Irs Mileage Log Template

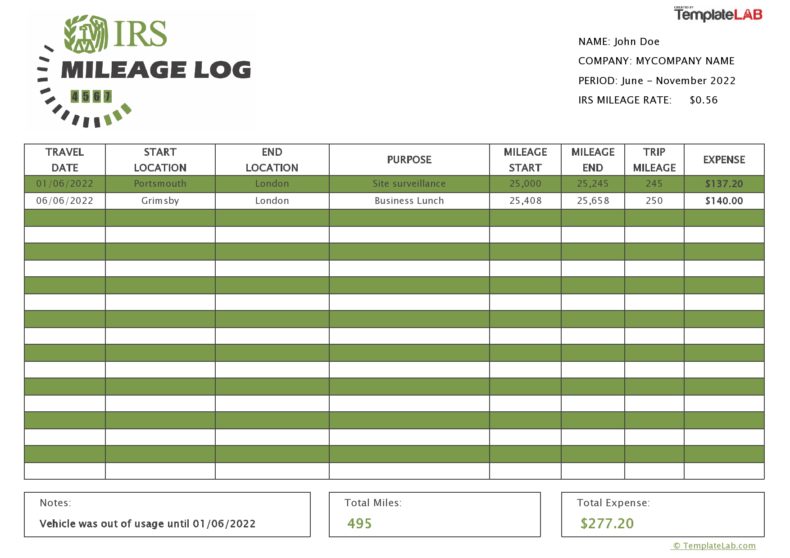

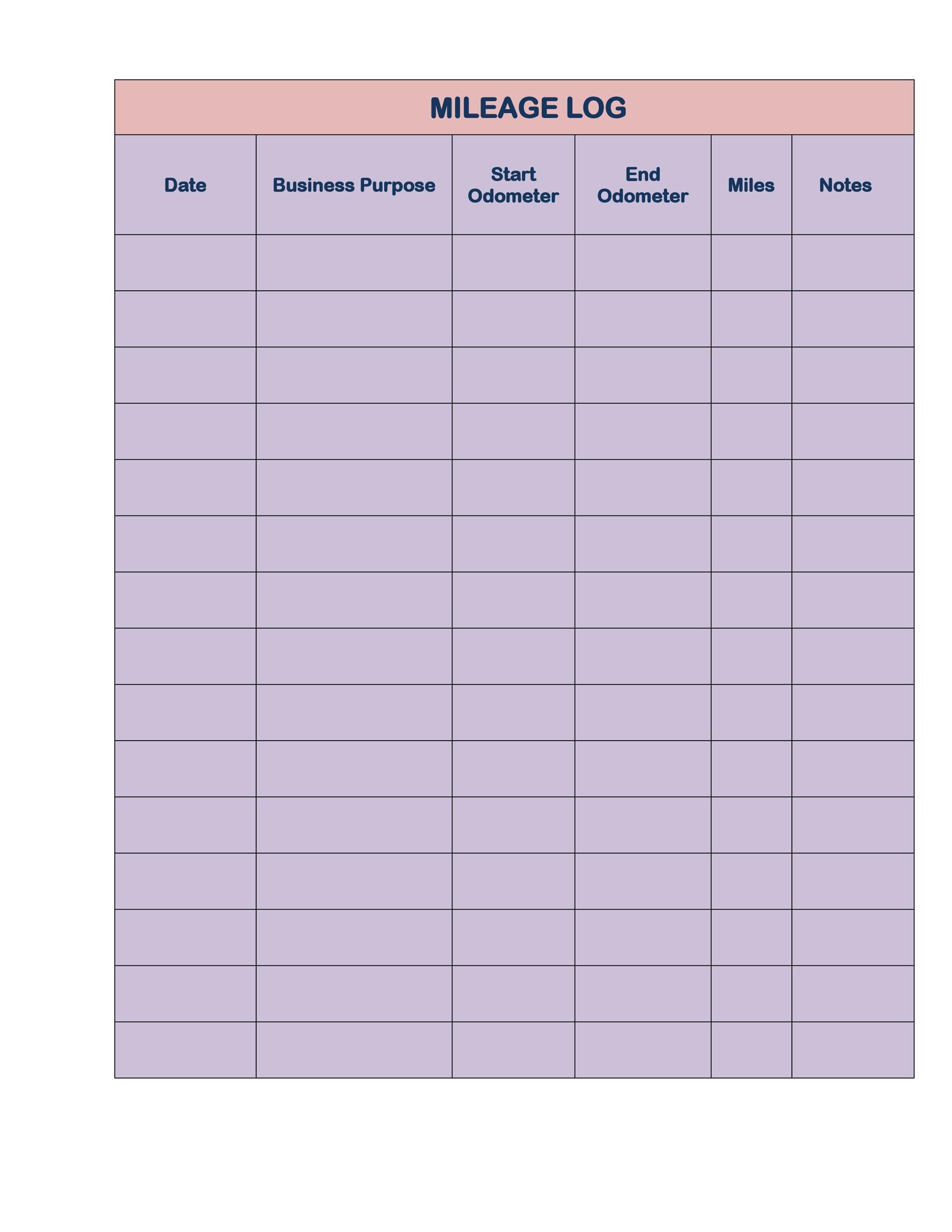

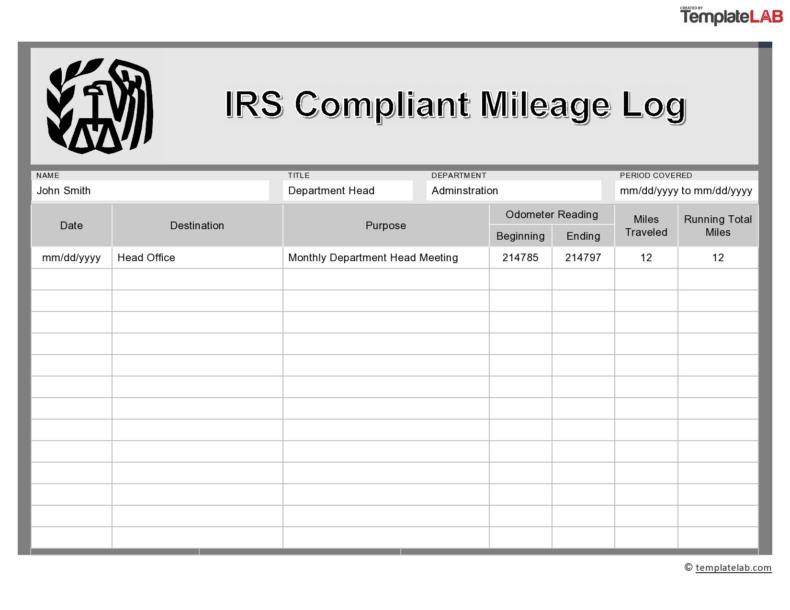

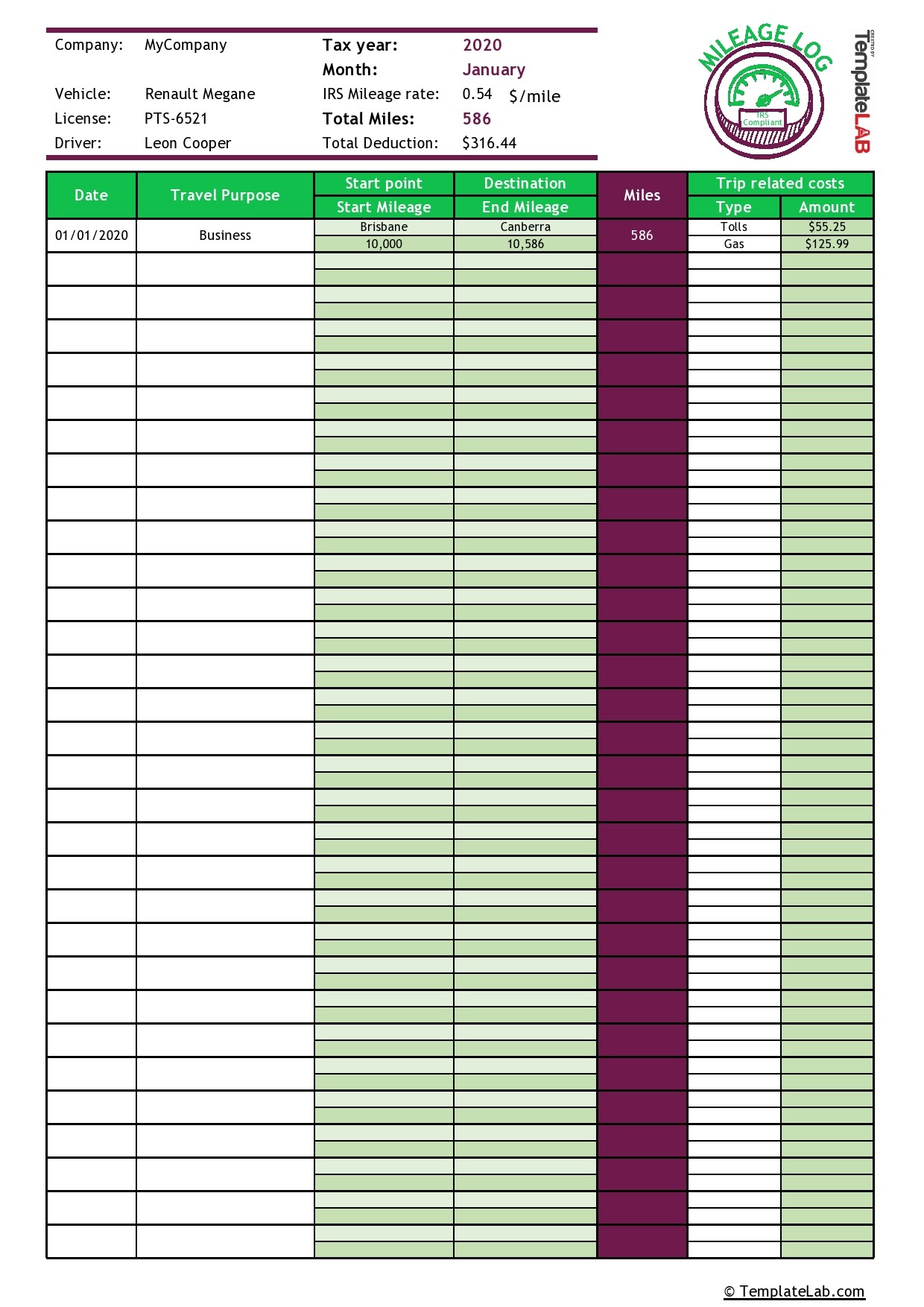

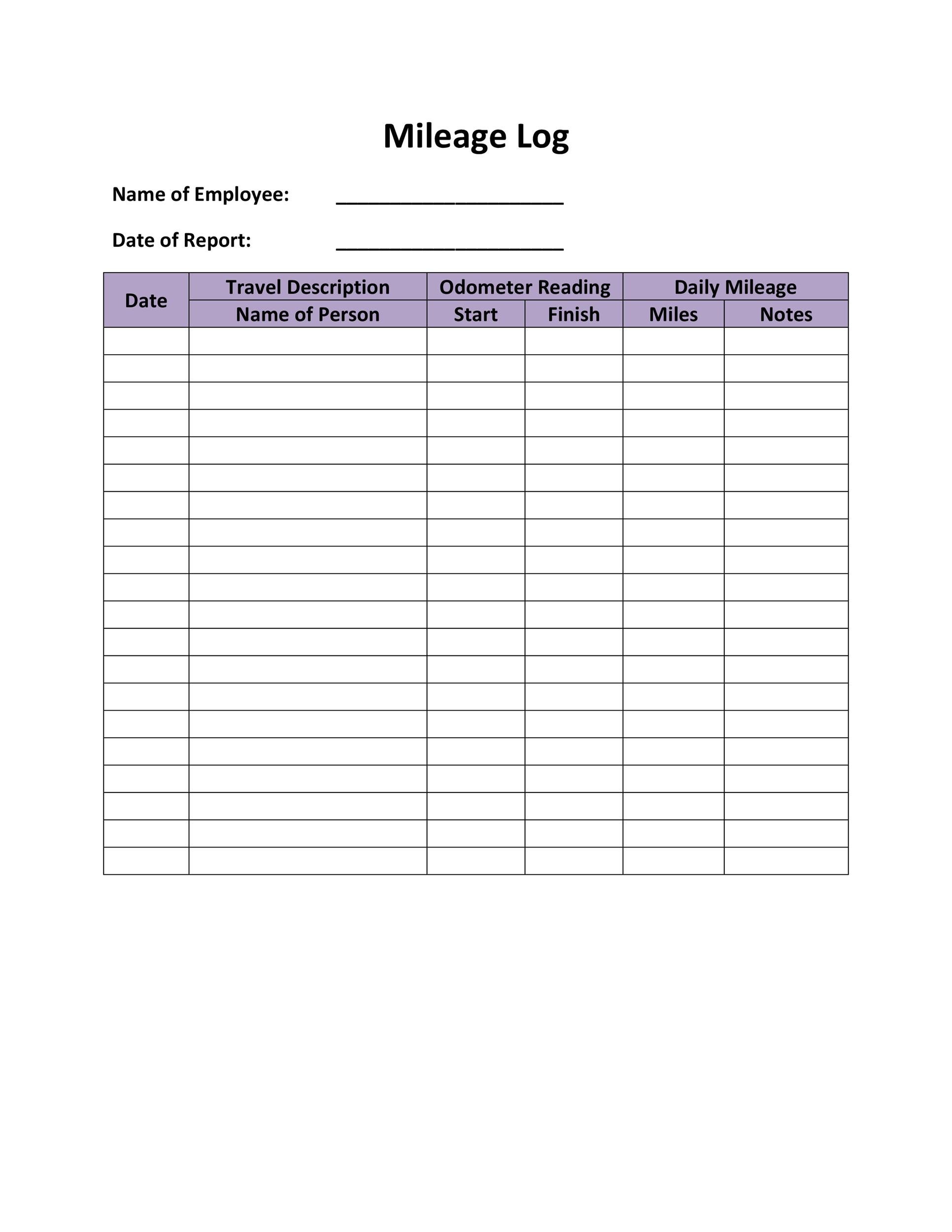

Irs Mileage Log Template - A paper log is a simple, written record of your business miles driven. Web how the keeper mileage log works. For drivers who chose aem (actual expense method), the single most important thing for their business mileage tax deduction is to maintain their records of relevant receipts, invoices, and all. Web then this irs mileage log template is for you. The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images: Follow these best practices to avoid an audit. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. Depreciation limits on cars, trucks, and vans. See an overview of previous mileage rates. Car expenses and use of the standard mileage rate are explained in chapter 4. Car expenses and use of the standard mileage rate are explained in chapter 4. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Web then this irs mileage log template is for you. The snippet below shows all the above mentioned details, except for the odometer and. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Web how the keeper mileage log works. Paper logs and digital logs. Web then this irs mileage log template is for you. See an overview of previous mileage rates. A paper log is a simple, written record of your business miles driven. It should include the date, the purpose of the trip, and the total miles driven for each business trip. Web the irs accepts two forms of mileage log formats: Web for actual expense method: See an overview of previous mileage rates. This free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Paper logs and digital logs. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.. The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images: Web how the keeper mileage log works. Tax expert and contributor mileiq. See an overview of previous mileage rates. Web the irs accepts two forms of mileage log formats: For drivers who chose aem (actual expense method), the single most important thing for their business mileage tax deduction is to maintain their records of relevant receipts, invoices, and all. Follow these best practices to avoid an audit. It should include the date, the purpose of the trip, and the total miles driven for each business trip. Web you can. Tax expert and contributor mileiq. Follow these best practices to avoid an audit. See an overview of previous mileage rates. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Car expenses and use of the standard mileage rate are explained in chapter 4. Car expenses and use of the standard mileage rate are explained in chapter 4. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Web you can use it as a free irs mileage log template. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5. Web then this irs mileage log template is for you. The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images: Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. Car expenses and use of the. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Depreciation limits on cars, trucks, and vans. A paper log is a simple, written record of your business miles driven. It should include the date, the purpose of the trip, and the total miles driven for each business trip. Web how the keeper mileage. Web you can use it as a free irs mileage log template. See an overview of previous mileage rates. Tax expert and contributor mileiq. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. A paper log is a simple, written record of your business miles driven. This free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Printable mileage log template for 2024. It should include the date, the purpose of the trip, and the total miles driven for each business trip. Web then this irs mileage log template is for you. Web for actual expense method: Web the irs accepts two forms of mileage log formats: A mileage log for taxes can lead to large savings but what does the irs require from your records? Car expenses and use of the standard mileage rate are explained in chapter 4. The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images: Depreciation limits on cars, trucks, and vans. Follow these best practices to avoid an audit.![]()

25 Printable IRS Mileage Tracking Templates GOFAR

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

ReadyToUse IRS Compliant Mileage Log Template 2021 MSOfficeGeek

30 Printable Mileage Log Templates (Free) Template Lab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

25 Printable IRS Mileage Tracking Templates GOFAR

30 Printable Mileage Log Templates (Free) Template Lab

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

Web Discover 25 Printable Irs Mileage Tracking Templates.

Web How The Keeper Mileage Log Works.

Web This Monthly Mileage Report Template Can Be Used As A Mileage Calculator And Reimbursement Form.

Paper Logs And Digital Logs.

Related Post: