Dispute Letter Template For Collection

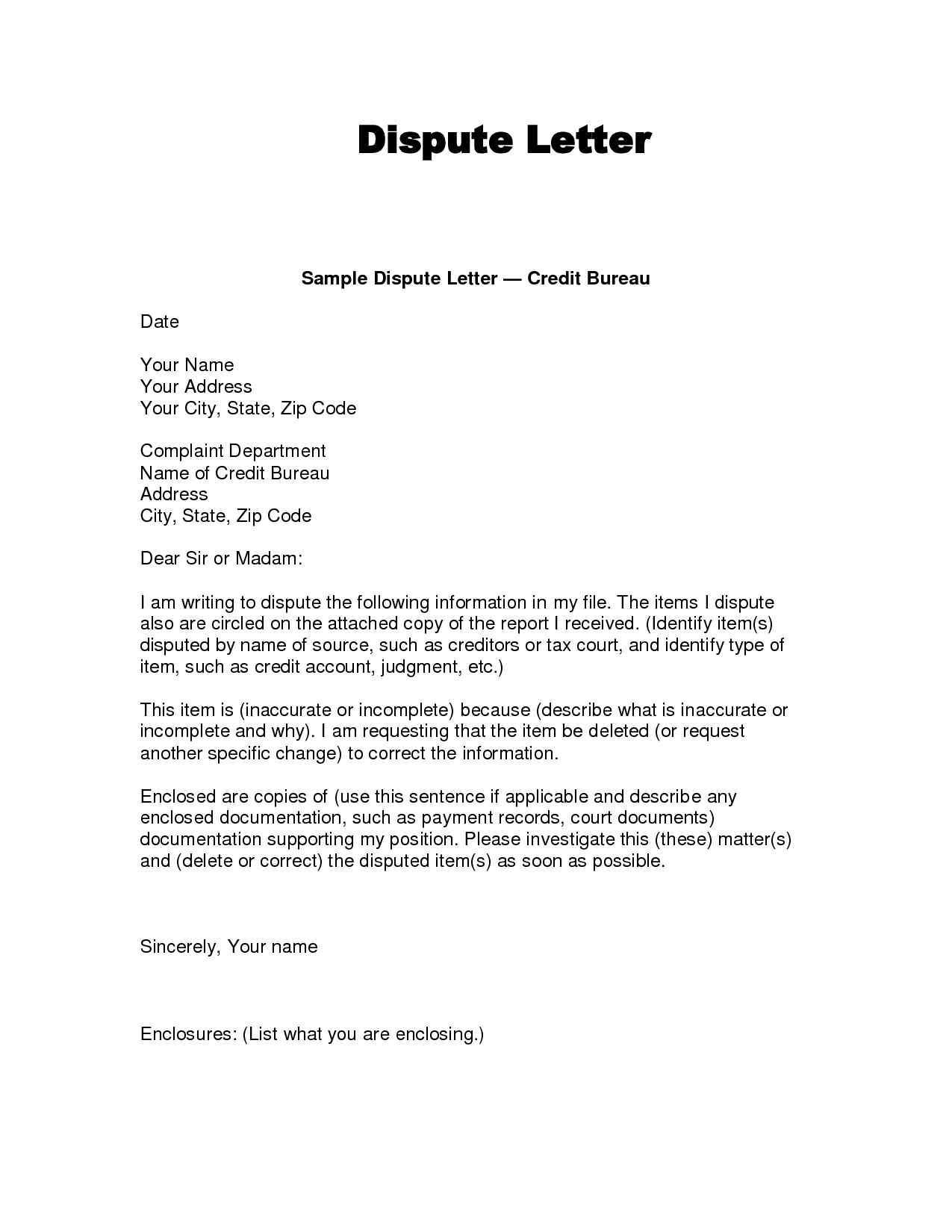

Dispute Letter Template For Collection - You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific accounts or. It also requests that the credit bureau remove specific kinds of inquiries and place a promotional suppression on your credit file. This letter is sent to credit bureaus and requests they verify the information about the collection account. Trusted by millionspaperless workflowform search enginemoney back guarantee One in four had an. Web because i have disputed this debt in writing within 30 days of receipt of your initial notice, you must obtain verification of the debt or a copy of the judgment against me and mail these items to me at your expense. Was your credit or debit card charged for something you returned, ordered but never got, or don’t recognize? A study by the federal trade commission found that one in five consumers had at least one error in their credit report. [date] [collection agency name] [collection agency address] [re: All three credit reporting bureaus ( equifax , experian , and transunion ) accept dispute requests online, standard mail, and by phone. Identify the owed collection debt. Web dispute debt collection letter template. Include a declaration disputing the debt. The amount of the alleged debt; Consumers free weekly credit reports through annualcreditreport.com. The name of the creditor. Web sample letters to dispute information on a credit report. Web this letter is for basic disputes for entries on your credit report. What should you include in a credit dispute letter? Use this letter if you believe an entry contains incorrect information, or is erroneously on your report. Web sample debt collection dispute letter. Web disputing a debt you believe you don't owe can be intimidating. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific accounts or. Your account number, if known] to whom it may concern:. Wish to dispute the following charges that your company is attempting collection of: “jimmy had a mess on his hands,” gamage said in an interview from his shop on main street. The name of the creditor. That you can dispute the debt and that if you don’t dispute the debt within 30 days the debt collector will assume the debt. Wish to dispute the following charges that your company is attempting collection of: One in four had an. Documentation showing you have verified that i am responsible for this. The name of the creditor. Web validation information must include: What should you include in a credit dispute letter? Box 2000 chester, pa 19016. Sign up onlinecheck pricing detailsask questions Web sample letters to dispute information on a credit report. Web write a dispute letter to the debt collector promptly, requesting validation of the debt and explaining your lack of recognition. Web this letter is for basic disputes for entries on your credit report. Wish to dispute the following charges that your company is attempting collection of: Box 2000 chester, pa 19016. Does the stated debt amount feel inflated or completely inaccurate? Use this letter if you believe an entry contains incorrect information, or is erroneously on your report. The amount of the alleged debt; Perhaps late fees have ballooned to absurd proportions, or duplicate charges muddle the water. Sign up onlinecheck pricing detailsask questions This letter is sent to credit bureaus and requests they verify the information about the collection account. Trusted by millionspaperless workflowform search enginemoney back guarantee All three credit reporting bureaus ( equifax , experian , and transunion ) accept dispute requests online, standard mail, and by phone. Use this letter if you believe an entry contains incorrect information, or is erroneously on your report. Web brannan hired gamage to appraise the sizeable collection of artwork that indiana had left behind. It also requests that the. Wish to dispute the following charges that your company is attempting collection of: The full name and mailing address of the original creditor for this alleged debt; Web mail the dispute form with your letter to: Web sample letters to dispute information on a credit report. Web dispute debt collection letter template. Web brannan hired gamage to appraise the sizeable collection of artwork that indiana had left behind. This letter is sent to credit bureaus and requests they verify the information about the collection account. Trusted by millionspaperless workflowform search enginemoney back guarantee That you can dispute the debt and that if you don’t dispute the debt within 30 days the debt collector will assume the debt is valid. What should you include in a credit dispute letter? Web validation information must include: Please verify the debt as required by the fair debt collection practices act. Use this letter if you believe an entry contains incorrect information, or is erroneously on your report. Perhaps late fees have ballooned to absurd proportions, or duplicate charges muddle the water. You cannot add interest or fees except those allowed by the original contract or state law. That if you dispute the debt in writing within 30 days the debt collector will provide verification of the debt. If a credit bureau does not respond to your credit dispute letter — or any other letters you might send — use this template to follow up with them. Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Sign up onlinecheck pricing detailsask questions If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as. The amount of the alleged debt;

Dispute Letter for Debt Collection Assignment Point

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-05.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Dispute Letter Sample For A Charge Collection Letter Template Collection

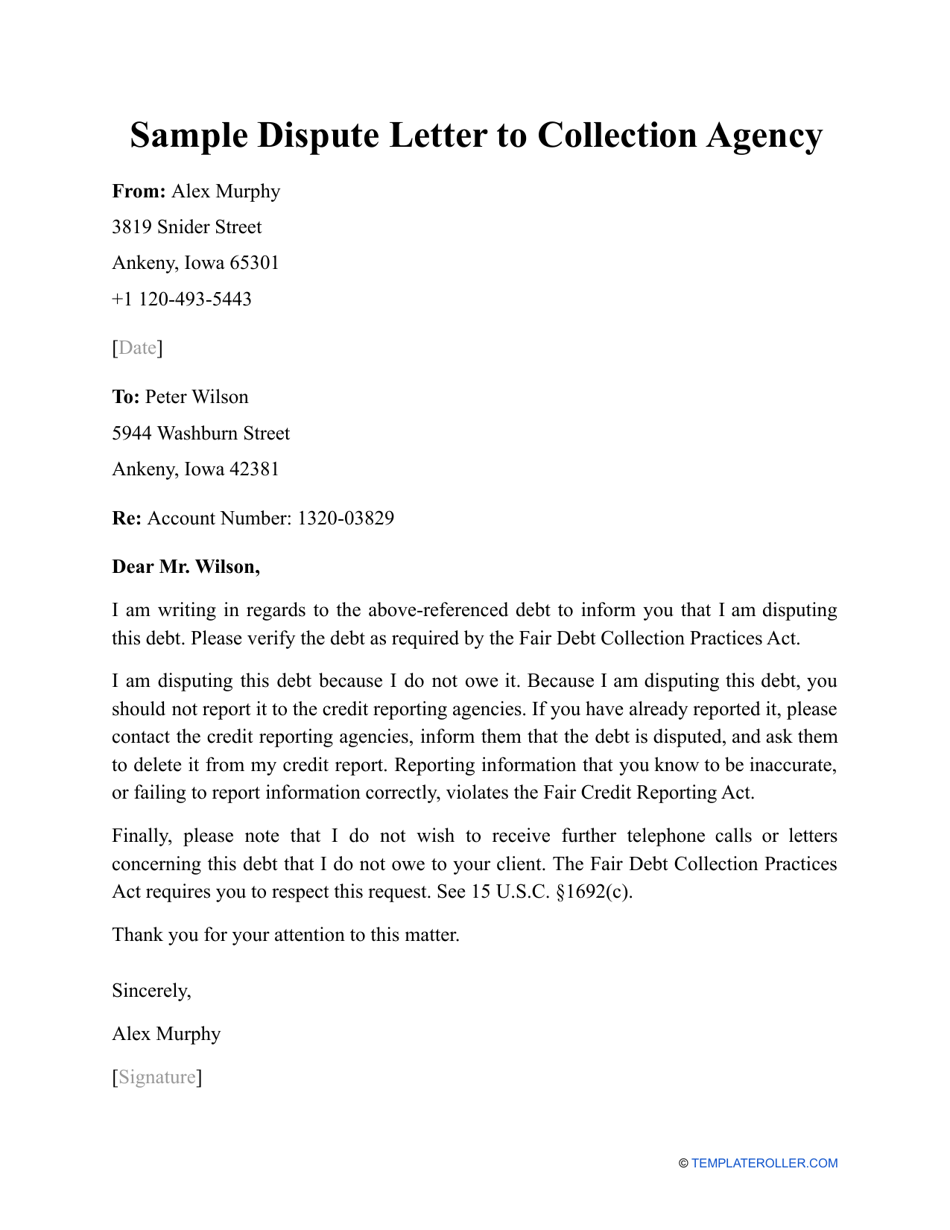

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

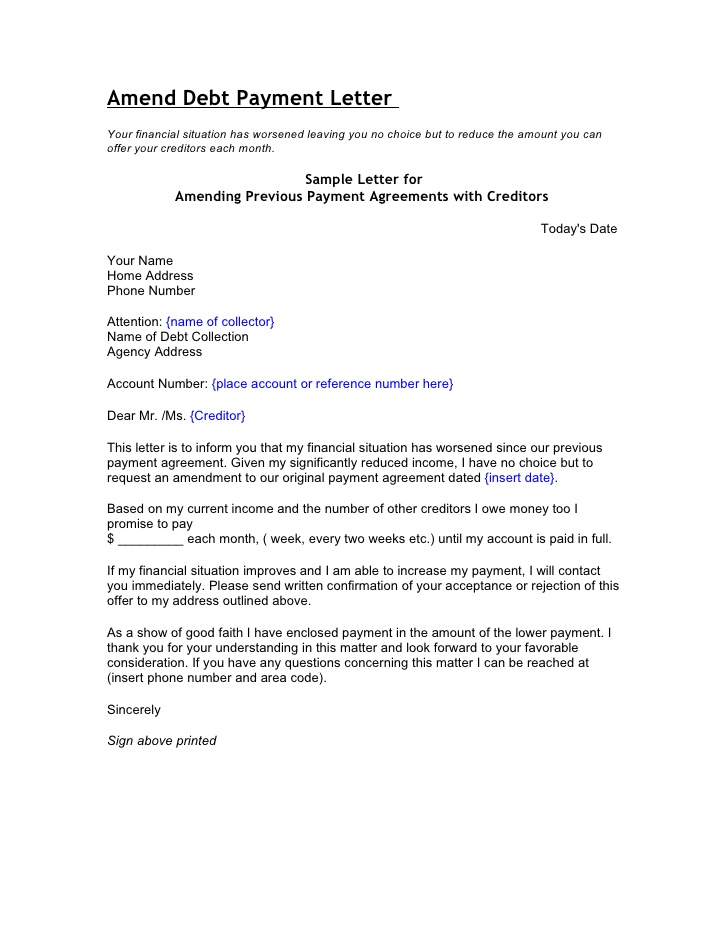

023 Template Ideas Debt Collection Letter 166342 Marvelous Regarding

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-30.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-03.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Judgement Proof Letter Template Collection Letter Template Collection

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-20.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-34.jpg?w=790)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Web February 26, 2021 • 6 Min Read.

Am Disputing This Debt Because I Do Not Owe It.

Consumers Free Weekly Credit Reports Through Annualcreditreport.com.

Disputing A Debt With A Collection Agency.

Related Post: