Guaranteed Payments Vs Draws

Guaranteed Payments Vs Draws - The equivalent of a salary for llc members and partners. Web what are llc guaranteed payments? Web another way an llc member can be paid is through a draw, which is different from a guaranteed payment. A draw payment comes directly out of the. The draw method and the guaranteed payments method. Owner's draw or draw payment is a colloquial term rather than an irs term, defined as a distribution of cash or property an owner or partner takes out of a pass. Web owner’s draws, also known as “personal draws” or “draws,” allow business owners to withdraw money as needed and as profit allows. 707 (c) is very clear on the criterion for a guaranteed payment: Guaranteed payments to partners are payments meant to. Web what is a partnership draw? 707 (c) is very clear on the criterion for a guaranteed payment: A draw payment comes directly out of the. What is a guaranteed payment? Guaranteed payments to partners are payments meant to. Web guaranteed payments vs. Guaranteed payments to partners are payments meant to. Web what are llc guaranteed payments? Web to emphasize this difference, irc sec. Web another way an llc member can be paid is through a draw, which is different from a guaranteed payment. All of these are great questions and. Web guaranteed payments vs. Guaranteed payments to partners are payments meant to. Many entities (including llcs) classified as partnerships for tax purposes pay guaranteed payments to partners or members who are service providers. Web what is the difference between a guaranteed payment and a draw? Web as a business owner, there are two main ways to pay yourself and your. What are guaranteed payments to partners? Many entities (including llcs) classified as partnerships for tax purposes pay guaranteed payments to partners or members who are service providers. Guaranteed payments to partners are payments meant to. Payments to a partner for services or for the use of capital are guaranteed payments to. A draw may seem like a. Web to emphasize this difference, irc sec. This type of payment has certain tax benefits. Web owner’s draws, also known as “personal draws” or “draws,” allow business owners to withdraw money as needed and as profit allows. What are guaranteed payments to partners? Web guaranteed payments vs. Web updated may 4, 2022. With draws, money can similarly be taken from the business throughout the year. Although draw payments are similar to guaranteed payments, they’re not the same. Web guaranteed payments vs draws another way partners can get paid is through draws. Guaranteed payments are paid to llc members (owners) regardless of whether the company has generated net. Web what are llc guaranteed payments? A draw is a regularly scheduled payment, but it’s meant to be a prepayment of profit. Llc draws aren’t usually guaranteed, but they can be made to members at any time and are essentially an advance on estimated llc profits. Web what is a partnership draw? What are guaranteed payments to partners? A draw payment comes directly out of the. Web to emphasize this difference, irc sec. A draw may seem like a. Payments to a partner for services or for the use of capital are guaranteed payments to the extent that they. Guaranteed payments to partners are payments meant to. Web updated september 27, 2022. Web to emphasize this difference, irc sec. Web another way an llc member can be paid is through a draw, which is different from a guaranteed payment. What is a guaranteed payment? A draw is a regularly scheduled payment , but. Web updated may 4, 2022. Web owner’s draws, also known as “personal draws” or “draws,” allow business owners to withdraw money as needed and as profit allows. Payments to a partner for services or for the use of capital are guaranteed payments to. Business owners and partners can receive payment in a variety of ways, depending on certain factors, such. Web a guaranteed draw, or payment, is used as the llc equivalent of salary to managing members. Although draw payments are similar to guaranteed payments, they’re not the same. Payments to a partner for services or for the use of capital are guaranteed payments to. Web what is the difference between a guaranteed payment and a draw? A draw payment comes directly out of the. Payments to a partner for services or for the use of capital are guaranteed payments to the extent that they. What is a guaranteed payment? Web another way an llc member can be paid is through a draw, which is different from a guaranteed payment. A draw is a regularly scheduled payment, but it’s meant to be a prepayment of profit. Owner's draw or draw payment is a colloquial term rather than an irs term, defined as a distribution of cash or property an owner or partner takes out of a pass. Many entities (including llcs) classified as partnerships for tax purposes pay guaranteed payments to partners or members who are service providers. Guaranteed payments are paid to llc members (owners) regardless of whether the company has generated net. Web as a business owner, there are two main ways to pay yourself and your partners: This type of payment has certain tax benefits. Web to emphasize this difference, irc sec. What are guaranteed payments to partners?

Guaranteed Payments in Partnership. YouTube

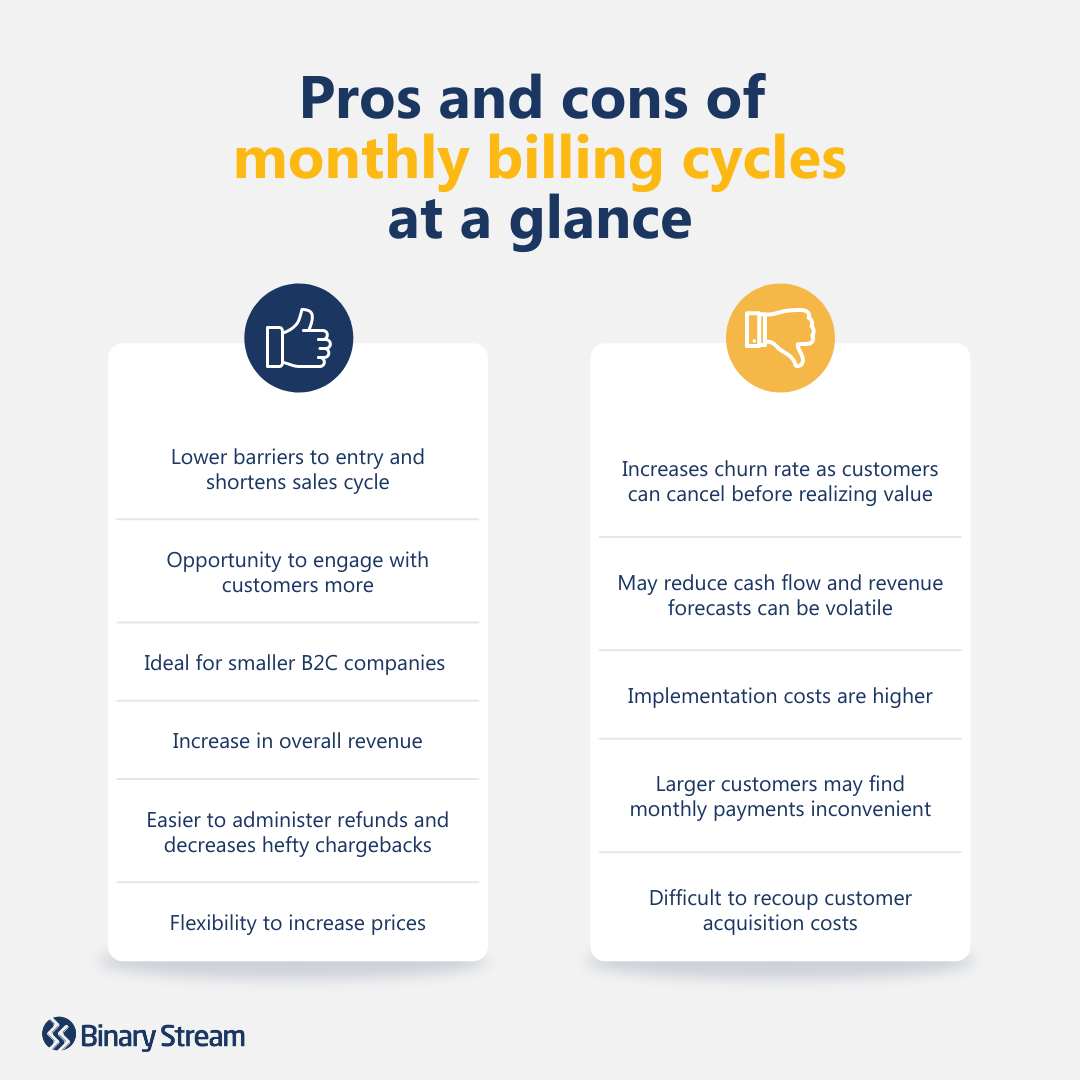

Annual vs monthly billing cycles The pros and cons of each

What Are Guaranteed Payments? A Guide For Entrepreneurs

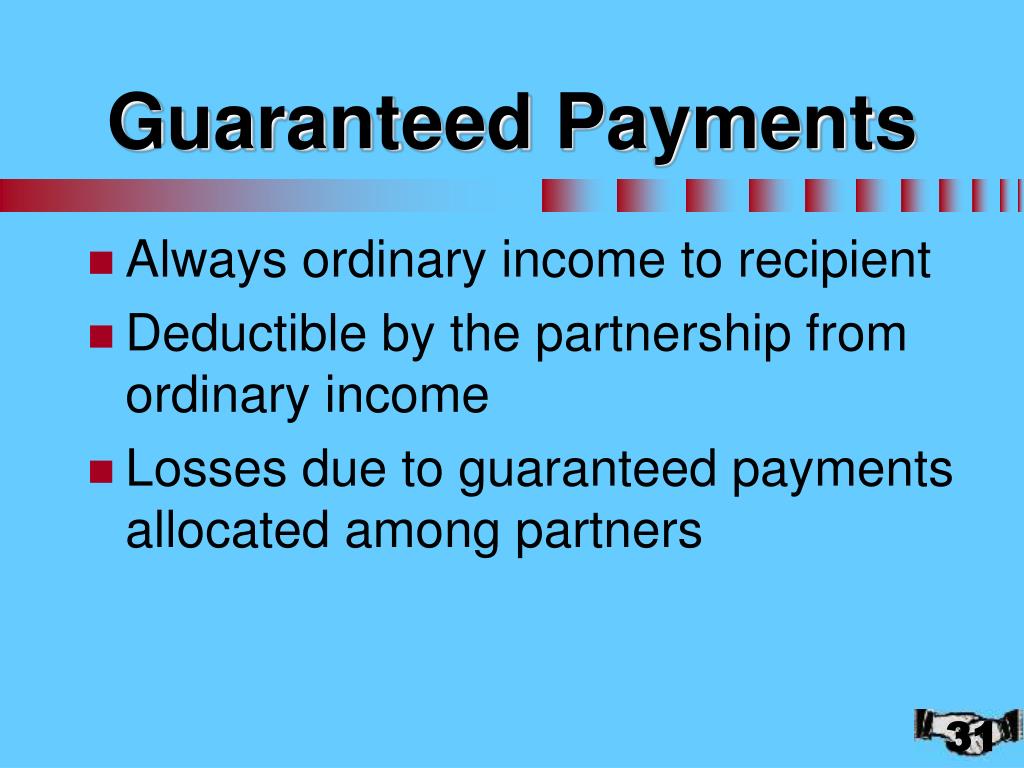

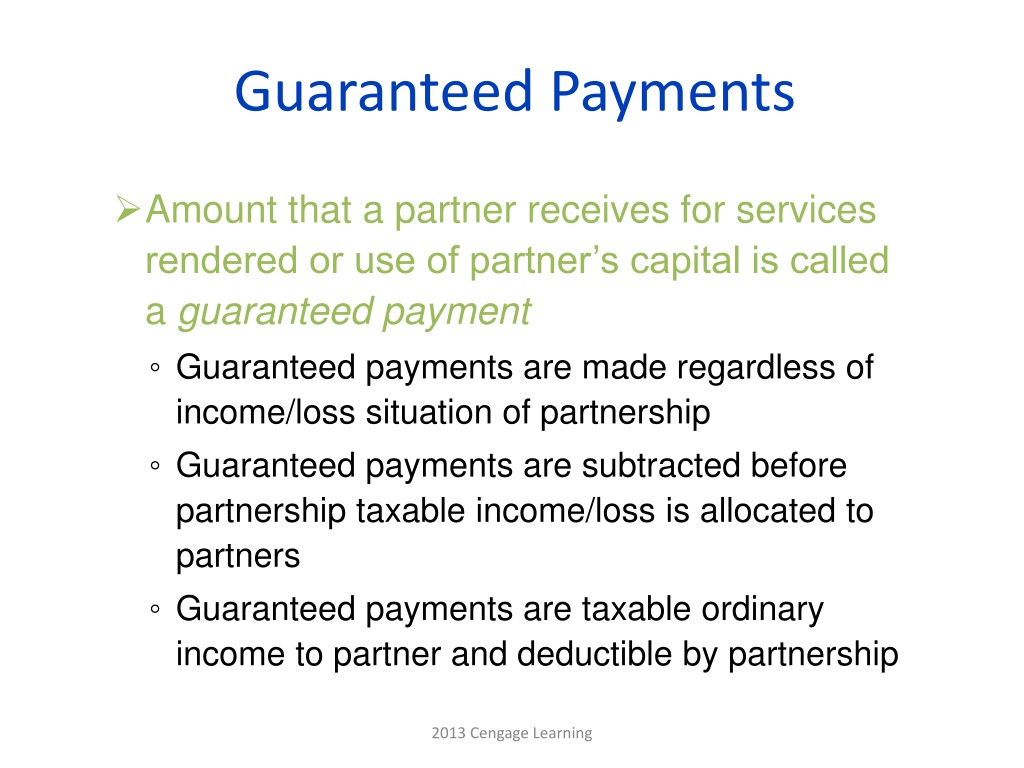

PPT PARTNERSHIP TAXATION PowerPoint Presentation, free download ID

PPT Chapter 9 Partnership Formation and Operation PowerPoint

What Are Guaranteed Payments? A Guide For Entrepreneurs

PPT Chapter 10 Partnership Taxation PowerPoint Presentation, free

Guaranteed Payments or Draws? Acuity

The 7 Different Modes of Payments Explained with Pros and Cons (2022)

Making Guaranteed Payments to Partners YouTube

When A Company Has Multiple Members, This Is Called.

Web Owner’s Draws, Also Known As “Personal Draws” Or “Draws,” Allow Business Owners To Withdraw Money As Needed And As Profit Allows.

Web What Are Llc Guaranteed Payments?

Web Updated May 4, 2022.

Related Post: