1099Nec Template Word

1099Nec Template Word - Click on employer and information returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order. It’s used to report payments to contractors and service providers who are not employees at your company and do not have taxes withheld. Web updated january 11, 2024. Written by sara hostelley | reviewed by brooke davis. Web updated on january 12, 2022. This template is easily editable and easy to use. Copy a appears in red, similar to the official irs form. This template is great to make a latter of internal revenue service. Red chinese style business report. This process works best on inkjet printers where manual adjustment of the paper form is easier. Just write it by hand. Web forms and instructions. This includes names, addresses, social security numbers, and taxpayer identification numbers. Once you’ve purchased and downloaded the fillable 1099 form template, unzip the folder and select the template you wish to complete. Make small adjustments if needed. Download this 2023 excel template. Click on employer and information returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order. Once you’ve purchased and downloaded the fillable 1099 form template, unzip the folder and select the template you wish to complete. Fill out online for free. Just open the word. This template is great to make a latter of internal revenue service. Once you’ve purchased and downloaded the fillable 1099 form template, unzip the folder and select the template you wish to complete. New form started in 2020. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this. Once you’ve purchased and downloaded the fillable 1099 form template, unzip the folder and select the template you wish to complete. Download this 2023 excel template. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. This is important tax information and is being furnished to the irs. Wise doesn’t offer. Red chinese style business report. And if you need a better way to pay for freelance work or to receive international payments in your local currency, check out the wise business account. Web updated on january 12, 2022. Web forms and instructions. The.zip folder includes both a 1099 and 1096 transmission templates. This includes names, addresses, social security numbers, and taxpayer identification numbers. This process works best on inkjet printers where manual adjustment of the paper form is easier. Do not print and file copy a downloaded from this website; Other items you may find. Print to your paper 1099 or 1096 forms and mail. Just write it by hand. And if you need a better way to pay for freelance work or to receive international payments in your local currency, check out the wise business account. This is important tax information and is being furnished to the irs. Wise doesn’t offer legal or tax advice. Print to your paper 1099 or 1096 forms and. The.zip folder includes both a 1099 and 1096 transmission templates. Red chinese style business report. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. Copy a appears in red, similar to the official irs form. This template is great to make a latter of internal revenue service. This process works best on inkjet printers where manual adjustment of the paper form is easier. Other items you may find. Download this 2023 excel template. Web updated on january 12, 2022. This includes names, addresses, social security numbers, and taxpayer identification numbers. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. And if you need a better way to pay for freelance work or to receive international payments in your local currency, check out the wise business account. Just open the word document, fill in your recipient's information, and print the info. Make small adjustments if needed. (keep for your records) www.irs.gov/form1099nec. Web updated january 11, 2024. Once you’ve purchased and downloaded the fillable 1099 form template, unzip the folder and select the template you wish to complete. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. Copy a of this form is provided for informational purposes only. Web federal income tax withheld. New form started in 2020. Web to order official irs information returns, which include a scannable copy a for filing with the irs and all other applicable copies of the form, visit www.irs.gov/orderforms. Other items you may find. Just open the word document, fill in your recipient's information, and print the info onto your paper 1099 form. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. United states federal legal forms. Filing information returns electronically (fire) category. Web united states legal forms. *the featured form (2022 version) is the current version for all succeeding years.

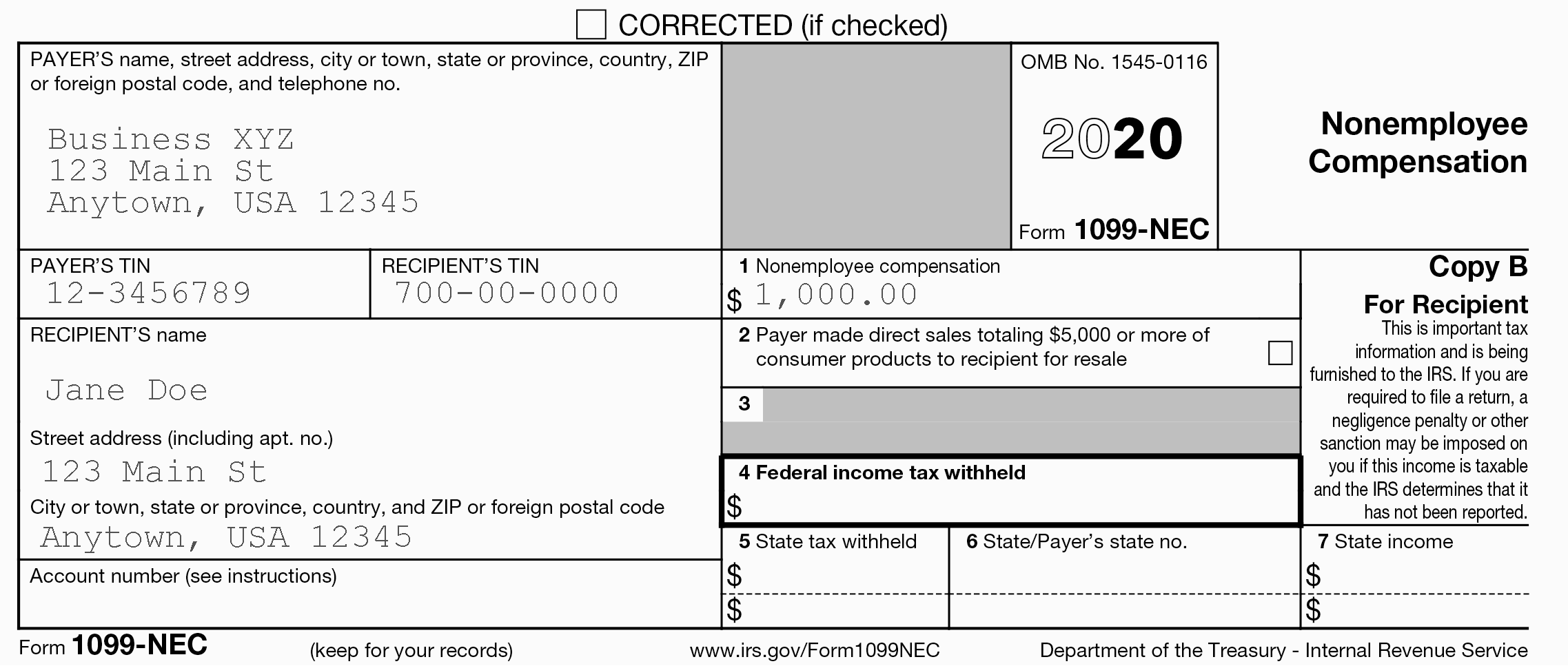

Printable 1099 Nec Form 2021 Printable World Holiday

1099NEC Template Editable Proof of Word Doc Etsy

1099NEC Excel Template for Printing Onto IRS Form 2022 Etsy

Free Printable 1099 Nec Form 2022 Printable Word Searches

1099NEC Template Editable Proof of Word Doc Etsy

2020 1099NEC Form Print Template for Word or PDF 1096 Etsy Israel

1099Nec Template Free

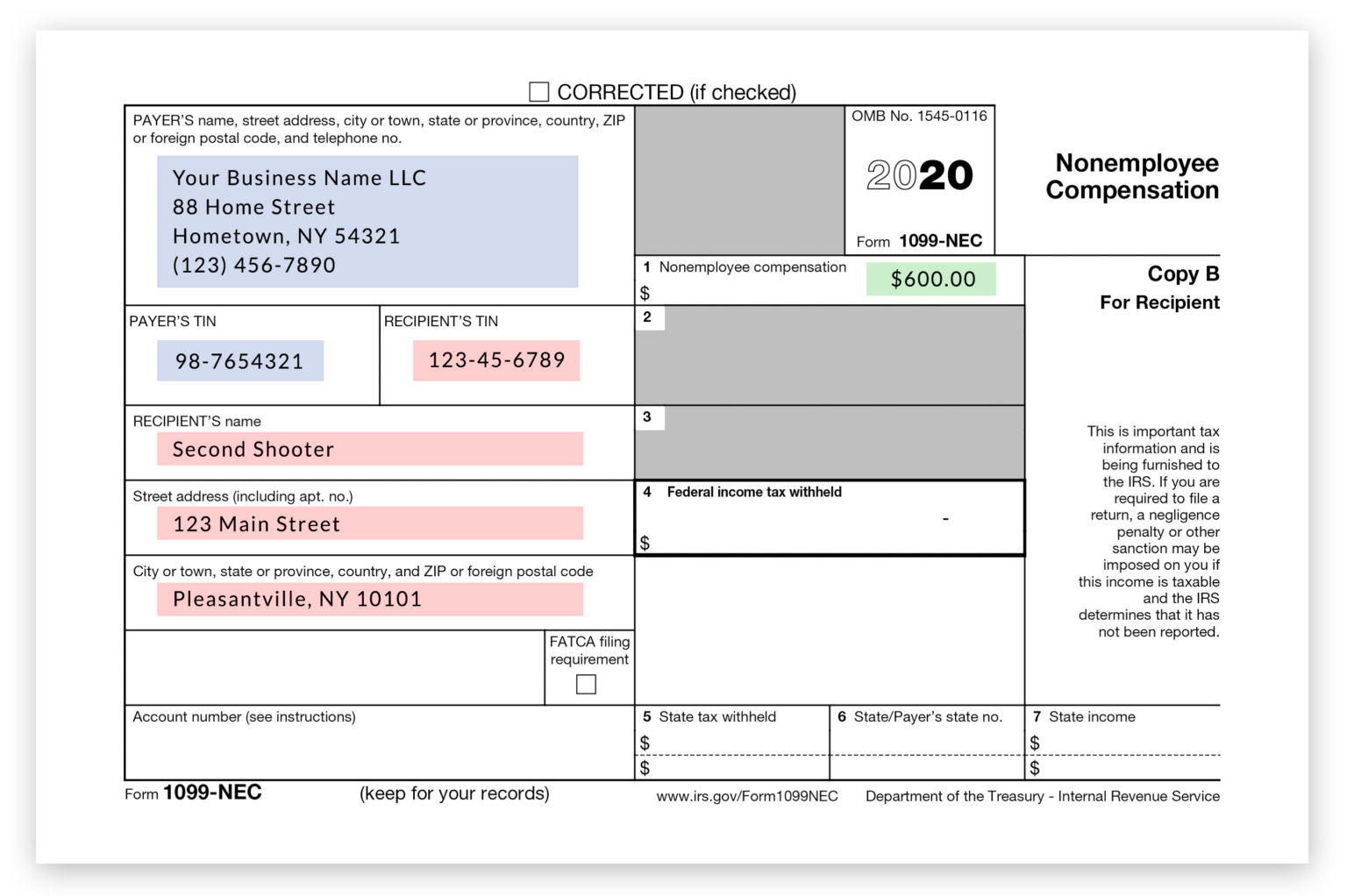

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Nec 1099 Form 2023 Printable Forms Free Online

Pa 1099 Nec Filing Requirements 2024 Nevsa Adrianne

This Template Is Great To Make A Latter Of Internal Revenue Service.

This Template Is Great For A Businessman To Create Form Of Internal Revenue Like A Report.

Web Forms And Instructions.

It’s Used To Report Payments To Contractors And Service Providers Who Are Not Employees At Your Company And Do Not Have Taxes Withheld.

Related Post: