Future Calendar Spread

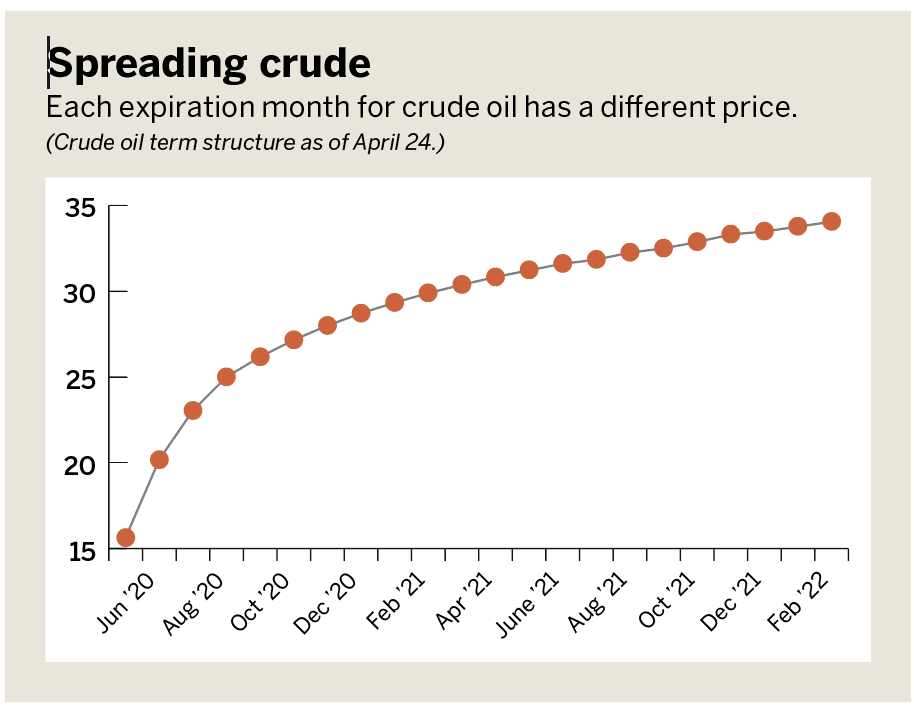

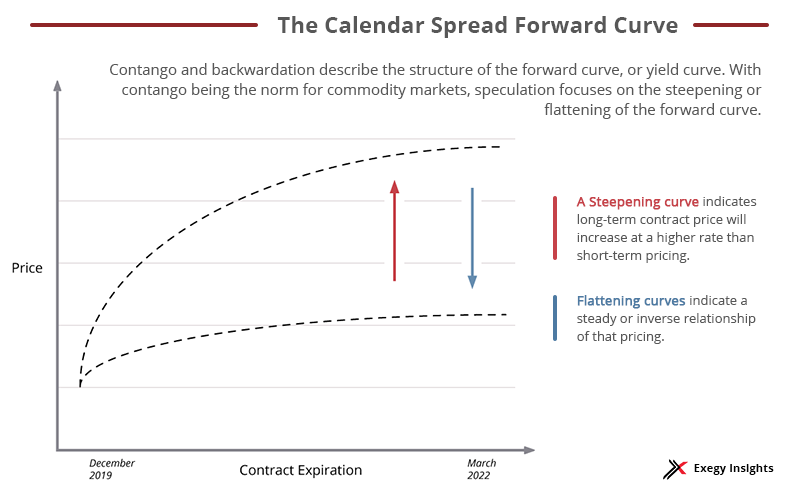

Future Calendar Spread - Sell the february 89 call for $0.97 ($97 for one contract) 2. The opposite positions can differ in expiries or even underlying. Web updated october 31, 2021. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. In a futures spread, the. Web fund selling spread to coffee markets on thursday, traders said. From the “all products” screen on the trade page, enter a future in the symbol entry field. Web it basically refers to taking a long position in one futures contract and a short position in another. For any given futures product, a standard calendar spread is a transaction that. You can do the following calendar spread: Web futures calendar spread trading is a popular strategy used by traders to profit from the price difference between two futures contracts with different expiration. At the futures dropdown, select “all” for active contract and set the spread to. Equity total cost analysis tool. Buy the march 89 call for $2.22 ($222 for one contract) the net cost of the. Chicago board of trade soybean futures rose on wednesday on intramarket spread trading after an oil worker strike in argentina lifted. Web a futures spread is an arbitrage technique in which a trader takes two positions on a commodity to capitalize on a discrepancy in price. At the futures dropdown, select “all” for active contract and set the spread to.. Web updated october 31, 2021. The opposite positions can differ in expiries or even underlying. Equity total cost analysis tool. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Buy the march 89 call for $2.22 ($222 for one contract) the net cost of the spread is thus as follows: Calendar spreads and the roll. Web fund selling spread to coffee markets on thursday, traders said. Web futures calendar spreads are first and foremost a hedging product used to reduce the market’s inherent risk. What currency pairs are spreads available for? You can do the following calendar spread: Option trading strategies offer traders and investors the opportunity to profit in ways not. There is currently no calendar data for this product. Fell 4.6% to $2.061 per lb, while robusta coffee prices rc2!, which had hit. In a futures spread, the. Web come hear from our upstate new york engineering employees as they share more about how national grid. Maintaining market exposure and retaining competitive pricing on. Buy the march 89 call for $2.22 ($222 for one contract) the net cost of the spread is thus as follows: Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more. From the “all products” screen on the trade page, enter a future. Web treasury futures calendar spreads. Calendar spreads and the roll. Web it basically refers to taking a long position in one futures contract and a short position in another. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Web may 1, 202412:15 pdt. At the futures dropdown, select “all” for active contract and set the spread to. Web building a strong financial future: Chicago board of trade soybean futures rose on wednesday on intramarket spread trading after an oil worker strike in argentina lifted. Web it basically refers to taking a long position in one futures contract and a short position in another.. The opposite positions can differ in expiries or even underlying. There is currently no calendar data for this product. Web may 1, 202412:15 pdt. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. In a futures spread, the. There is currently no calendar data for this product. From the “all products” screen on the trade page, enter a future in the symbol entry field. Calendar spreads and the roll. Web fund selling spread to coffee markets on thursday, traders said. Buy the march 89 call for $2.22 ($222 for one contract) the net cost of the spread is. Web this bear call spread trade was found using the bear call spread screener and involves selling the june expiry 130 strike call and buying the 135 strike call. Web treasury futures calendar spreads. For any given futures product, a standard calendar spread is a transaction that. Web what are futures calendar spreads? Maintaining market exposure and retaining competitive pricing on. Ice canola futures finished higher on friday for the third straight day, lifted by soybean strength and technical buying. From the “all products” screen on the trade page, enter a future in the symbol entry field. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. What contract months can be traded in a. Web come hear from our upstate new york engineering employees as they share more about how national grid is engineering the future! Web updated october 31, 2021. Buy the march 89 call for $2.22 ($222 for one contract) the net cost of the spread is thus as follows: At the futures dropdown, select “all” for active contract and set the spread to. If you have any questions, please feel free to contact us. What currency pairs are spreads available for? Web futures calendar spread trading is a popular strategy used by traders to profit from the price difference between two futures contracts with different expiration.

The secret behind Calendar Spread options strategy

Futures Trading the definitive guide to trading calendar spreads on

What Exactly Are Futures Spreads StoneX Financial Inc, Daniels

What are Calendar Spread and Double Calendar Spread Strategies

Futures Curve by Accutic Treasury Futures Calendar Spreads

Leg Up on Futures Calendar Spreading luckbox magazine

Getting Started with Calendar Spreads in Futures Exegy

Calendar Spread Explained InvestingFuse

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Everything You Need to Know about Calendar Spreads Simpler Trading

Web Futures Spread Is A Trading Technique Where You Open A Long And A Short Position Simultaneously To Take Advantage Of A Price Discrepancy.

Sell The February 89 Call For $0.97 ($97 For One Contract) 2.

The Opposite Positions Can Differ In Expiries Or Even Underlying.

You Can Do The Following Calendar Spread:

Related Post: