business owner by business type. Is an owner’s draw considered income? Web an owner's draw is when a business owner takes funds out of their business for personal use. There is no fixed amount and no fixed interval for these. How are corporate llcs taxed? Compare the tax implications, flexibility, and benefits of each method. 2 post, with catching freedom at. In a corporation, owners can receive compensation by a salary or. Find out the difference between owner's draw and. West paces racing, danny gargan, gmp stables, first derby for each. With tarifa established as the favorite in the $1.5 million, grade 1 stakes. How are owner’s draws taxed? Web learn what an owner's draw is, how it affects your business finances, and how to choose between draw and salary methods. There is no fixed amount and no fixed interval for these. Technically, an owner’s draw is a distribution from the owner’s equity account, an account that represents the owner’s investment in the. West paces racing, danny gargan, gmp stables, first derby for each. As an owner of a limited. Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. You’re allowed to withdraw from your share. The account in which the draws are recorded is a. 2 post, with catching freedom at. Find out the difference between owner's draw and. Web an owner's draw is when a business owner takes funds out of their business for personal use. Web owner’s draws are withdrawals of a sole proprietorship’s cash or other assets made by the owner for the owner’s personal use. As a business owner, at least a part of your business bank account belongs to you. Sierra leone drew the no. What is an owner's draw? How much should i pay myself as a business owner? More like this small business.

Owner Draw 101 for Photographers YouTube

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)

Owner's Draw What Is It?

What is an Owner’s Draw, and Why is it Important?

All About The Owners Draw And Distributions Let's Ledger

What Is an Owner's Draw? Definition, How to Record, & More

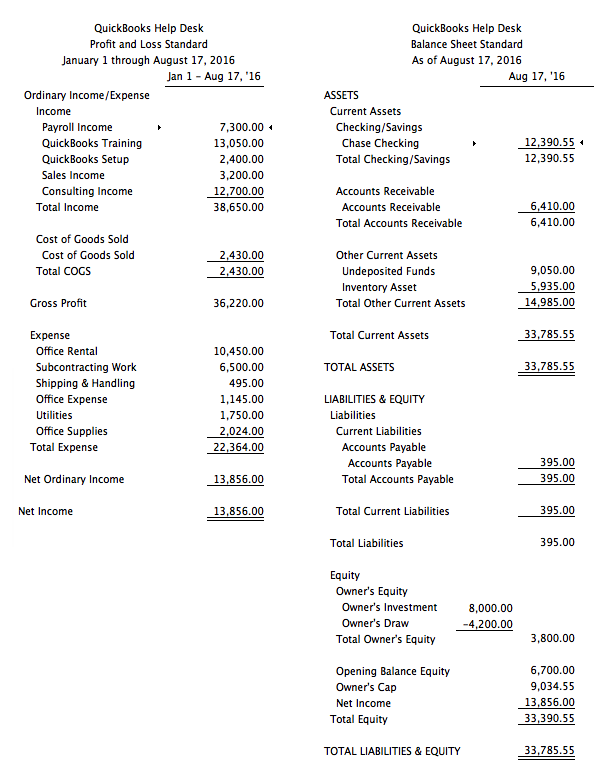

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Owners Draw

Owners Draw

What is Owner’s Draw (Owner’s Withdrawal) in Accounting? Accounting

Web In Accounting, An Owner's Draw Is When An Accountant Withdraws Funds From A Drawing Account To Provide The Business Owner With Personal Income.

Should I Pay Myself A Salary?

Web Learn The Pros And Cons Of The Draw Method And The Salary Method For Small Business Owners.

Post Positions For The 2024 Kentucky Oaks Are Set;

Related Post: