Calendar Spread Futures

Calendar Spread Futures - Web overnight trading in the futures markets can provide potential opportunities to take advantage of news events that happen while the u.s. At the futures dropdown, select “all” for active contract and set the spread to “calendar.” 3. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. The calendar spread strategy can be effective during times of low volatility and potentially useful if you think a stock or etf will trend sideways in the near term. To set up, first sell the front month option and then buy the same strike price and contract back month option for the next month. Additionally, some traders use futures as a proxy, in an attempt to help manage. Let's gain a better understanding of this with the help of an example. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Click the arrow next to your pre contract to view all of the listed spreads that include the symbol. A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month. Setting up a calendar spread. Traditionally calendar spreads are dealt with a price based approach. At the futures dropdown, select “all” for active contract and set the spread to. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Let's gain a better understanding of this with the help of an example. Let’s look at a few possibilities. Setting up a calendar spread. Traditionally calendar spreads are dealt with a price. Web this is referred to as buying the calendar spread: Web a calendar spread is a strategy used in options and futures trading: If you have any questions, please feel free to contact us. One example would be the buying the march 2018 eurodollar futures contract and selling the march 2021 eurodollar futures contract. Web it’s called the calendar spread. Definition and examples of calendar spread. A calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates. Let’s look at a few possibilities. Let's gain a better understanding of this with the help of an example. Any. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Matt levine is a bloomberg opinion columnist. A calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and. Any trades are educational examples only. Matt levine is a bloomberg opinion columnist. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. I had briefly introduced the. Web updated october 31, 2021. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Et, while nasdaq 100 futures traded marginally lower. Since yield futures have a dv01 value of $10, the value of the position has increased by $990 (9.9 basis points. Web april 25, 2024 at 10:05 am pdt. Futures trading is a very volatile activity, as most prices are affected due to multiple external macroeconomic conditions that cannot be controlled. To set up, first sell the front month option and then buy the same strike price and contract back month option for the next month. One example would be the. Web s&p 500 and dow jones industrial average futures were down 0.1% shortly after 5.30 a.m. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. If you have any questions, please feel free to contact us. Web this is referred to as buying the calendar spread: Since yield futures have. Web it’s called the calendar spread. One example would be the buying the march 2018 eurodollar futures contract and selling the march 2021 eurodollar futures contract. Traditionally calendar spreads are dealt with a price based approach. In a calendar spread, both the futures contracts have the same underlying, however their expiries are different. From the “all products” screen on the. Web this is referred to as buying the calendar spread: Options have many strategies that allow you to profit in any market, and calendar spreads are just such a strategy. Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract in one month while simultaneously selling the same contract in a different month. It is deployed by taking a long position in one futures contract and simultaneously a short position in another futures contract. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. A calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates. Learn how to optimize this strategy to capitalize on time decay and implied volatility changes, while minimizing risks and maximizing gains. Equity total cost analysis tool. Web overnight trading in the futures markets can provide potential opportunities to take advantage of news events that happen while the u.s. Calculate the fair value of current month contract. The cash spread over the same window has narrowed by 10.3 basis points. Stock index futures were rising ahead of a week that will not only deliver apple and amazon results, but a federal reserve interest rate decision as well. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Since yield futures have a dv01 value of $10, the value of the position has increased by $990 (9.9 basis points x $10 dv01 x 10 contracts). Dow futures rose 41 points, or 0.1%. Let's gain a better understanding of this with the help of an example.

How To Trade Calendar Spreads The Complete Guide

How to Trade Options Calendar Spreads (Visuals and Examples)

What are Calendar Spread and Double Calendar Spread Strategies

Calendar Spread Explained InvestingFuse

What Exactly Are Futures Spreads StoneX Financial Inc, Daniels

Everything You Need to Know about Calendar Spreads Simpler Trading

The secret behind Calendar Spread options strategy

Futures Trading the definitive guide to trading calendar spreads on

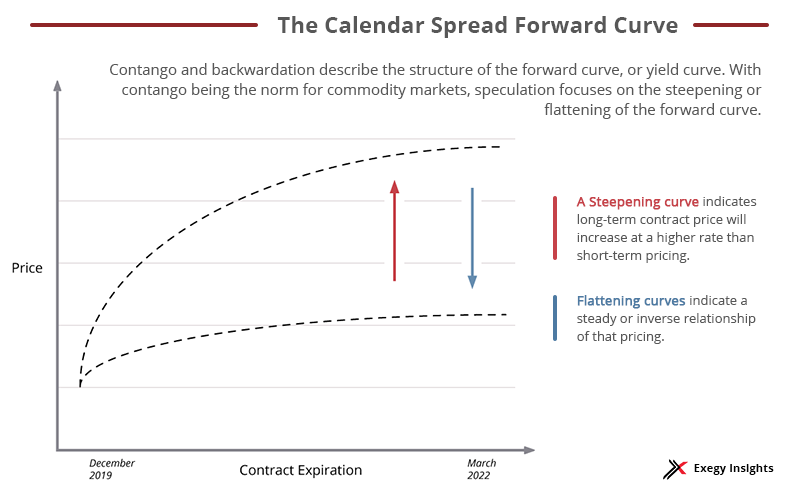

Getting Started with Calendar Spreads in Futures Exegy

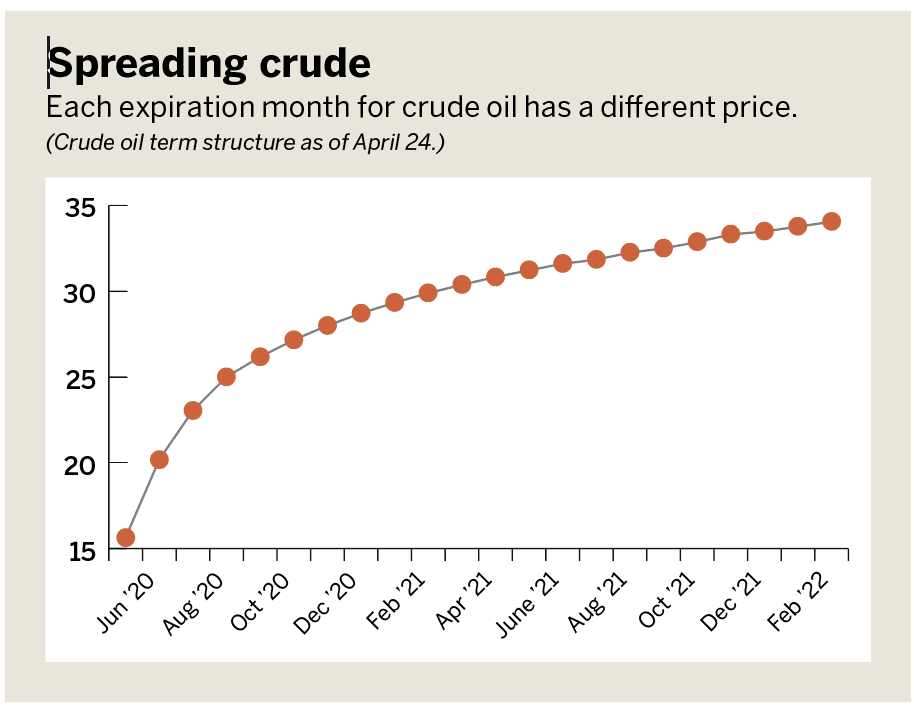

Leg Up on Futures Calendar Spreading luckbox magazine

Matt Levine Is A Bloomberg Opinion Columnist.

Et, While Nasdaq 100 Futures Traded Marginally Lower.

Setting Up A Calendar Spread.

Web S&P 500 And Dow Jones Industrial Average Futures Were Down 0.1% Shortly After 5.30 A.m.

Related Post: