Charitable Donation Receipt Template

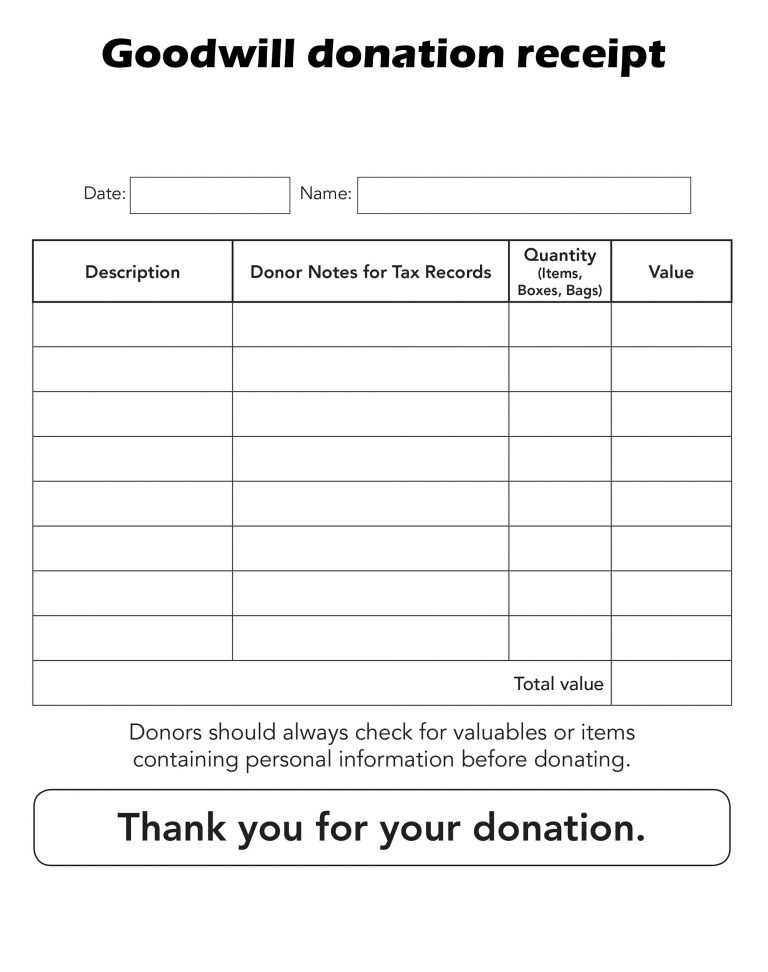

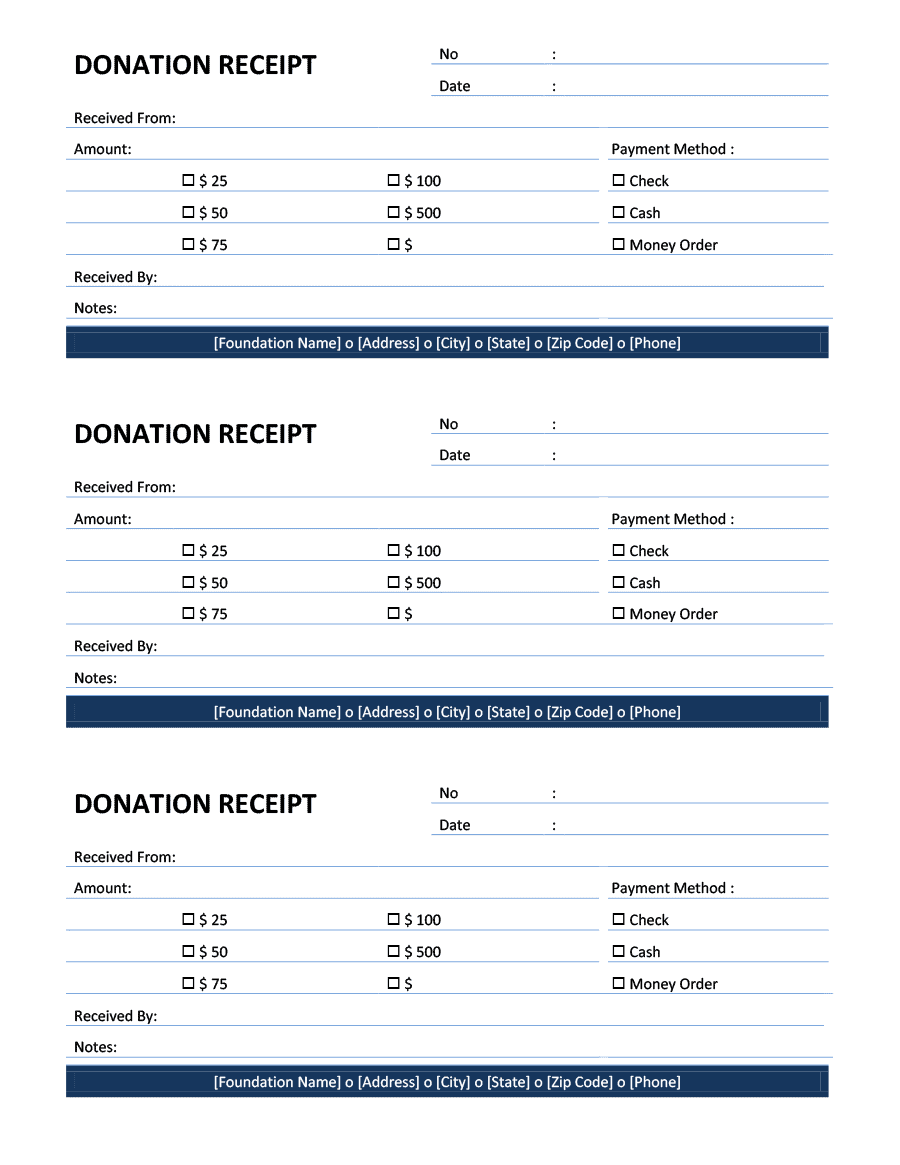

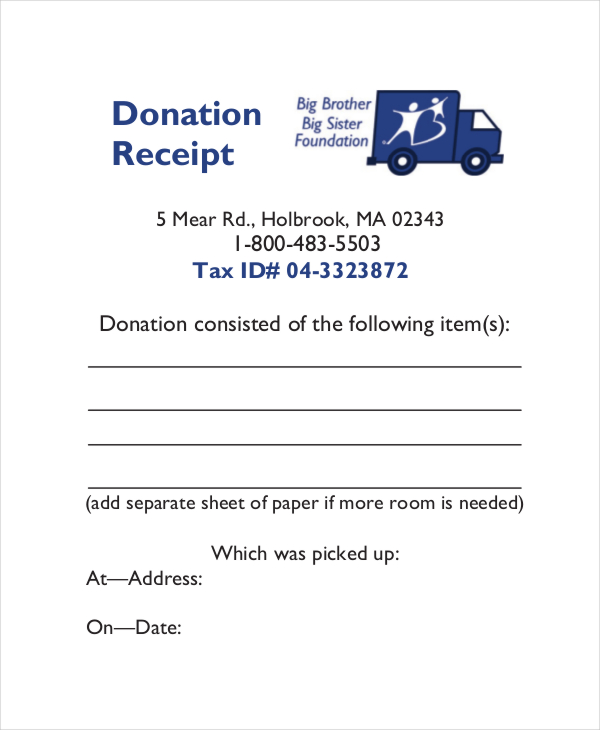

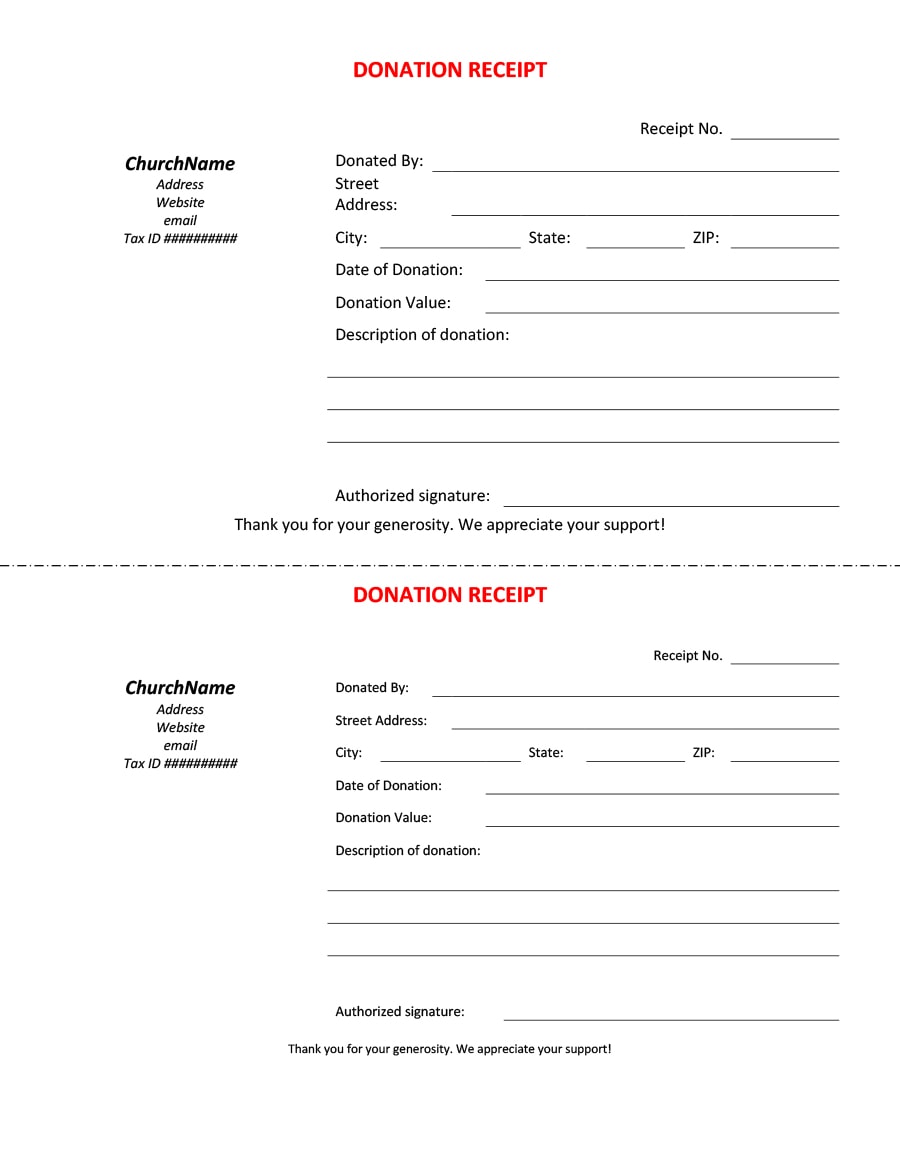

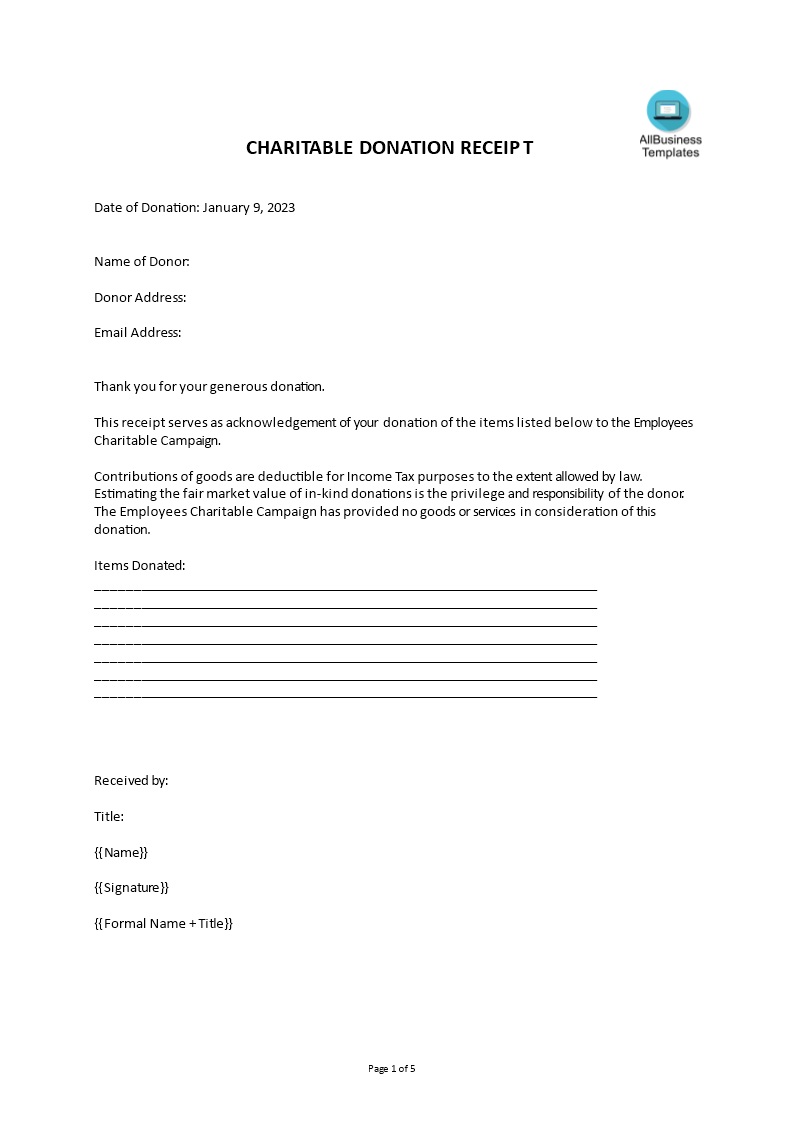

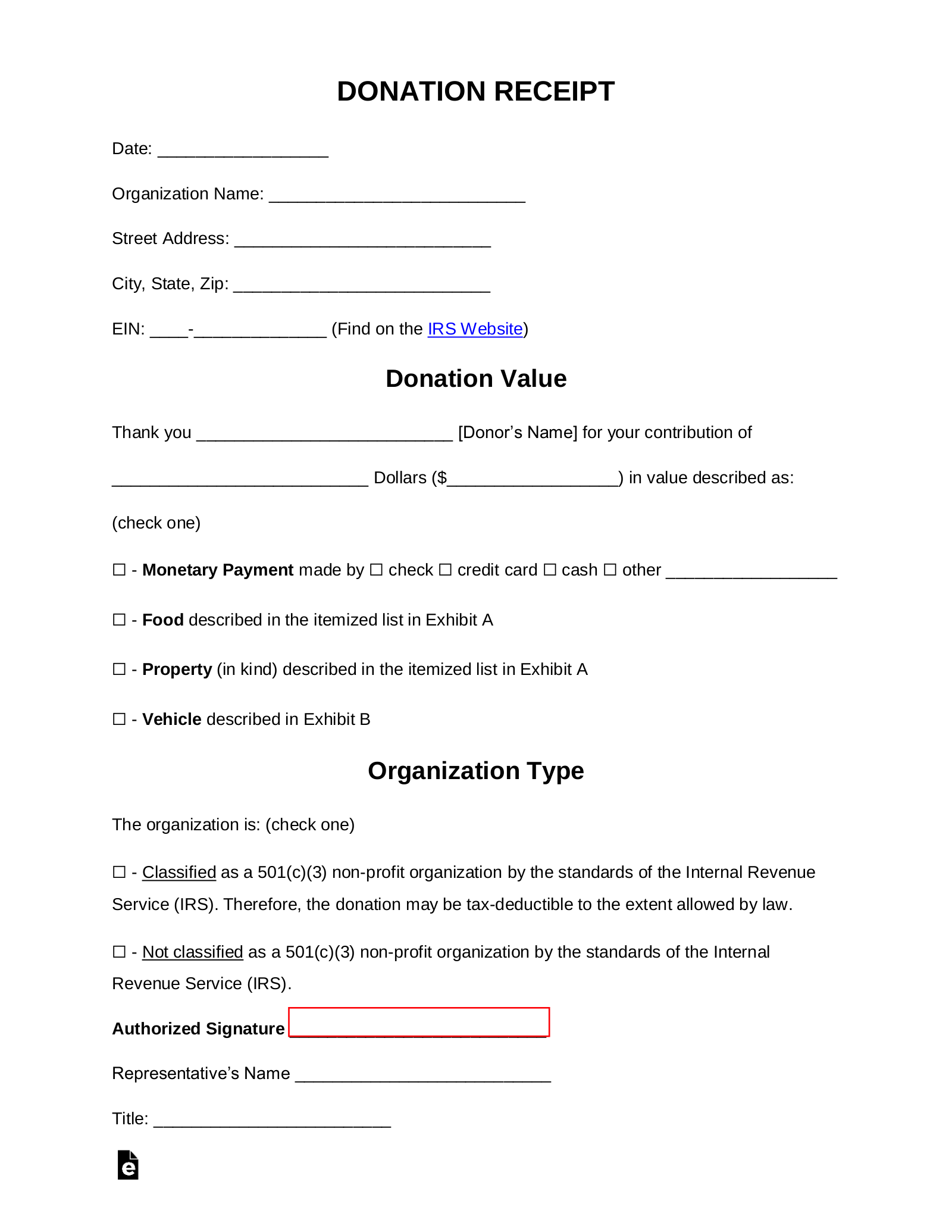

Charitable Donation Receipt Template - Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Web donation receipt templates. Nonprofit organizations tend to perfect the art of accomplishing more with less compared to the average business. Microsoft word (.docx) clothing donation receipt template. This document provides information about the transaction, such as the date and amount of donation, who received it (e.g., organization name), and any other explanations for why it is presented (e.g., “in honor of”) or a title of. Statement that no goods or services were provided by the organization, if. They’re important for anyone who wants to itemize their charitable giving when tax season rolls. __________________ (find on the irs website) donor information. Use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Microsoft word (.docx) cash donation receipt template. Microsoft word (.docx) church donation receipt template. Receipt for recurring charitable donations. Microsoft word (.docx) clothing donation receipt template. Statement that no goods or services were provided by the organization, if. Donors use them as a confirmation that their gift was received; You can use this template to thank donors when they first set up their ongoing donation. There are many other reasons to send a receipt after receiving a donation. Web nonprofits must send a receipt for any single donation of $250 or more. Nonprofit organizations tend to perfect the. This blog shares why donation receipts matter to donors and nonprofits, what to include, and how to customize and automate them to save time and raise more funds! Web general charitable donation receipt template. Web if you have a monthly giving program, you’ll need a donation receipt template that will automatically thank your recurring donors. Web a donation receipt is. You can use this template to thank donors when they first set up their ongoing donation. Receipt for recurring charitable donations. Donors use them as a confirmation that their gift was received; It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. They’re important. This is where a tool like formstack documents can come in handy. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the income tax act. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Microsoft word (.docx) cash donation receipt template. Web updated april 24, 2024. Receipt for recurring charitable donations. Web here are some free 501 (c) (3) donation receipt templates for you to download and use; This blog shares why donation receipts matter to donors and nonprofits, what to include, and how to customize and automate them to save time and raise more funds! This document provides information about the transaction, such as the date and amount of donation, who received it (e.g., organization name), and any other explanations for why it is presented (e.g., “in. Microsoft word (.docx) cash donation receipt template. Why do you need a donation receipt? Web 501(c)(3) organization donation receipt. Web our donation receipt templates can help you quickly send a receipt to all of your donors. In addition to showing donor appreciation, these messages help your supporters file their annual income tax return deductions and help your charitable organization keep. Web the donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. 6 free templates | instrumentl. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Nonprofit organizations tend to perfect the art of accomplishing more with. This document provides information about the transaction, such as the date and amount of donation, who received it (e.g., organization name), and any other explanations for why it is presented (e.g., “in honor of”) or a title of. Benefits of a 501c3 donation receipt. Nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters.. If your organization has a program with regular monthly donations or giving that occurs at recurring intervals, you'll need a receipt template that acknowledges the nature of this type of donation. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Web here are some free 501 (c) (3) donation receipt templates for you to download and use; Donors use them as a confirmation that their gift was received; Use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Web so to make things easier we’ve created charitable donation receipt templates you can use for every occasion. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Statement that no goods or services were provided by the organization, if. __________________ (find on the irs website) donor information. Receipt for recurring charitable donations. In addition to showing donor appreciation, these messages help your supporters file their annual income tax return deductions and help your charitable organization keep good internal records of gifts. Benefits of an automated donation receipt process. Feel free to download, modify and use any you like.

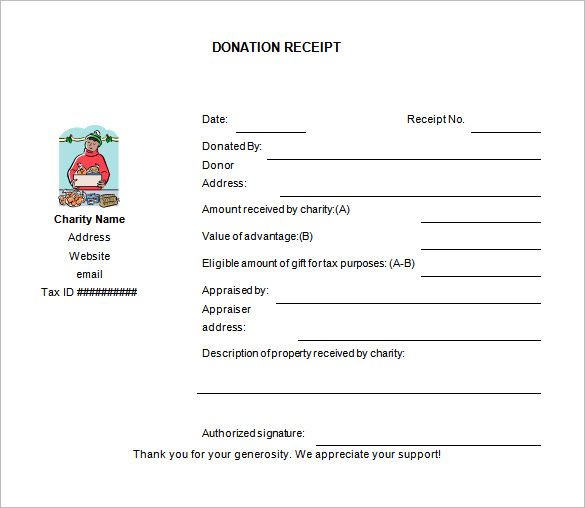

16 Donation Receipt Template Samples Templates Assistant

Donation Receipt Template in Microsoft Word

Free Sample Printable Donation Receipt Template Form

Free Printable Donation Receipt Template

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

Charitable Organization Donation Receipt Template Beautiful Receipt Forms

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

Donation Receipt 10+ Examples, Format, Pdf Examples

Charitable Donation Receipt Templates at

Printable Donation Receipt Letter Template Printable Templates

Web A Donation Receipt Is An Official Document That Provides Evidence Of Donations Or Gifts Given To An Organization By Donors.

Web 501(C)(3) Organization Donation Receipt.

This Blog Shares Why Donation Receipts Matter To Donors And Nonprofits, What To Include, And How To Customize And Automate Them To Save Time And Raise More Funds!

Web If You Have A Monthly Giving Program, You’ll Need A Donation Receipt Template That Will Automatically Thank Your Recurring Donors.

Related Post: