Charitable Donation Acknowledgement Letter Template

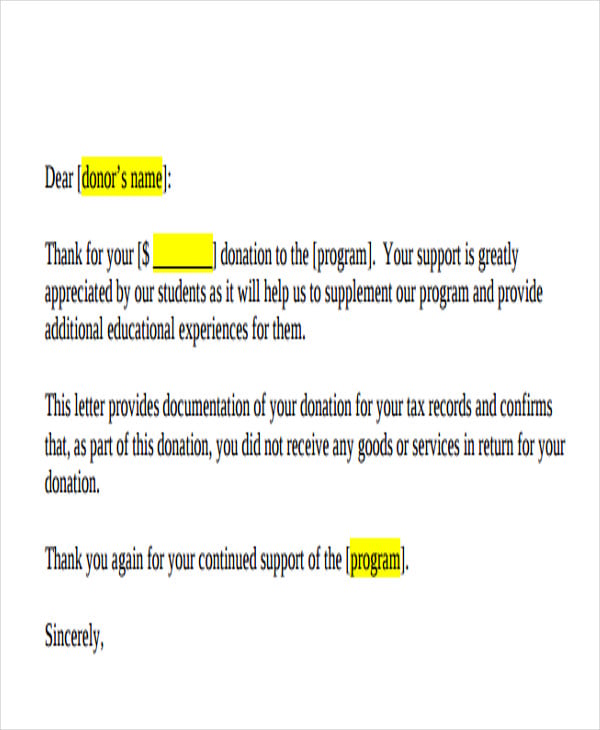

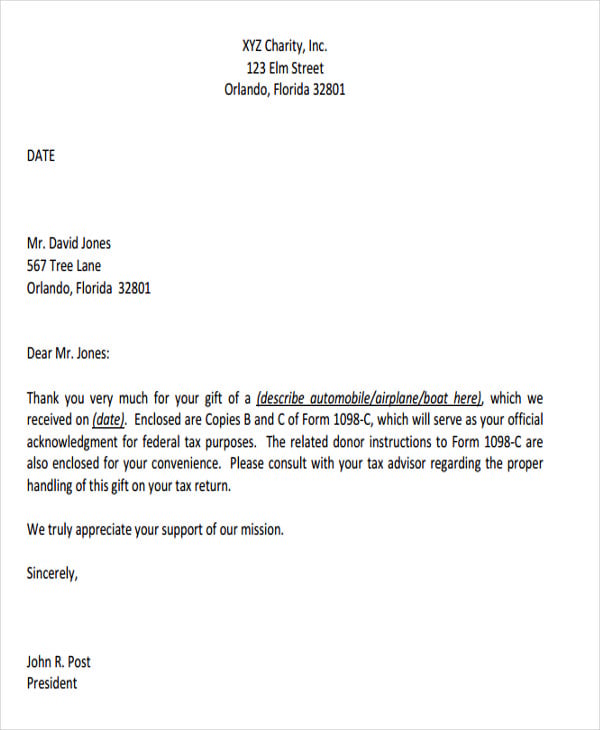

Charitable Donation Acknowledgement Letter Template - Fill out online for free. However, that’s not always the case. Assure the sender that the donations will be used for a good cause. The purpose of the document is to provide the donor with a letter that confirms that they have made a charitable donation. Tax deductible donation acknowledgement letter; The irs requires these organizations (also known as 501 (c) (3) organizations) to send a formal acknowledgment. (i) a good faith estimate of the fair market value (“fmv”) of the goods and services provided to the donor (see the discussion of fmv below. You may also want to inform the sender of the finer points on where the donations would be used. Donation acknowledgement thank you letter; Sample ira gift receipt letter. Without registration or credit card. Receive the charitable donation with many thanks and express it in a genial manner. The following sample letter is suggested as an immediate acknowledgement and receipt that will provide the proper record for the giver. Prompt and thoughtful gift acknowledgments are central to effective fundraising. This acknowledges that we received your gift directly from [name. The following sample letter is suggested as an immediate acknowledgement and receipt that will provide the proper record for the giver. Web by ann swindell. Assure the sender that the donations will be used for a good cause. Do you need to acknowledge every donation? This acknowledges that we received your gift directly from [name of ira. A donation acknowledgement letter is a type of donor letter that you send to donors to take a note of donations. Thank you very much for your $ gift to [name of charity] from your individual retirement account (ira), received on [date]. Web sample text to be included in receipt/letter acknowledging donation of $250 or more where the donor does. Web a donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Start with his name of the person or organization, official address, city, state and zip code. Web donor acknowledgment letter template [free to download] here is a downloadable guide that visually highlights best practices as well as. An acknowledgment letter should follow a proper business letter format and therefore, must start with the details of the donor to whom the letter is being sent. Without registration or credit card. This lets you express gratitude for donors’ support, share your progress and future goals, and ensure they know you received their gift. All donors deserve to be thanked,. Web receipt for a gift received from a donor’s ira. Fill out online for free. Sometimes your donation receipt functions as a donor acknowledgement. When is a donation acknowledgement letter required? Thank you for your contribution of $250 on [date]. When a church or charity receives a gift directly from an ira administrator, that gift will need a special gift acknowledgement. Thank you very much for your $ gift to [name of charity] from your individual retirement account (ira), received on [date]. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information:. This lets you express gratitude for donors’ support, share your progress and future goals, and ensure they know you received their gift. Web charitable donation acknowledgement letter; You may also want to inform the sender of the finer points on where the donations would be used. Check out givebutter’s free template, automated donation receipts, and more. You only have to. Receive the charitable donation with many thanks and express it in a genial manner. You may also want to inform the sender of the finer points on where the donations would be used. The purpose of the document is to provide the donor with a letter that confirms that they have made a charitable donation. Without registration or credit card.. Sometimes your donation receipt functions as a donor acknowledgement. Prompt and thoughtful gift acknowledgments are central to effective fundraising. Reiterate your thanks for such generosity shown by the sender. Nonprofits treasure donations in any amount because they’re the lifeblood of almost every charity. An acknowledgment letter should follow a proper business letter format and therefore, must start with the details. Tax deductible donation acknowledgement letter; You only have to send acknowledgment letters to donors who gave a single contribution of $250 or more. Web sample text to be included in receipt/letter acknowledging donation of $250 or more where the donor does not receive anything of value in return for his/her contribution. Assure the sender that the donations will be used for a good cause. Prompt and thoughtful gift acknowledgments are central to effective fundraising. Charity’s name and address date sent to donor name and address of donor. A donation acknowledgement letter is a document that can be used when a charitable organization has received a contribution from a donor. Sometimes your donation receipt functions as a donor acknowledgement. Receive the charitable donation with many thanks and express it in a genial manner. The irs requires these organizations (also known as 501 (c) (3) organizations) to send a formal acknowledgment. Web a donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. All donors deserve to be thanked, no matter the size of their gift. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Start with the donor’s details. Free 10+ charity acknowledgement letter samples & templates in ms word | pdf; An acknowledgment letter should follow a proper business letter format and therefore, must start with the details of the donor to whom the letter is being sent.

sample donation receipt letter documents pdf word acknowledgement

13+ Free Donation Letter Template Format, Sample & Example

Charity Donation Letter Template HQ Template Documents

Exclusive Acknowledgement Receipt Of Donation Template Stunning

Donation Acknowledgement Letter Template

Acknowledgement Of Donation Letter Template Collection Letter

Charitable Donation Letter Template Addictionary

8+ Donation Acknowledgement Letter Templates Free Word, PDF Format

8+ Donation Acknowledgement Letter Templates Free Word, PDF Format

Pin on Certificate Template Ideas

Web Donor Acknowledgment Letter Template [Free To Download] Here Is A Downloadable Guide That Visually Highlights Best Practices As Well As Gives You A Template And Worksheet You Can Use To Get Started Right Away!

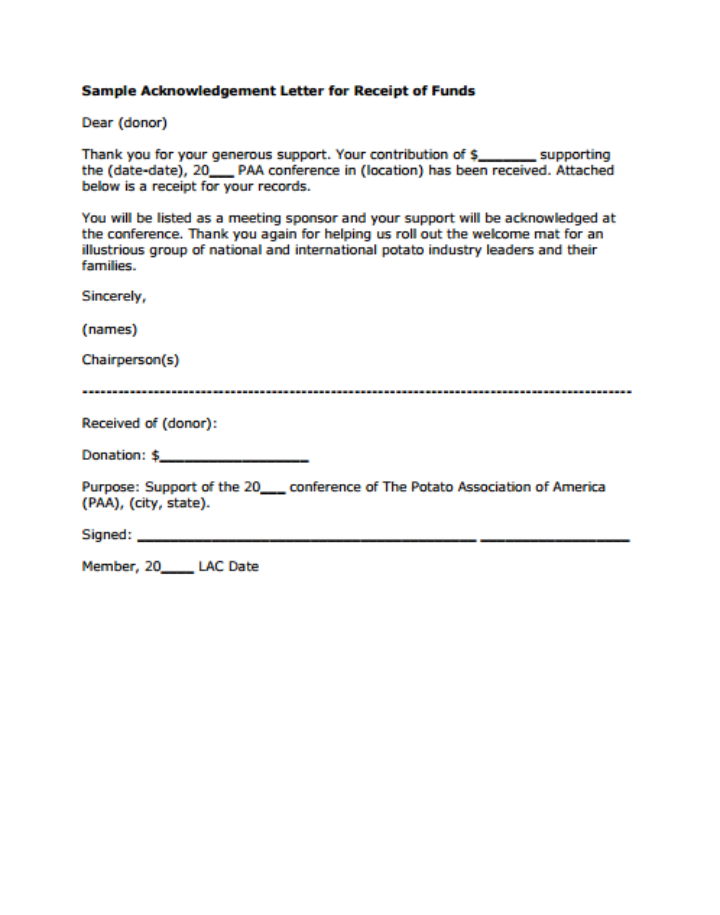

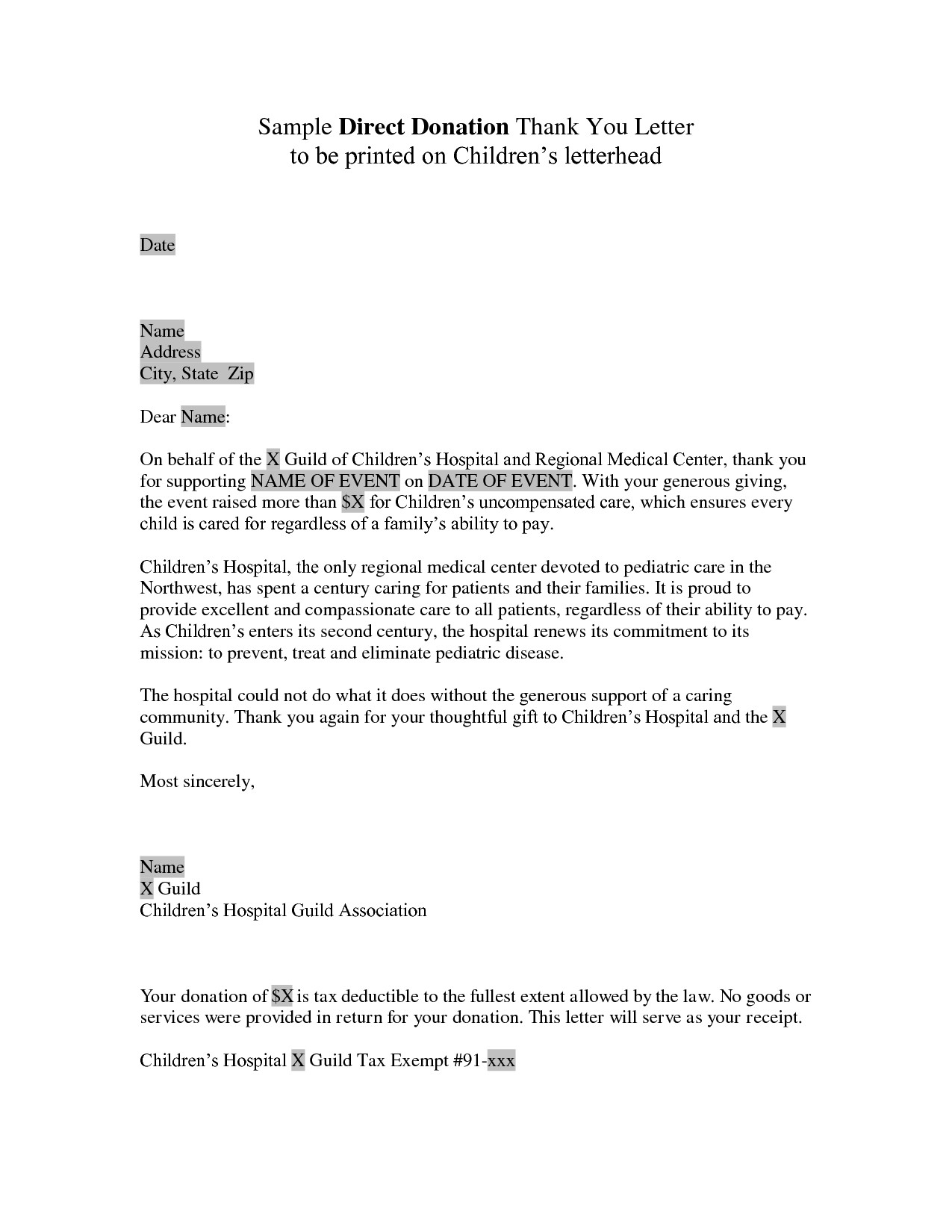

The Following Sample Letter Is Suggested As An Immediate Acknowledgement And Receipt That Will Provide The Proper Record For The Giver.

When A Church Or Charity Receives A Gift Directly From An Ira Administrator, That Gift Will Need A Special Gift Acknowledgement.

A Donation Acknowledgement Letter Is A Type Of Donor Letter That You Send To Donors To Take A Note Of Donations.

Related Post: