Free Printable 1099

Free Printable 1099 - Pricing starts as low as $2.75/form. Web page last reviewed or updated: Web updated november 06, 2023. Iris accepts 1099 series forms for tax year 2022 and after. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Web select which type of form you’re printing: Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system (iris). Web the 1099 form is a common irs form covering several potentially taxable income situations. This article answers the question, what is the. File your 1099 with the irs for free. Web select which type of form you’re printing: Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. Web updated november 06, 2023. Web updated january 11, 2024. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Web page last reviewed or updated: Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system (iris). *the featured form (2022 version) is the current version for all succeeding. *the featured form (2022 version) is the current version for all succeeding years. The payer fills out the 1099 and sends copies to you and the irs. Web what is a 1099? Web updated november 06, 2023. Web the 1099 form is a common irs form covering several potentially taxable income situations. (you don’t want the information getting printed in the wrong box!) Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Web updated november 06, 2023. Used for the 2021 tax year only. This article answers the question, what is the. The payer fills out the 1099 and sends copies to you and the irs. Quick & secure online filing. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Web updated january 11, 2024. Business taxpayers can file electronically any form 1099 series information returns for free with the. Pricing starts as low as $2.75/form. The payer fills out the 1099 and sends copies to you and the irs. Quick & secure online filing. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Irs 1099 forms are a series of tax reporting documents used by businesses and. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or even more than one of the same 1099 forms. Web page last reviewed or updated: Web updated november 06, 2023. This article answers the question, what is the. Web learn about the irs 1099 form: Web the 1099 form is a common irs form covering several potentially taxable income situations. Persons with a hearing or speech disability with access to tty/tdd equipment can. Quick & secure online filing. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or even more than one of. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Web the 1099 form is a common irs form covering several potentially taxable income situations. This article answers the question, what is the. File your 1099 with the irs for free. Payments above a specified dollar threshold for rents,. Web updated november 06, 2023. The payer fills out the 1099 and sends copies to you and the irs. Web updated january 11, 2024. Quick & secure online filing. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends,. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. File your 1099 with the irs for free. Iris is available to any business of any size. Web select which type of form you’re printing: *the featured form (2022 version) is the current version for all succeeding years. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system (iris). Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or even more than one of the same 1099 forms. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Iris accepts 1099 series forms for tax year 2022 and after. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. If you paid an independent contractor more than $600 in a. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. Web page last reviewed or updated: Persons with a hearing or speech disability with access to tty/tdd equipment can. Quick & secure online filing. Web learn about the irs 1099 form:

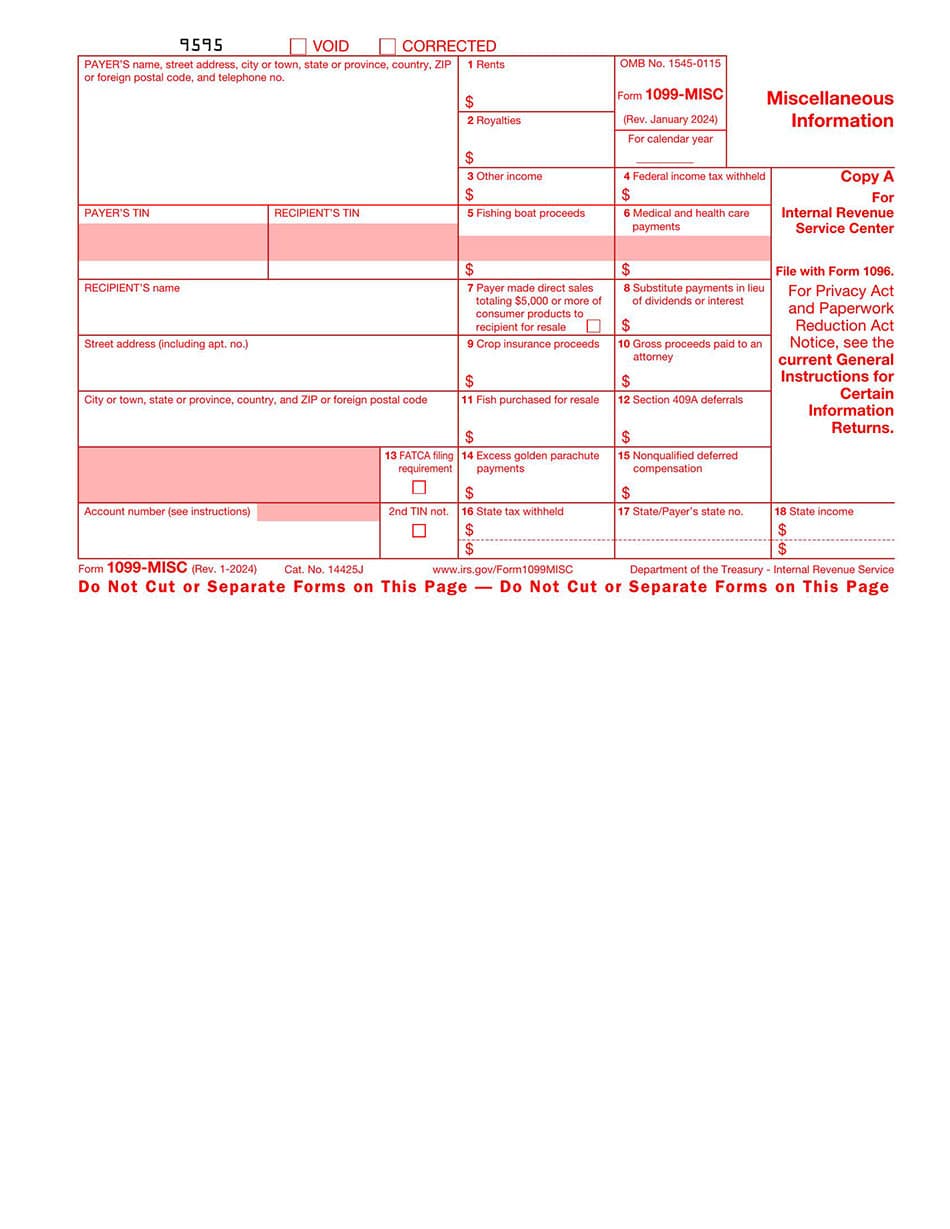

1099 Form Statements Fillable Form Soda PDF

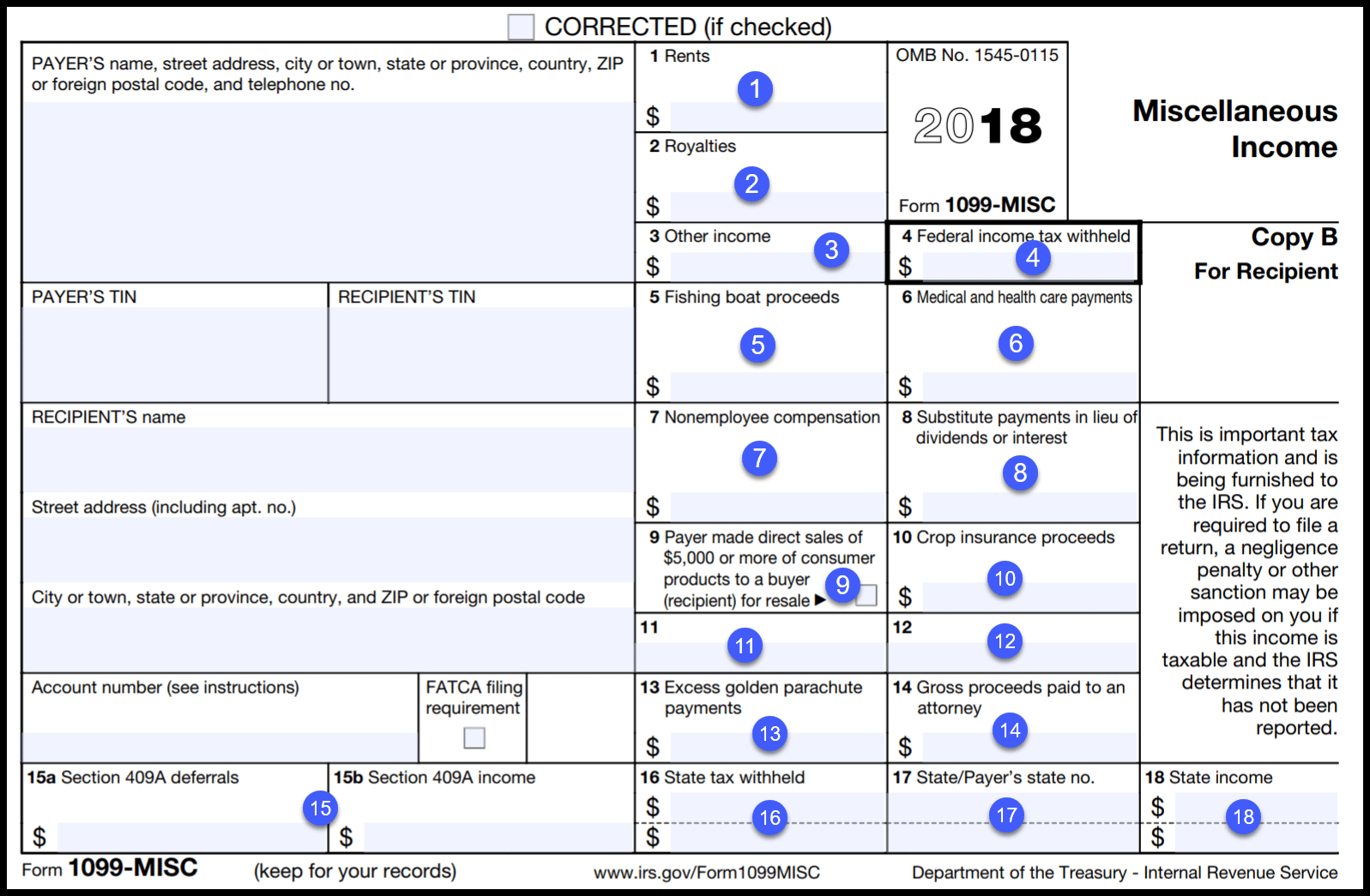

What is a 1099Misc Form? Financial Strategy Center

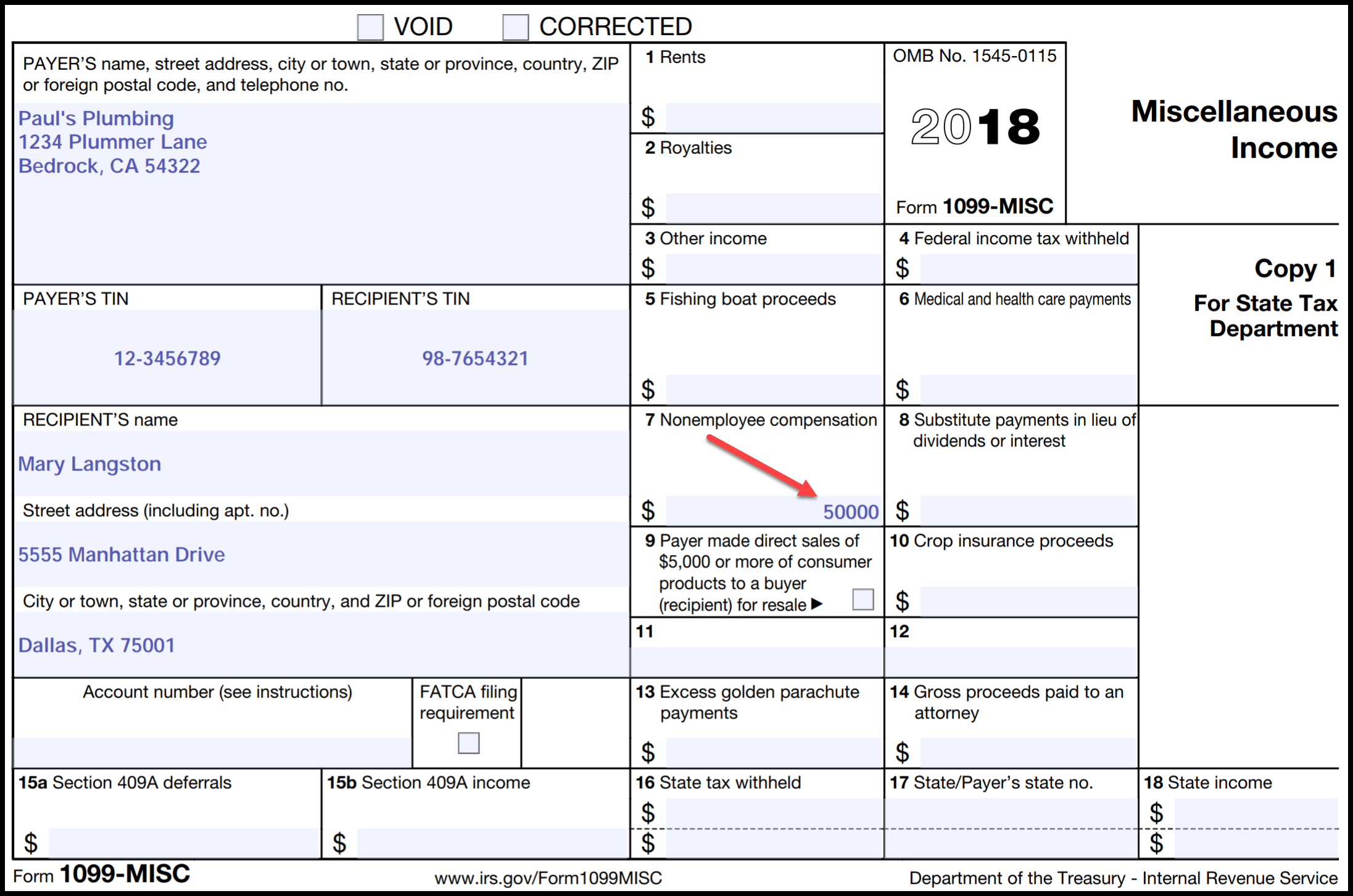

1099 Contract Template HQ Printable Documents

Printable Form It 1099 R Printable Forms Free Online

Free Printable 1099 Tax Form Printable Forms Free Online

Form 1099 Nec 2023 Printable Forms Free Online

What Is a 1099 & 5498? uDirect IRA Services, LLC

Free Printable 1099 Form 2018 Free Printable

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099

Printable 1099 Misc Form 2018 Printable Word Searches

A 1099 Form Is A Record That An Entity Or Person Other Than Your Employer Gave Or Paid You Money.

Web Updated January 11, 2024.

(You Don’t Want The Information Getting Printed In The Wrong Box!)

Web Updated November 06, 2023.

Related Post: