Free Irs Mileage Log Template

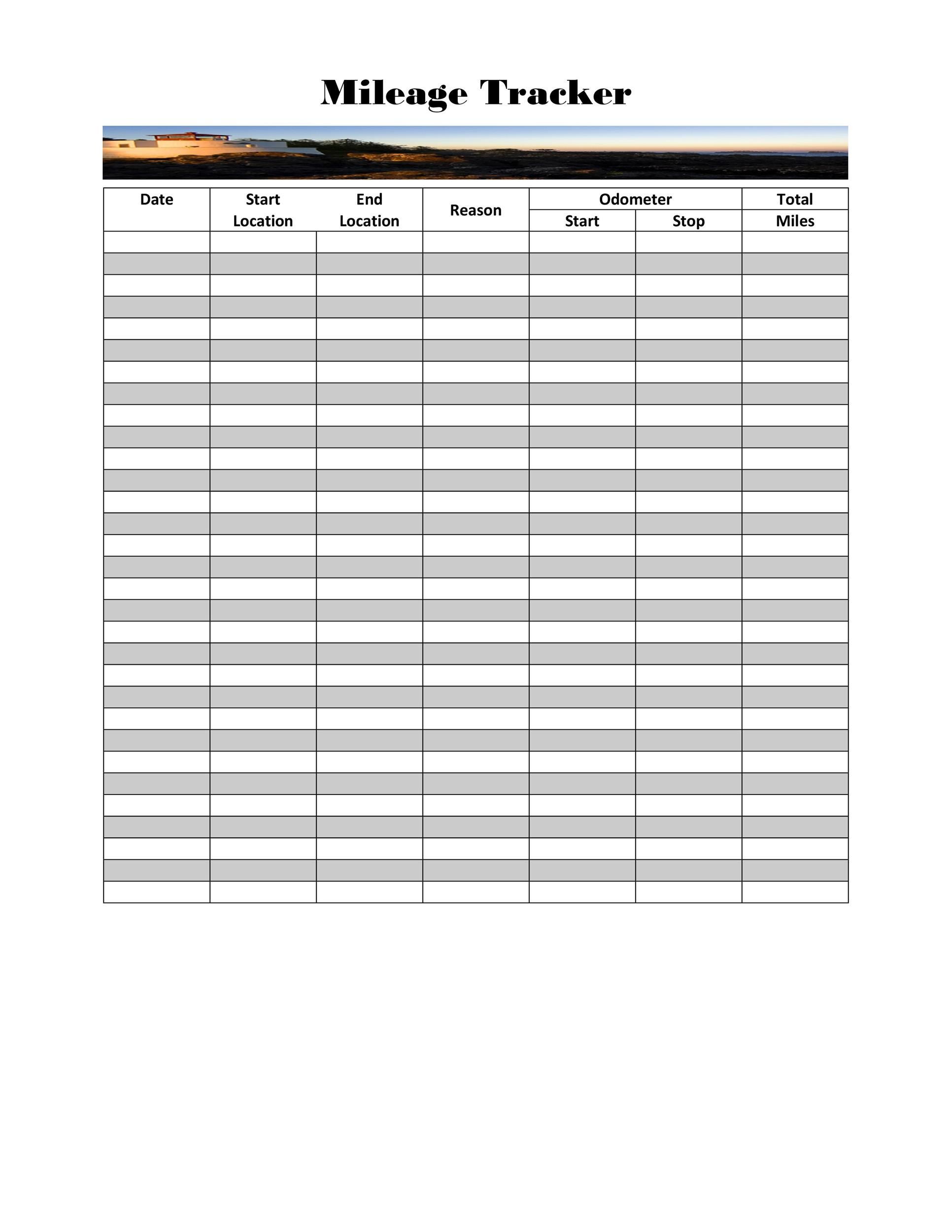

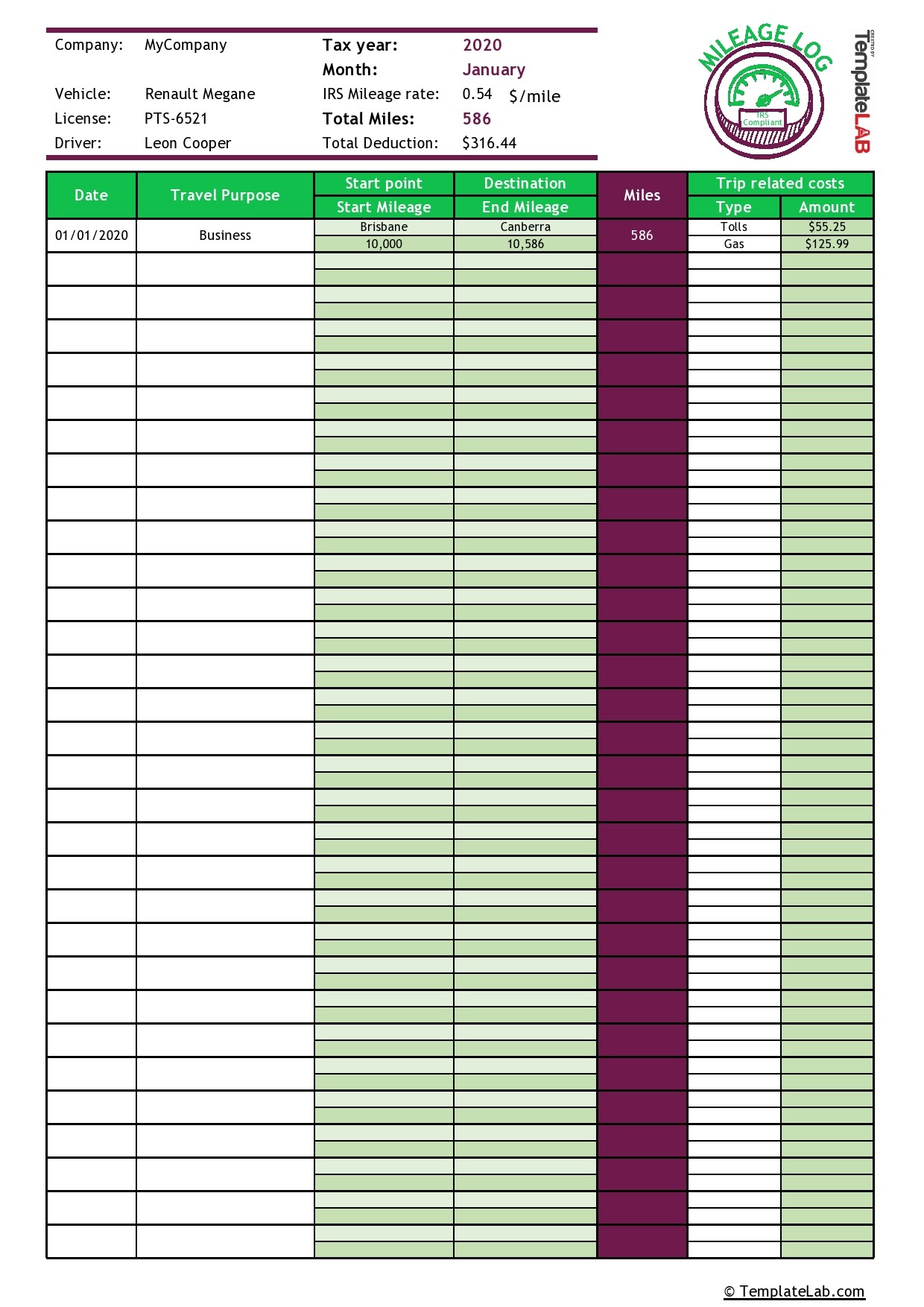

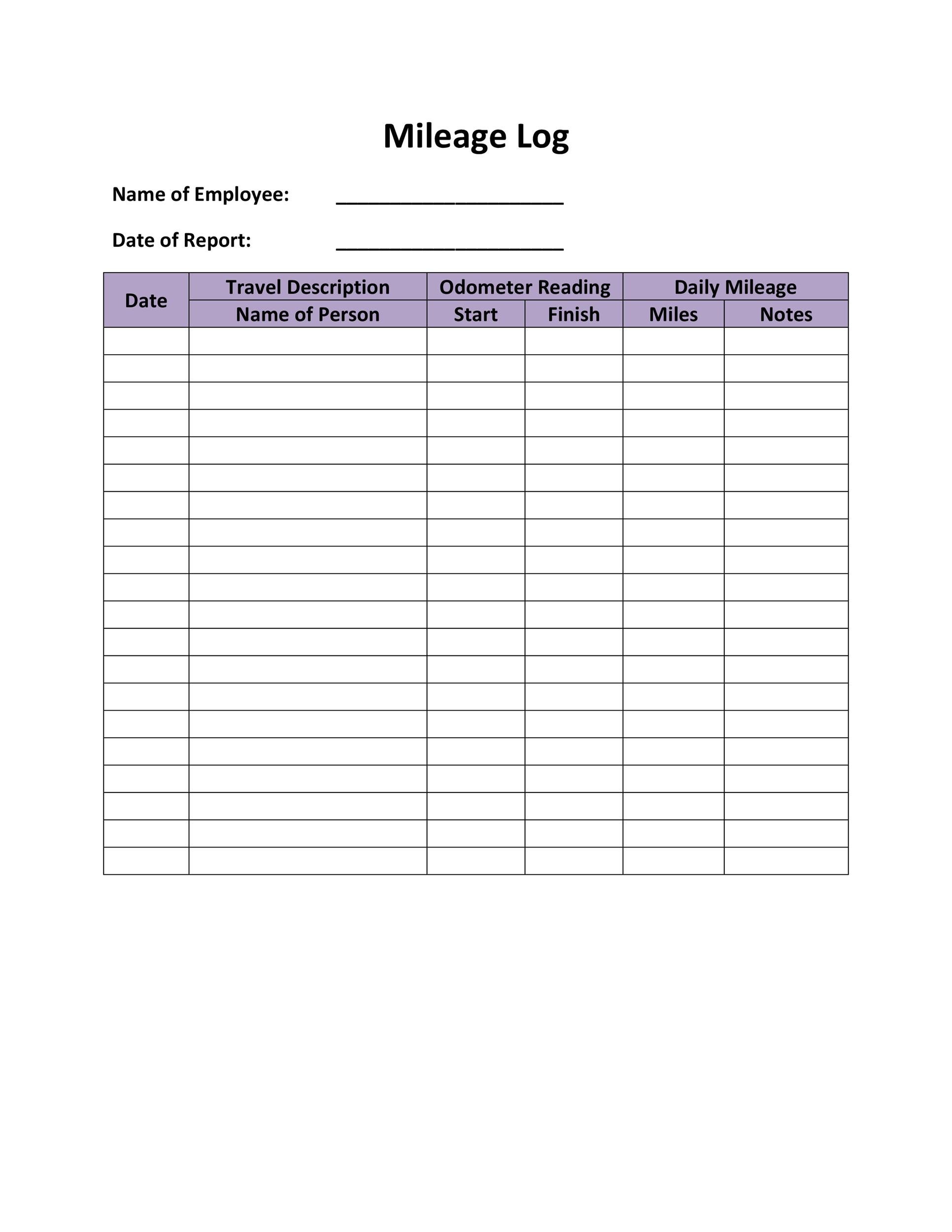

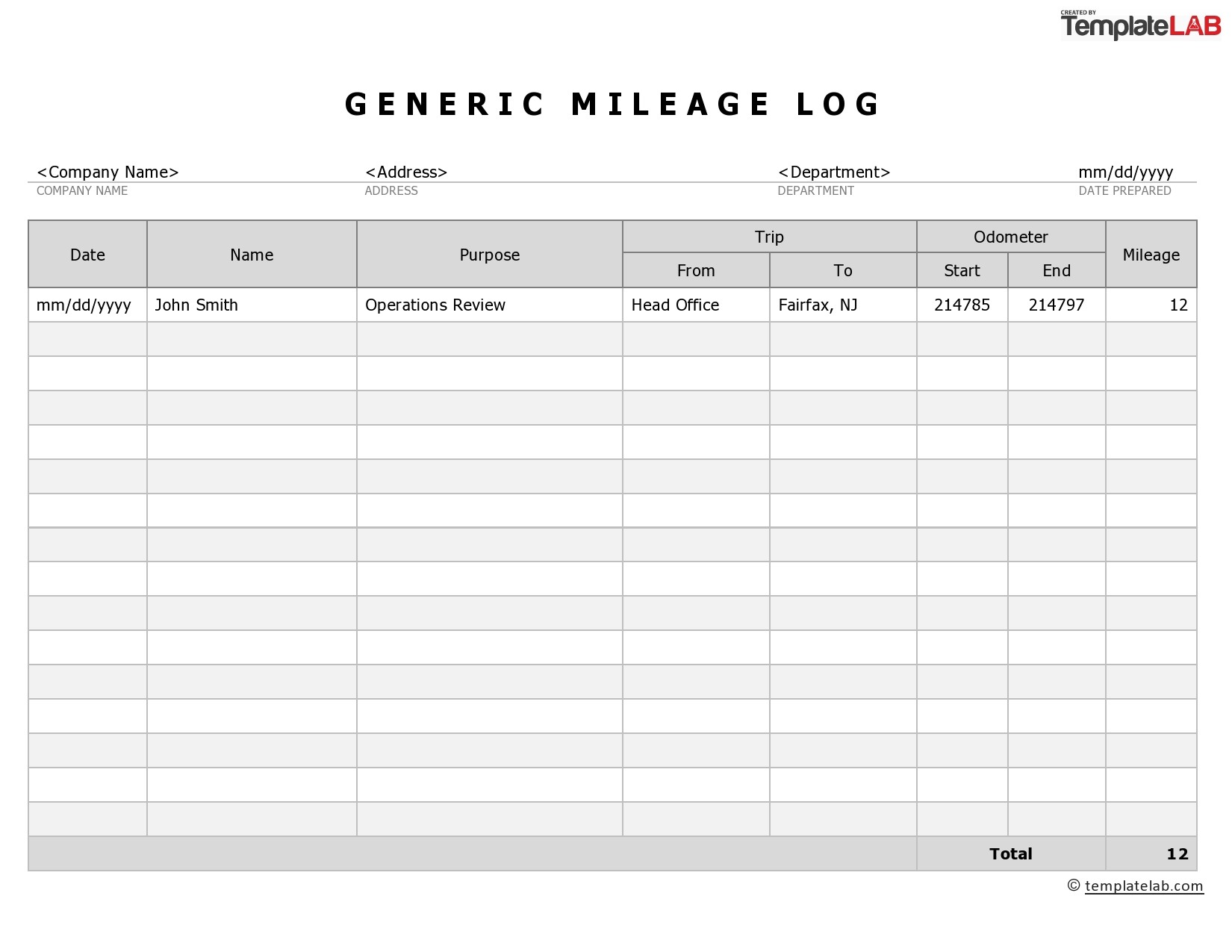

Free Irs Mileage Log Template - Web you can record the miles you travel and the gas you buy or record your mileage to claim your expenditure using the irs standard rate in a mileage log for instance. Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement form or for determining the mileage deduction on your tax return. Web free mileage log template for excel. What are the irs mileage log requirements? Follow these best practices to avoid an audit. Web the irs accepts two forms of mileage log formats: Date, destination, business purpose, odometer start, odometer stop, miles this trip, expense type, expense amount. Free irs printable mileage log form to download. Irs compliant mileage log 2022. Free in pdf, word, excel, and google formats. A combination schedule will ensure that you have everything required to hand in to support your claim. It should include the date, the purpose of the trip, and the total miles driven for each business trip. Switch to the #1 mileage tracking & reimbursement solution. You can download the following templates for free: Web how the keeper mileage log works. Web free mileage log template for taxes. You must not operate more than 5 vehicles. Paper logs and digital logs. Web download our free company mileage log template to make your mileage reimbursement process simpler! Many business owners underestimate how beneficial it is to track their business mileage. What are the irs mileage log requirements? Fleet vehicle mileage records are reported differently. Paper logs and digital logs. You can use the following log as documentation for your mileage deduction. Web requirements for the standard mileage rate. Web how the keeper mileage log works. You must not operate more than 5 vehicles. A paper log is a simple, written record of your business miles driven. Printable irs compliant mileage log printable format. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Benefits of using a mileage tracker as a delivery driver. Web download our free company mileage log template to make your mileage reimbursement process simpler! Your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. You can use the following log as documentation for your mileage deduction. You can download. Web download our free company mileage log template to make your mileage reimbursement process simpler! Web how the keeper mileage log works. Fleet vehicle mileage records are reported differently. Web free mileage log template for excel. If you visit medical appointments, you’re able to deduct a certain amount of money per mile as a medical mileage tax deduction. Web free mileage log template for excel. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement. What are the irs mileage log requirements? What is a delivery driver mileage log? You must not operate more than 5 vehicles. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Web the easiest way to keep records is to use a mileage log template that will. A combination schedule will ensure that you have everything required to hand in to support your claim. Some people just prefer to input their trips manually. Benefits of using a mileage tracker as a delivery driver. (4.8 rating score) schedule live demo. Web requirements for the standard mileage rate. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. Your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Free irs printable mileage log form to download. Web a mileage. Download the free 2024 mileage log template as a pdf, sheets or excel version and keep track of your trips. Some people just prefer to input their trips manually. This free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web then this irs mileage log template is for you. Web requirements for the standard mileage rate. You can use the following log as documentation for your mileage deduction. Web free mileage log template for excel. Date, destination, business purpose, odometer start, odometer stop, miles this trip, expense type, expense amount. Web you can use it as a free irs mileage log template. Free irs printable mileage log form to download. Web the irs accepts two forms of mileage log formats: The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images: Paper logs and digital logs. You have to own or lease the vehicle. As a delivery driver, keeping track of your mileage is essential for tax purposes and to ensure that you are reimbursed for the miles you travel on the job. It should include the date, the purpose of the trip, and the total miles driven for each business trip.

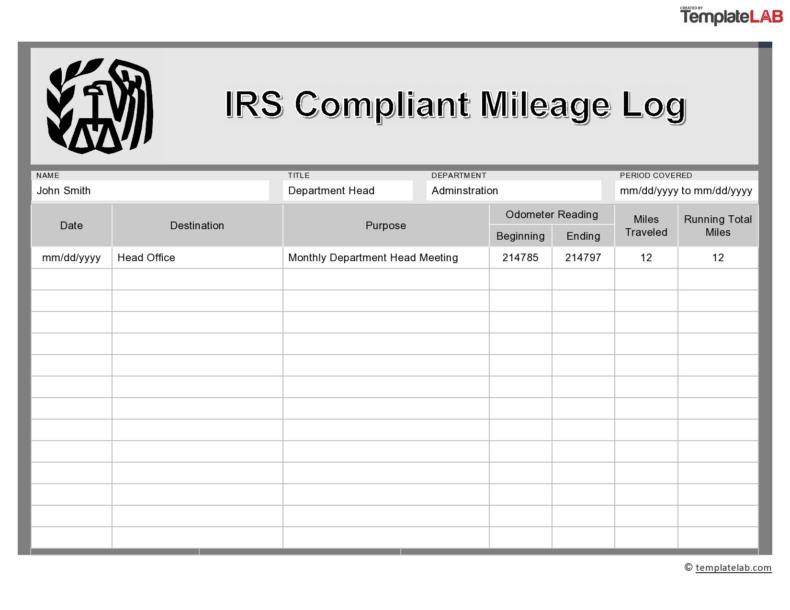

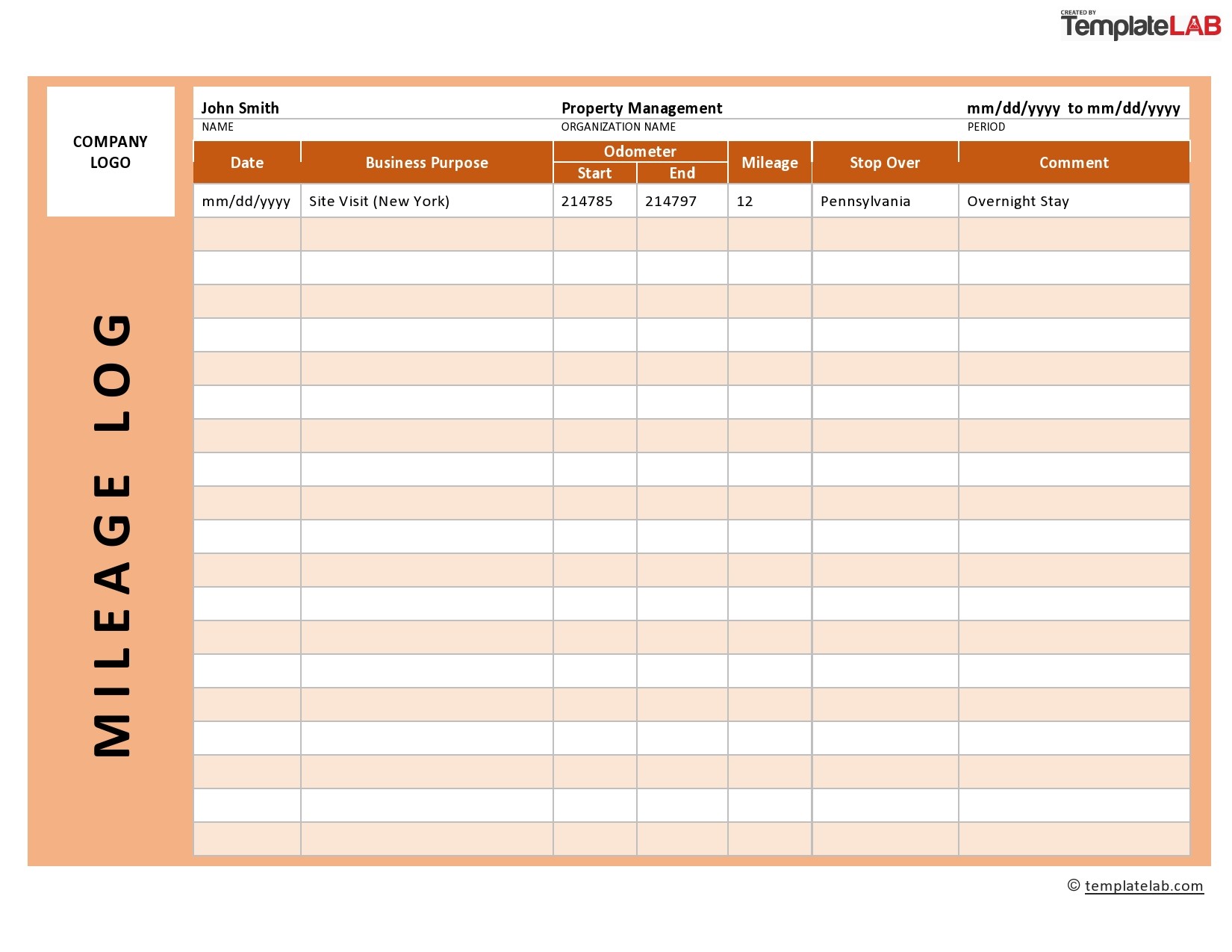

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

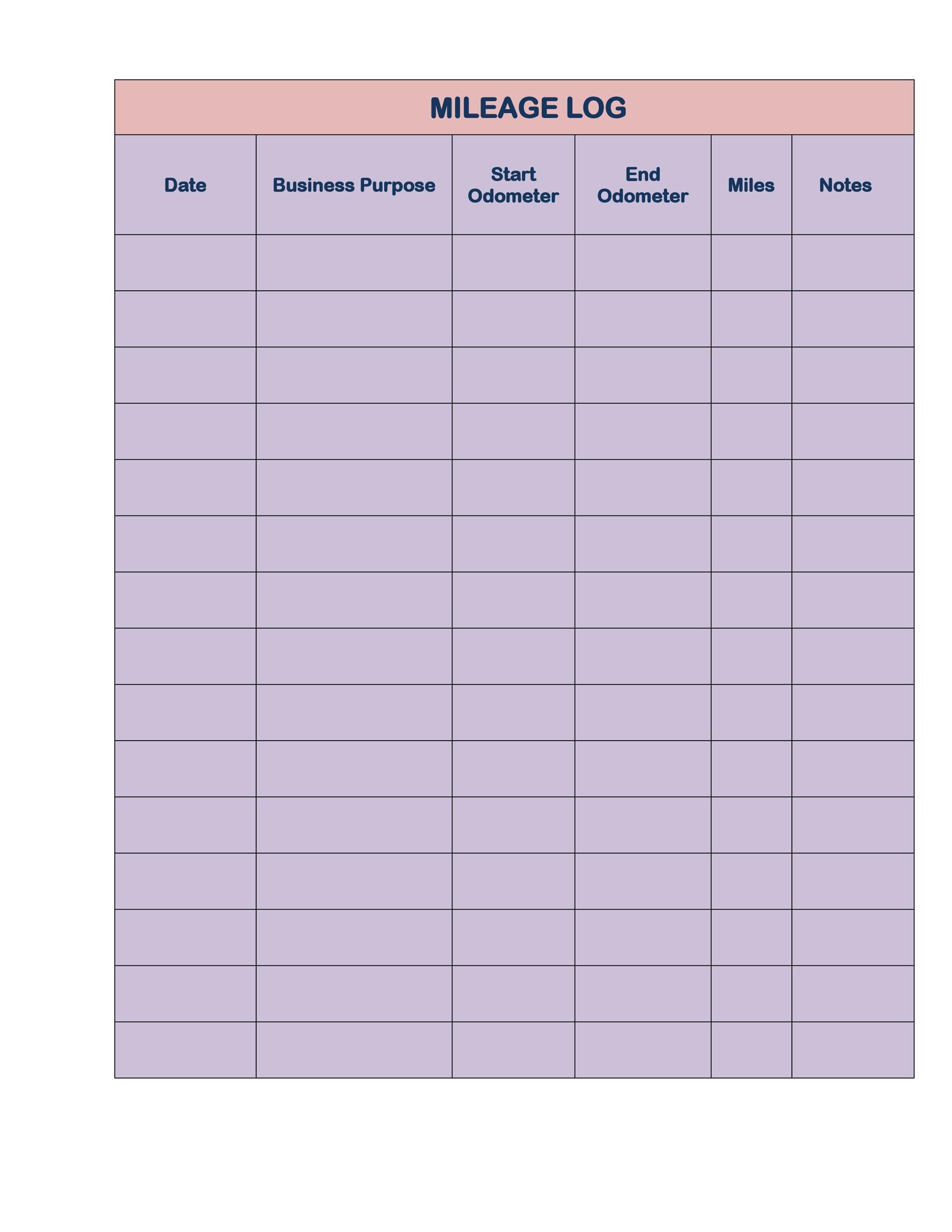

30 Printable Mileage Log Templates (Free) Template Lab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

![]()

25 Printable IRS Mileage Tracking Templates GOFAR

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

What Are The Irs Mileage Log Requirements?

Benefits Of Using A Mileage Tracker As A Delivery Driver.

Web Our Free Mileage Log Templates Will Enable You To Comply With All Irs Regulations, Thus Allowing You To Legally And Conveniently Deduct Business Mileage Expenses.

This Would Be Considered A Fleet.

Related Post: