Irs Form 4868 Printable

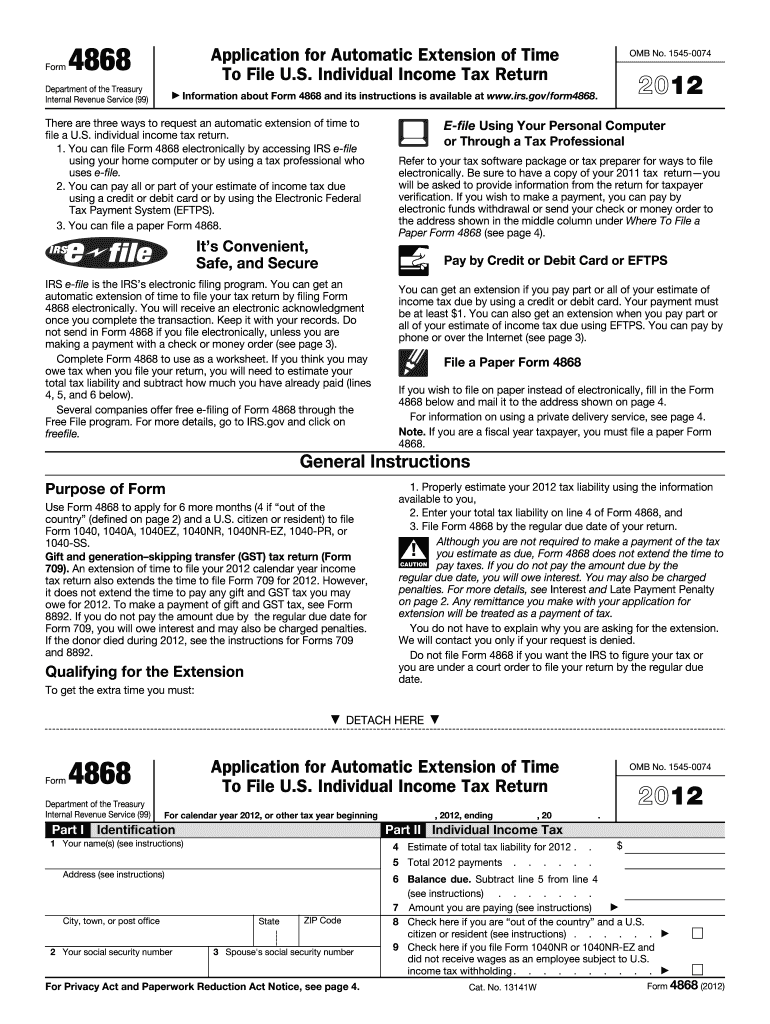

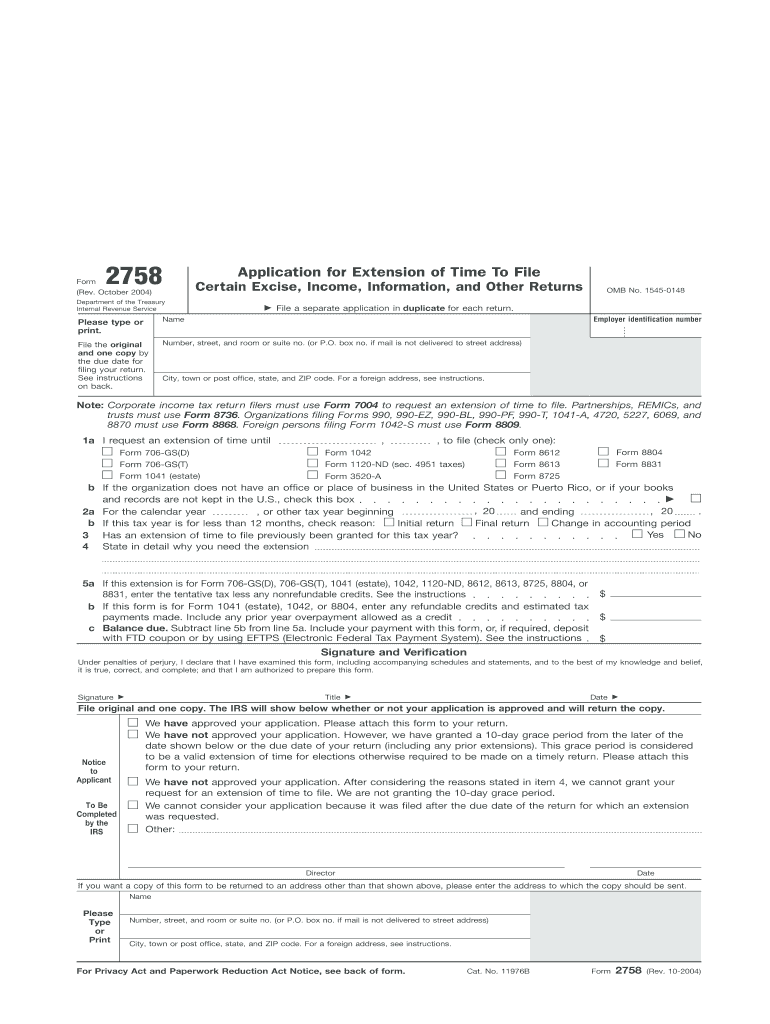

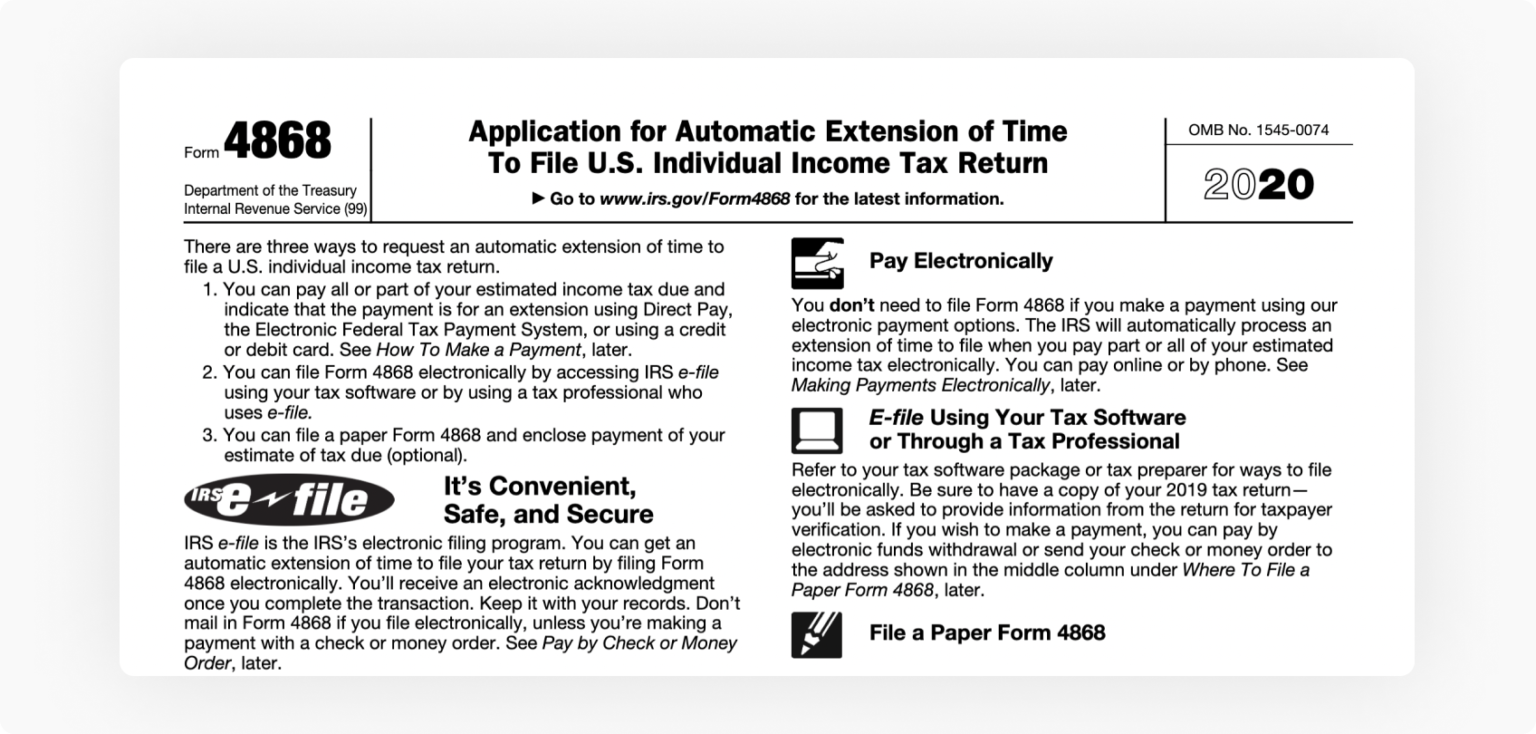

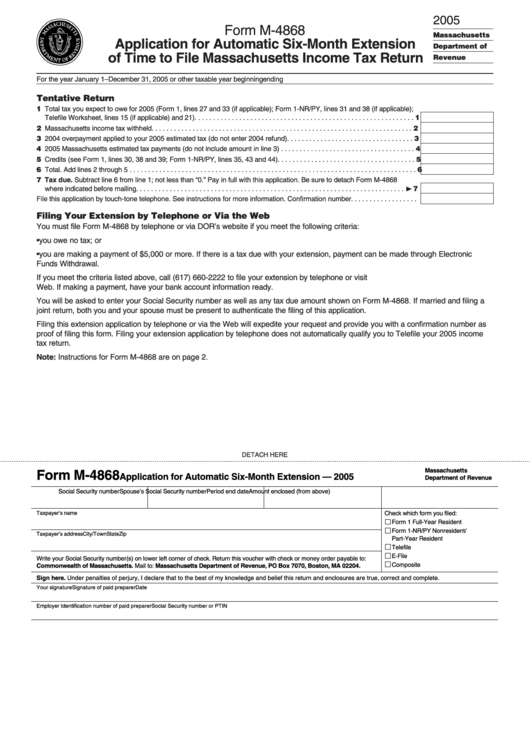

Irs Form 4868 Printable - Department of the treasury internal revenue service. Application for automatic extension of time to file u.s. Subtract the taxes you already paid for the filing year. Estimate how much tax you owe for the year on the extension form: An extension for federal income tax returns due on april 15 delays the submission until oct. You should include your tax payment in the same envelope and mail it to the address outlined in the form instructions. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web you have two options to submit your irs form 4868. Mail in the paper irs form 4868. Web if you’re submitting a paper form, you can download a printable irs form 4868 directly from the agency's website [0] Go to www.irs.gov/form4868 for the latest information. Web irs form 4868, also called the “application for automatic extension of time to file u.s. Anyone can qualify for an automatic federal tax extension. File form 4868, application for automatic extension of time to file u.s. Estimate how much tax you owe for the year on the extension form: Estimate how much tax you owe for the year on the extension form: Citizen or resident files this form to request an automatic extension of time to file a u.s. There are three ways to request an automatic extension of time to file a u.s. Application for automatic extension of time to file u.s. Web if you’re submitting a paper. Individual income tax return,” is used by those that need more time to file their federal income tax return. Web if you’re submitting a paper form, you can download a printable irs form 4868 directly from the agency's website [0] There are three ways to request an automatic extension of time to file a u.s. Department of the treasury internal. Estimate how much tax you owe for the year on the extension form: You should include your tax payment in the same envelope and mail it to the address outlined in the form instructions. Individual income tax return,” is used by those that need more time to file their federal income tax return. Go to www.irs.gov/form4868 for the latest information.. Application for automatic extension of time to file u.s. The extension doesn’t extend the time to pay any tax due. Individual income tax return,” is used by those that need more time to file their federal income tax return. An extension for federal income tax returns due on april 15 delays the submission until oct. Application for automatic extension of. Subtract the taxes you already paid for the filing year. Citizen or resident files this form to request an automatic extension of time to file a u.s. Application for automatic extension of time to file u.s. Estimate how much tax you owe for the year on the extension form: Web if you’re submitting a paper form, you can download a. Individual income tax return,” is used by those that need more time to file their federal income tax return. Anyone can qualify for an automatic federal tax extension. Individual income tax return is an internal revenue service (irs) form for individuals who wish to extend the amount. Web if you’re submitting a paper form, you can download a printable irs. Department of the treasury internal revenue service. Individual income tax return is an internal revenue service (irs) form for individuals who wish to extend the amount. Individual income tax return,” is used by those that need more time to file their federal income tax return. Application for automatic extension of time to file u.s. Subtract the taxes you already paid. Web if you’re submitting a paper form, you can download a printable irs form 4868 directly from the agency's website [0] Subtract the taxes you already paid for the filing year. Individual income tax return,” is used by those that need more time to file their federal income tax return. Mail in the paper irs form 4868. The extension doesn’t. Mail in the paper irs form 4868. Application for automatic extension of time to file u.s. Web you have two options to submit your irs form 4868. The extension doesn’t extend the time to pay any tax due. An extension for federal income tax returns due on april 15 delays the submission until oct. Individual income tax return,” is used by those that need more time to file their federal income tax return. An extension for federal income tax returns due on april 15 delays the submission until oct. Web if you’re submitting a paper form, you can download a printable irs form 4868 directly from the agency's website [0] Subtract the taxes you already paid for the filing year. Application for automatic extension of time to file u.s. You should include your tax payment in the same envelope and mail it to the address outlined in the form instructions. Go to www.irs.gov/form4868 for the latest information. Department of the treasury internal revenue service. Web form 4868 is known as the application for automatic extension of time to file u.s. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web you have two options to submit your irs form 4868. File form 4868, application for automatic extension of time to file u.s. Mail in the paper irs form 4868. Application for automatic extension of time to file u.s. Individual income tax return is an internal revenue service (irs) form for individuals who wish to extend the amount. Anyone can qualify for an automatic federal tax extension.

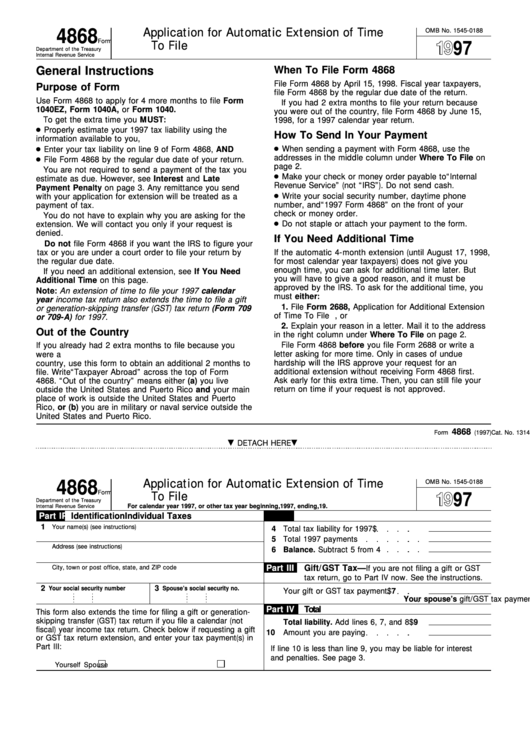

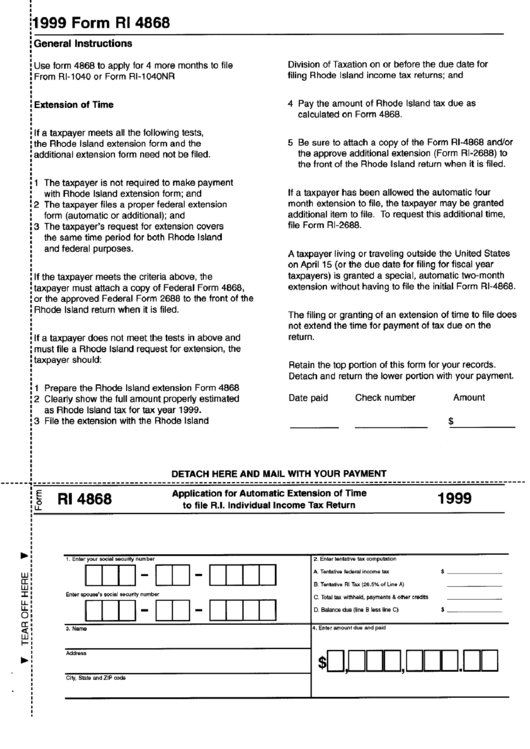

Fillable Online 2020 Form 4868. Application for Automatic Extension of Time To File U.S

Fillable Form 4868 Application For Automatic Extension Of Time To File U.s. Individual

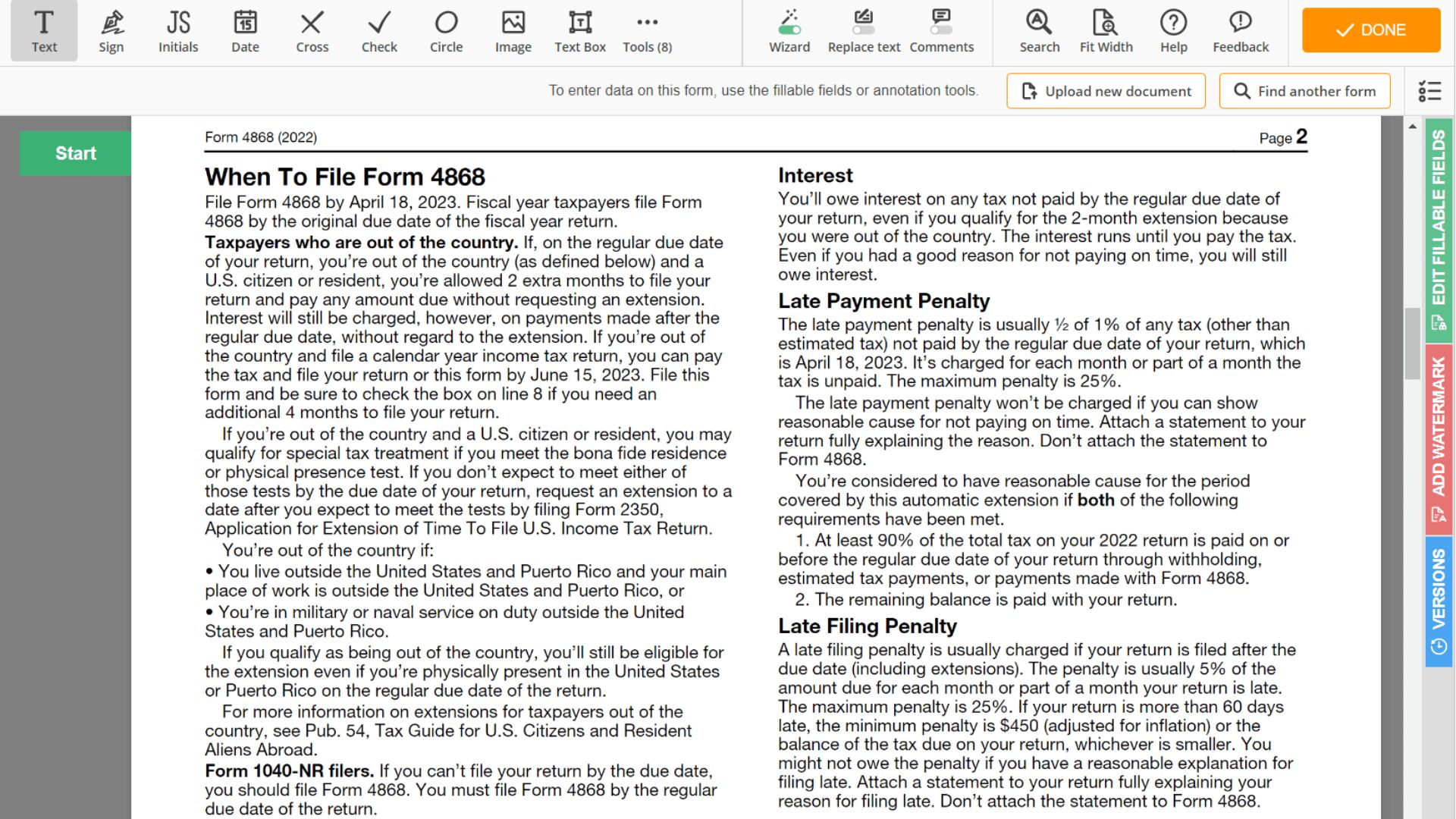

IRS 4868 Form Printable 📝 Get Tax Extension Form 4868 for 2022 Online PDF to Print & Instructions

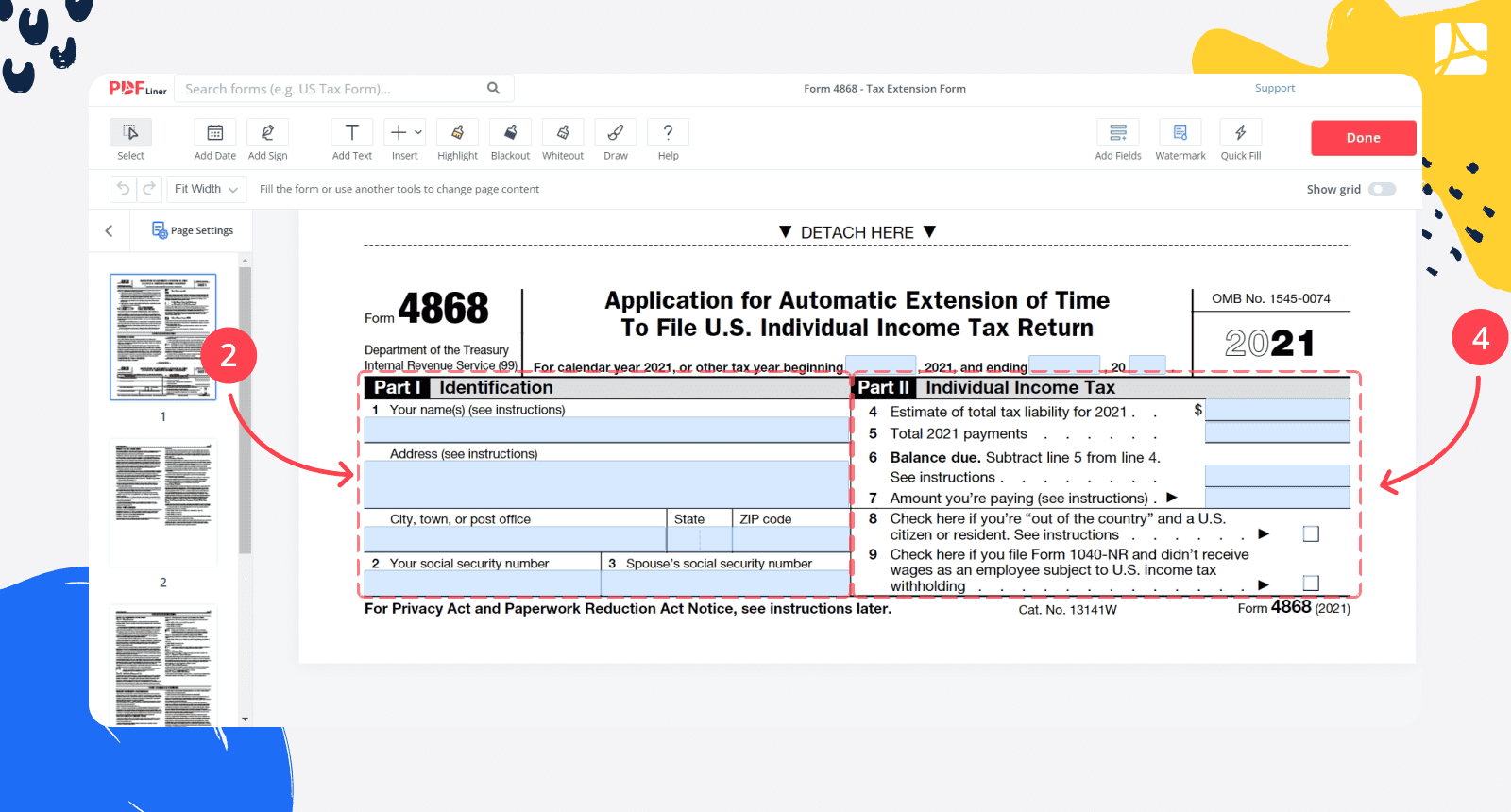

IRS Form 4868 2023, Application for Automatic Tax Extension PDFliner

Form 4868 Application For Automatic Extension Of Time To 2021 Tax Forms 1040 Printable

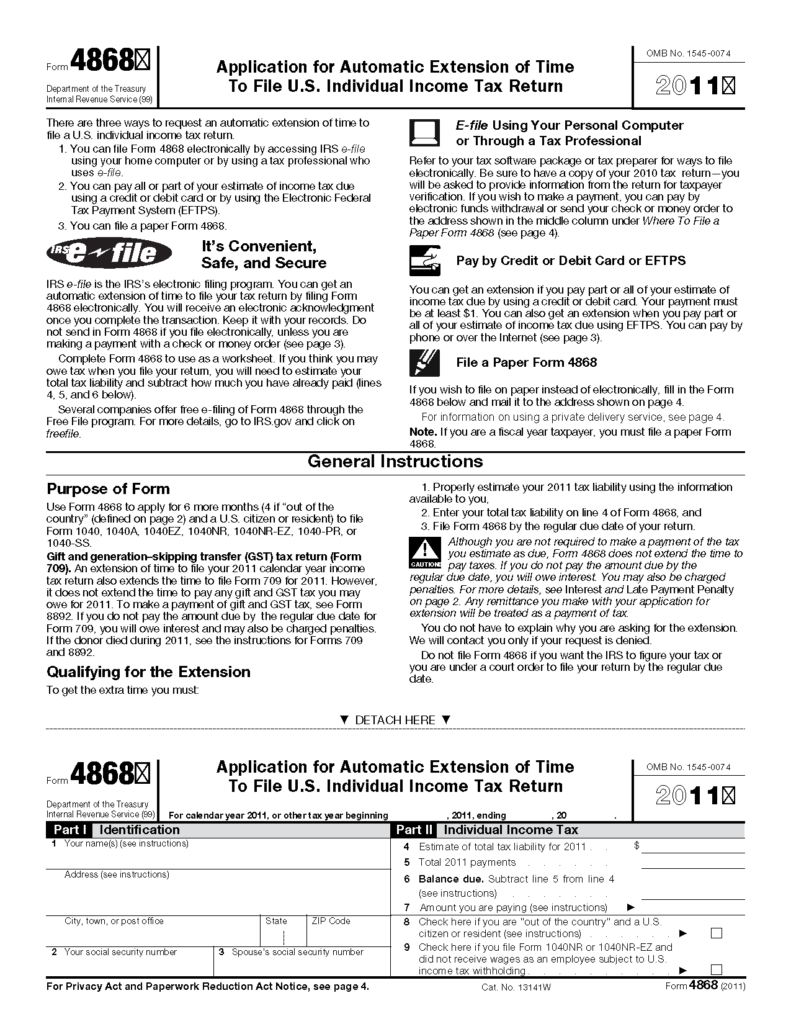

2012 Form IRS 4868 Fill Online, Printable, Fillable, Blank pdfFiller

Irs form 4868 printable free Fill out & sign online DocHub

Printable Form 4868

Form 4868 Printable

Web Irs Form 4868, Also Called The “Application For Automatic Extension Of Time To File U.s.

There Are Three Ways To Request An Automatic Extension Of Time To File A U.s.

The Extension Doesn’t Extend The Time To Pay Any Tax Due.

Estimate How Much Tax You Owe For The Year On The Extension Form:

Related Post: